This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status.

This article has been viewed 357,035 times.

Book value (also carrying value) is an accounting term used to account for the effect of depreciation on an asset. While small assets are simply held on the books at cost, larger assets like buildings and equipment must be depreciated over time. The asset is still held on the books at cost, but another account is created to account for the accumulated depreciation on the asset. Learning how to calculate book value is as simple as subtracting the accumulated depreciation from the asset's cost.

Steps

Sample Book Value Calculator

Understanding Book Value

-

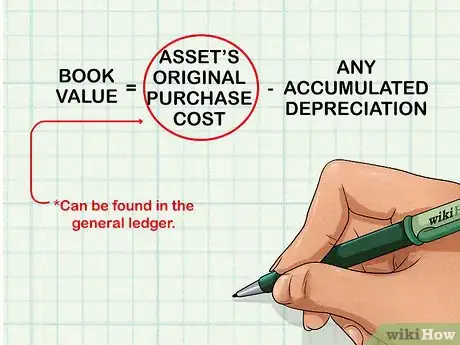

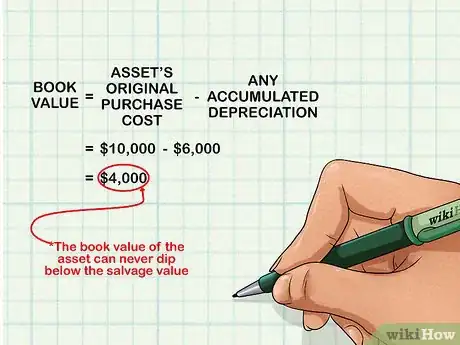

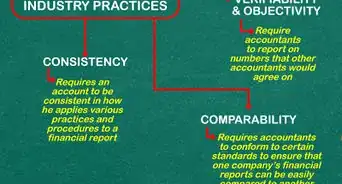

1Define what book value represents. The book value of an asset is its original purchase cost minus any accumulated depreciation. In accordance with the cost principle of accounting, assets are always listed in the general ledger at cost; this helps create consistency in reporting standards. Large assets like a piece of factory equipment can't be expected to hold this value over their life, so they are depreciated over time. Subtracting this depreciation from the original cost yields the book value.[1]

-

2Determine the cost of the asset. Before calculating the book value, you will need to know what the asset's original cost was. This is usually the price paid to acquire the asset. This amount will be equal to the asset's cost in the general ledger.[2]Advertisement

-

3Determine the accumulated depreciation associated with the asset. After determining the cost of the asset, you will need to know the sum of the depreciation expenses to date on the asset. These expenses are recorded in an account called Accumulated Depreciation in the general ledger. However, a separate depreciation account is not generally maintained for each asset, so you may need to look up the depreciation schedule for the asset in question.[3]

Calculating Depreciation

-

1Estimate salvage value. Salvage value is a measure of the remaining value of an asset after that asset has reached the end of its useful life. The asset may be either sold or scrapped to achieve the salvage value. Most machines, for example, can be sold for scrap if necessary. An asset's useful life may be as short as 1 year or as long as 30 years or more, depending on the asset and how often it is used. Salvage value can be estimated by the business or decided by a regulatory body like the IRS.

- Salvage value is instrumental in determining the annual depreciation of an asset. This is because depreciation is calculated as an annual reduction in the difference between the asset's original cost and its salvage value.[4]

- For example, imagine an asset that costs $12,000 and can be salvaged for $2,000 after its 5-year useful life. The annual depreciation would be calculated from the difference between it's cost and salvage value, which would be $12,000 - $2,000, or $10,000.

- Using the straight-line method, the annual depreciation would then be $10,000/ 5 (for each year of useful life), or $2,000.

-

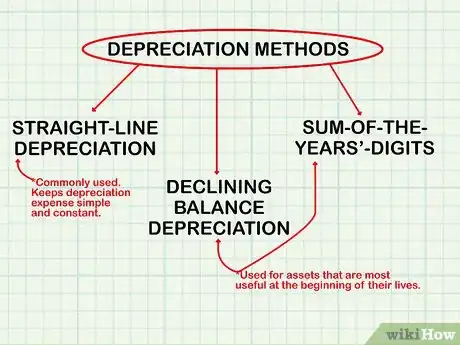

2Decide which depreciation method to use. Depreciation expense represents how much of the value of an asset is expensed each year as depreciation. This can be calculated in a number of ways. The most common is straight-line depreciation, but other methods, like declining balance depreciation and sum-of-the-years'-digits to accelerate depreciation, among others, are also used. The selection of method depends on the nature of the asset.

- The straight-line is most commonly used by accountants to keep depreciation expense simple and constant throughout the asset's life.

