This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 88% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 76,320 times.

Counties across the United States charge real estate taxes. When these taxes go unpaid, a lien is placed on the property. After a certain period of time, if the back taxes are not paid, the property can be seized and sold to pay the debt. Buying these properties in "tax deed sales" can be a great investment. However, be cautious of certain risks involved with the process as well. To buy property in a tax deed sale, gather information about properties in your county, make bids, and finalize the purchase.

Steps

Gathering Property Information

-

1Contact your county. Different counties throughout the United States offer property auction information in different ways. One way information is offered is in person. In these counties, you can review property files by visiting the clerk's office. For example, in Pasco County, Florida, you can visit the clerk's office Monday through Friday between 8:30 AM and 5:00 PM and review property files.[1]

-

2Read paper advertisements. Most counties are required to publish a list of properties that are being auctioned in the next sale. You should always pick up a copy of the paper the county publishes this information in.

- For example, Franklin County, Florida publishes all their tax deed sale information in The Apalachicola Times. The information is advertised once a week for four consecutive weeks. The paper is available at the clerk's office for $1.00 per page.

Advertisement -

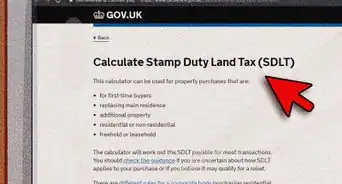

3Visit county websites. Some counties provide property information online. Visit your county clerk's website to see if they offer this service. For example, in Broward County, Florida, you can visit one of two websites to obtain information about properties being auctioned. These websites offer full lists of properties, including their addresses and parcel numbers.[2]

-

4Understand how the property is being offered. Tax deed sales can be a great way to purchase properties, but you have to be aware of the drawbacks. The county selling the property does not offer any warranty on the property and they do not make any promises about it's condition. Every sale is "buyer beware," which means the county will not guarantee anything. In addition:

- If you do not do your research, you could end up buying a drainage ditch, a sign, condemned property, a stairwell, a pile of junk, or a small sliver of nothing.

- The property may not be clear of all liens and encumbrances when you buy it at auction. While some liens will be discharged with the sale, others will follow the property. If a lien follows the property, you will become responsible for paying to have it removed.

- The county does not even look into zoning restrictions, its existing or potential uses, or other laws that may affect the property's use. You are responsible for all of this.

-

5Conduct title and lien searches. The county selling the property is simply conducting their statutory duty. They are not real estate agents or lawyers and do not have any information about the properties they are auctioning. Before you buy, consult an attorney about conducting various property searches. In general, you will want to conduct a title and lien search on any property you are interested in.

- When you conduct a title and lien search, you will go to the county recorder's office and look through a property's recorded files. They will include every transfer of the property and every lien that has ever been placed on the property. You can use this information to determine the quality of the title you will purchase.

- If it is unclear who holds proper title to the property, or what type of title is held, you should consider not purchasing the property. In addition, if you find outstanding liens on the property that will not be discharged in the tax deed sale, you should not buy the property.

-

6Visit the property. The county conducting the auction does not have keys to any piece of property and they will not tour the property with you. In addition, the county does not have pictures, floor plans, or other data regarding the property. Any visit will have to be planned on your own.

- While you should walk by the property, do not ever go onto the property or inside a structure (e.g., a house or a barn). Before the sale, the property is still owned by someone other than yourself. Without the owner's permission, you will be trespassing if you go onto the property.

Making Bids

-

1Determine how bids are taken. All tax deed sales are sold through an auction. Some counties conduct live auctions while others conduct auctions online. Contact your county and ask how they conduct their sales.

- If your auction is live, they will usually be held at the same time and place every month. For example, in Franklin County, Florida, tax deed sales are held on the first Monday of every month at 11:00 AM inside the main courthouse. You or your agent must be physically present at the auction in order to make bids. You should arrive a few minutes early in order to ensure you are ready to go.

