This article was co-authored by wikiHow staff writer, Sophia Latorre. Sophia Latorre is a Content Manager on the wikiHow team. Before joining wikiHow, Sophia worked as a technical editor and was published in six International Energy Agency (IEA) Wind Annual Reports. Now, she writes, edits, and reviews articles for the wikiHow Content Team, working to make the content as helpful as possible for readers worldwide. Sophia holds a BA in English from Colorado State University.

This article has been viewed 1,008 times.

Learn more...

Your pet is a part of the family. They brighten up the day with a wag of their tail, a spirited run around their wheel, or by purring on your lap in the evening. Things happen, though, and your pet might need care for illness or injury, which can get pretty expensive. Pet insurance can provide protection for a wide range of ailments and provide financial support for necessary treatment. Fear not, pet owners! We’ve put together a guide to help you find comprehensive, affordable pet insurance online to give you the peace of mind that your furry friend is protected.

Things You Should Know

- The pet insurance policy with the best coverage is Fetch Pet Insurance. For the best reimbursement and preventative insurance, go with Lemonade Pet Insurance.

- Purchase a policy to give yourself peace of mind in case your furry friend has an unexpected illness or injury—pet insurance will help cover the cost of their care.

- Compare a few plans and get a quote for each to help you decide which policy is best for you. Then, enroll your pet in your chosen policy right from the website.

Steps

Best Coverage Pet Insurance: Fetch Pet Insurance

-

1Fetch by The Dodo offers one of the most comprehensive pet insurance policies on the market. They pride themselves on covering things that most pet insurance providers charge extra for or don’t cover at all, such as dental care, sickness exams, virtual vet visits, and breed-specific issues (like breathing problems in French bulldogs). As with most pet insurance providers, routine visits and preventative care—such as spaying/neutering, dental cleaning, or vaccines—are not covered. Other costs not covered by Fetch include pre-existing conditions, prescription food, grooming, cosmetic procedures, and claims filed more than 90 days after treatment. However, Fetch does cover:

- Prescription medications and supplements

- Emergency vet visits

- Laboratory tests

- Surgeries

- Physical therapy

- Hospital stays

- Swallowed objects and toxins

- Cancer treatment

- Hereditary and congenital issues

- X-rays and CT scans

-

2You can choose your vet. Fetch permits you to use your existing vet or any other licensed vet in the U.S. or Canada (including specialists and emergency clinics). You’re also covered for up to $1,000 per policy each year in virtual vet visits via video, phone, email, and text.Advertisement

-

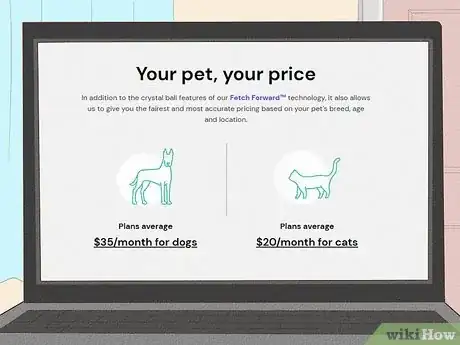

3The average cost for a policy from Fetch is $35/month for dogs and $25/month for cats. The insurance provider uses research and data to ensure you get the fairest and most accurate pricing based on your pet’s breed, age, and location. Note that there is a waiting period of 15 days between enrollment and the beginning of coverage.

- There is also a 6-month waiting period before injuries of the hips and knees are covered. However, this waiting period is waived if your pet is examined in the first 30 days of your policy and no relevant pre-existing conditions are identified.

- Learn more about Fetch Pet Insurance here.

Best Reimbursement and Preventative Insurance: Lemonade Pet Insurance

-

1The basic policy covers many services your pet might need. The coverage of Lemonade’s pet insurance policies have been carefully crafted in collaboration with a veterinarian team to ensure your pet gets the protection it needs. Coverage includes:

- Diagnostics, such as X-rays, CT scans, ultrasounds, MRIs, blood tests, and urinalysis

- Procedures, including hospitalization, surgery, and specialty and emergency care

- Medications, such as injections and prescription medications

-

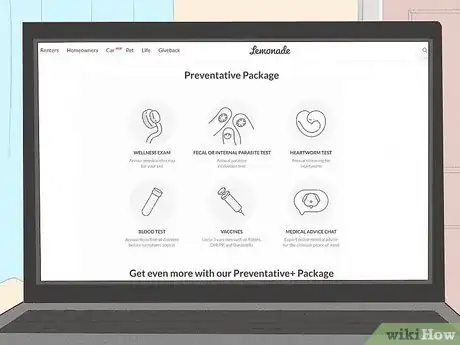

2The preventative policy offers even more coverage. Lemonade has an advantage over pet insurance providers with its preventative packages, which offer savings on tests, vaccines, and essential care. The preventative packages include:

- Annual wellness exam, bloodwork, heartworm screening, and parasite evaluation test.