- Declining balance and sum-of-the-years'-digits methods are used to calculated depreciation for assets that are most productive or useful at the beginning of their lives, and become less so by the end. Production machines are sometimes depreciated in this manner, because they can operate faster and more cleanly at the beginning of their lives.

- Depreciation is a business expense that is deducted for income tax calculations.

-

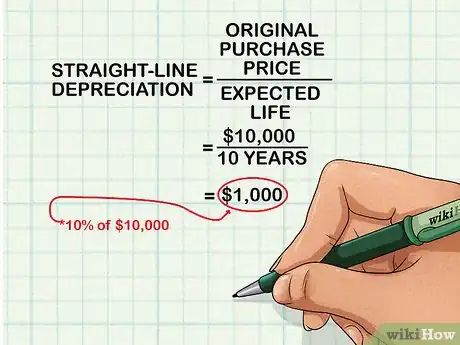

3Use straight-line depreciation. This is used when the same amount is expensed each period until the asset is fully depreciated. For example, if a piece of equipment was purchased for $10,000, and it has an expected life of 10 years, then the annual depreciation expense would be 10% of $10,000, or $1000.[5]

-

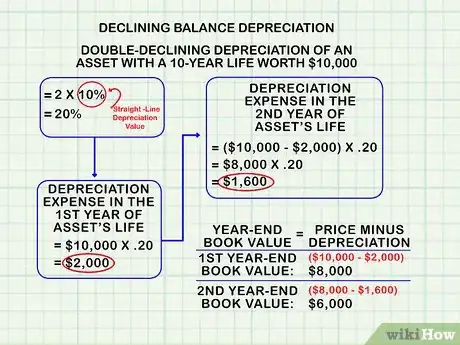

4Use declining balance depreciation. This is an accelerated depreciation method that expenses more depreciation at the beginning of the life of an asset than at the beginning. This rate is found by multiplying the straight line percentage of depreciation. For example, double-declining depreciation for asset with a 10-year life would be 2 x 10%, or 20%. This means that the new book value at the end of an accounting period would be 20% less than the previous book value. This 20%, $2,000 in the case of the first year of the asset's life, would be the depreciation expense.[6]

- To exemplify this method further, the depreciation expense in the second year would be based off of the first year-end book value, which is $10,000-$2,000, or $8,000. The depreciation expense in the second year would be 20% of $8,000, or $1,600, leaving us with a second year-end book value of $6,400 for the asset.

-

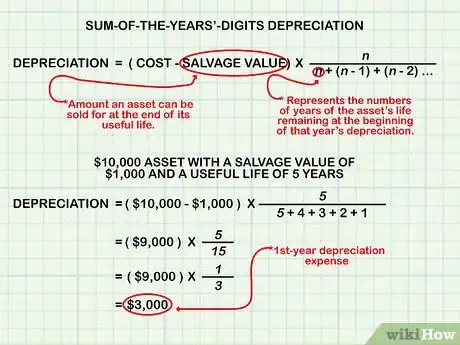

5Use sum-of-the-years'-digits depreciation. This method relies on an equation that is similar in overall effect to declining balance depreciation, but is calculated differently. The equation is as follows:

- In this equation, "n" represents the numbers of years of the asset's life remaining at the beginning of that year's depreciation. For example, in the first year n would be 5. The bottom of the fraction represents the total of the digits in the useful life of the asset (if 5 years, 5 + 4 + 3 + 2 +1).[7]

- Imagine the salvage value of our $10,000 asset is $1,000 and it has a useful life of 5 years. Under this method, the depreciation expense in the first year would be . This simplifies to or . Therefore, the depreciation expense in the first year is $3,000.

-

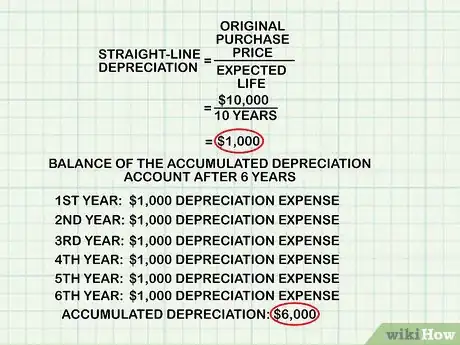

6Determine the accumulation depreciation. This is the balance of the Accumulated Depreciation account associated with the asset. Using the straight-line example above, suppose you are interested in the account balance after 6 years. For each of those 6 years, a depreciation expense of $1000 was recorded, so the accumulated depreciation is $6000. Depreciation for the other methods is calculated by repeating the described process for each year until the desired year is reached.

-

7Subtract the accumulated depreciation from the asset's cost. To arrive at the book value, simply subtract the depreciation to date from the cost. In the example above, the asset's book value after 6 years would be (10,000 - 6000) or $4000.

- Note that the book value of the asset can never dip below the salvage value, even if the calculated expense that year is large enough to put it below this value. If it reaches this value before its final year, the asset's book value will remain at salvage value there until it is sold, when its value will drop to $0.