- If your auction is online, you will visit the auction website and sign in using a personal ID and password. You can get the information by registering with the website. Check with the county to make sure you have the required software to run the auction site. In some counties, if you use an online system, you will be required to submit a bid deposit before you can be a part of the auction. This amount is usually 5% of the anticipated final bid price or $200.[3]

-

2Understand how the opening bid is calculated. The opening bid for a property is usually calculated by adding together the unpaid taxes, interest, administrative fees, and expenditure fees.

- The minimum bid may not include everything you will have to pay. You may have to pay additional taxes and fees after the bidding is complete.

-

3Make an initial bid. When the bidding starts, you can offer up an amount you feel is reasonable. If the auction is live, you will raise a paddle or your hand to show the auctioneer you are interested. If the bid is online, you will submit a bid by typing the amount you are willing to pay into a box and click "submit."[4]

-

4Continue the bidding process. As the auction goes on, people may out-bid you and you may have to enter subsequent bids in order to purchase the property. You should go back and forth until a price is reached that you are not willing to pay. If the auction ends and you are the successful bidder, you will be asked to stay and talk with the deputy clerk.

Finalizing the Sale

-

1Visit the county clerk's office. The deputy clerk will accompany you to the clerk's office as soon as the auction is complete. At the office, you will be notified of the total amount you owe. This amount will be the total of:

- Your bid amount;

- Fees needed to record the tax deed; and

- documentary stamps, which may cost around $.70 per $100 of the bid.

-

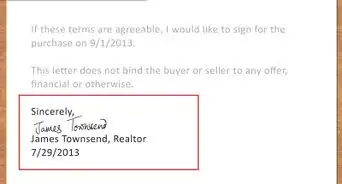

2Pay the purchase amount. If you pay the full amount as soon as the auction is over, you will have successfully completed the tax deed sale process. However, if you cannot pay the full amount on the spot, you will be required to post a nonrefundable deposit of 5% of the bid amount or $200, whichever is more. All payments must be made with a cashier's check, money order, or wire transfer. No other form of payment will be accepted.

- If you only post a deposit, you are required to pay the full amount within 24 hours.

- During that 24 hour period, and at any other time before the full purchase amount is paid, the property owner can stop the sale by redeeming the property and paying the amount owed to the tax collector. If this happens, the property will remain with the owner and you will not be able to purchase it.

-

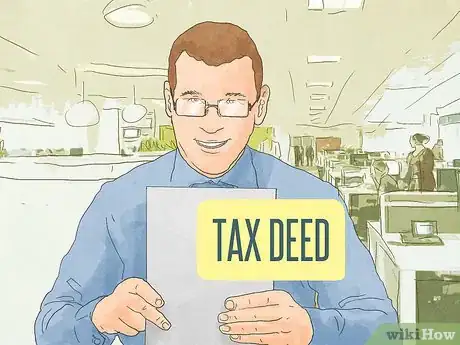

3Receive a tax deed. Once you pay the full purchase amount, you will receive ownership of the property through a tax deed. A tax deed is a specific form of title given as a result of a tax sale. The tax deed does not carry any warranties and does not promise clear title.

-

4Take possession immediately. Most state statutes allow you to take immediate possession of the property once the tax deed is recorded. This means that as soon as you pay the full purchase price, the property will be yours and you can use it for any legal purpose.

-

5Evict anybody left on the property. Just because you have an immediate right to possession does not mean you will be able to take possession right away. Often, previous owners will still be on the property or squatters may be present. You may have to take legal action to gain possession. If this is the case, contact a lawyer and ask about eviction proceedings or other proceedings you may need to go through to get possession.

-

6Clear title. You will also need to go through the process of clearing title so you can get title insurance and have peace of mind in the future. Having a clear title is important in case you ever want to sell the property in the future and to make sure nobody else will make a legal claim to your property. Most title insurance companies will make you go through a quiet title lawsuit before you can get insurance.

- Talk to an attorney about these procedures, including their costs.