Using Book Value

-

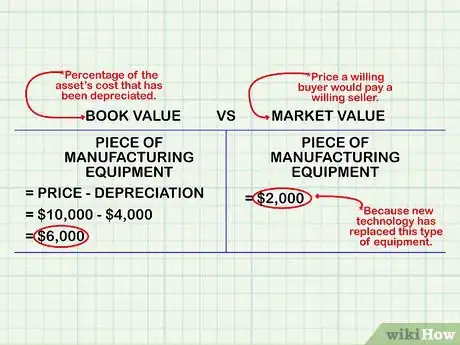

1Differentiate between book value and market value. Book value is not intended to provide an accurate valuation of the asset, meaning it will not reflect the market value. The book value is only meant to provide an understanding of what percentage of the asset's cost has been expensed (depreciated).[8]

- Market value is the price a willing buyer would pay a willing seller. For example, a piece of manufacturing equipment was purchased for $10,000 and depreciation over 4 years totaled $4,000. The book value is now $6,000. However new technology has replaced this type of equipment so willing buyers believe the market value is only $2,000.

- In some cases, such as that of heavy machinery, the market value will be significantly higher than the book value. This means that even though these assets are old and thus heavily depreciated, they still perform adequately.

-

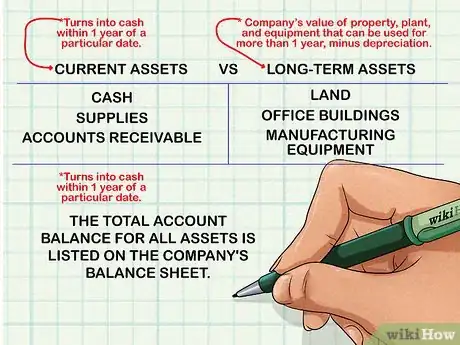

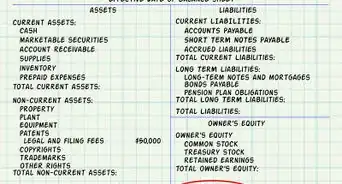

2Distinguish between Current Assets and Long-term Assets. Current assets are assets that can turn into cash within one year of a particular date. Long-term assets are a company's value of property, plant, and equipment that can be used for more than 1 year, minus depreciation. The total account balance for all assets is listed on the company's balance sheet.[9]

- Cash, supplies and accounts receivable are typical current assets while land, office buildings and manufacturing equipment are usually considered long-term assets.

-

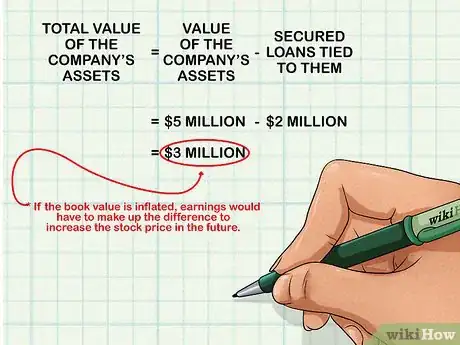

3Check to see if a company is using their assets to secure loans when it is struggling financially. If you are thinking of investing in the company, the value of the assets should be reduced by any secured loans tied to them. If the book value is inflated, earnings would have to make up the difference to increase the stock price in the future.[10]

- For example, if a company owns assets totaling $5 million, but has taken out $2 million in loans with some of the assets used for guarantees, the value of the company's total assets is really only $3 million.

References

- ↑ http://www.investopedia.com/articles/fundamental-analysis/09/book-value-basics.asp

- ↑ http://www.investopedia.com/articles/fundamental-analysis/09/book-value-basics.asp

- ↑ http://www.investopedia.com/articles/fundamental-analysis/09/book-value-basics.asp

- ↑ http://www.investopedia.com/terms/s/salvagevalue.asp

- ↑ http://www.investopedia.com/terms/b/bookvalue.asp

- ↑ http://accountinginfo.com/study/dep/depreciation-01.htm

- ↑ http://accountinginfo.com/study/dep/depreciation-01.htm

- ↑ http://www.investopedia.com/articles/fundamental-analysis/09/book-value-basics.asp

- ↑ http://www.investopedia.com/terms/l/longtermassets.asp

About This Article

To calculate book value of an asset, first find its original cost, which is the price paid to get the asset. Then determine the asset’s accumulated depreciation, which is how much value the asset loses over time. You can calculate accumulated depreciation by estimating the asset’s salvage value to get its annual depreciation, and then using an appropriate method of depreciation to get its depreciation over time. Finally, just subtract the asset’s accumulated depreciation from its original cost to get its book value. For more from our Business reviewer on calculating book value, including picking your method of depreciation to match your asset, read on!