- Up to 3 vaccinations, including rabies, bordetella, and DHLPP

- Routine dental cleaning including polishing, dental x-rays, anesthesia, and more

- Flea, tick, and heartworm medication

- Online expert medical advice

- There is also a preventative care package designed specifically for puppies and kittens, which covers procedures like spaying or neutering, flea medication, microchipping, and up to 6 vaccines or boosters.

-

3You can see any vet you like. With Lemonade, you can go to any vet in the US as long as they are licensed to operate in the state they are in. Claims are settled quickly via the Lemonade app and several discounts are available on multi-pet policies and bundle policies.

- Note that pre-existing conditions are not covered and there are waiting periods before coverage kicks in—2 days for accidents, 14 days for illnesses, and 6 months for cruciate ligament issues. However, if you opt for a preventative package, the benefits can be used the day after purchase.

- Learn more about Lemonade Pet Insurance here.

Choosing the Right Policy

-

1There are several factors to take into consideration when shopping for pet insurance. It might take some time to research providers, but with a little effort, you can ensure you're getting the right policy for your pet. Consider the following:

-

Price: The price of a policy is dependent on a wide range of factors, which can include (but may not be limited to):

- The type of policy

- Age of your pet

- Your pet’s current health

- Previous claims and treatment history

- Breed and sex of your pet

- Where you live

-

Age and breed of your pet: The age of your pet can significantly affect the price of an insurance policy. Typically, as a pet gets older the premium increases, as it’s more likely they will need vet treatment. Therefore, as your pet gets older, the more difficult it is to get insured. On the flip side, most insurance providers won’t insure a pet under the age of 8 weeks.

- The cost of insurance for pedigree breeds or exotic pets—such as lizards or reptiles—can be more expensive. For example, crossbreeds are generally less likely to be affected by inherited medical conditions seen with certain pedigree breeds (i.e. flat-nosed dogs and respiratory issues).

- Excess: The majority of pet insurance policies have an excess, which is the amount you pay towards the cost of a claim. Excesses can vary significantly so be sure to check how much they are and how they will be applied toward costs. Typically, the higher the excess, the lower the cost of the overall premium.

-

Price: The price of a policy is dependent on a wide range of factors, which can include (but may not be limited to):

-

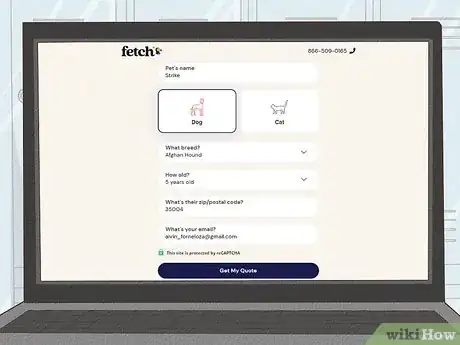

2Contact your top choices to get quotes. It’s super easy to request a quote. There is usually a button on the website where you can ask for a quote for your pet. Depending on the provider, you’ll be asked some questions about your pet. Answer honestly and ensure you agree to adhere to the company’s conditions, which may include things like your pet being at least 8 weeks old, not currently showing any signs of illness, not being used for racing or personal protection, and not living in a premise serving alcohol. Here are some questions you may be asked:

- What pet do you want to insure? (i.e. cat or dog)

- What breed is your pet? Is it pedigree, crossbreed, or mixed breed?

- What gender is your pet?

- When was your pet born?

- Does your pet have any pre-existing conditions?

- Has your pet suffered from any injury or illness in the past?

- Are your pet’s vaccinations up to date?

- Has your pet ever been attacked, bitten, or displayed aggressive behavior?

- Has your pet ever been involved in third-party insurance claims?

- Has your pet been spayed or neutered?

- Is your pet microchipped?

- How much did you pay for your pet?

-

3Enroll in your preferred policy. After you’ve spoken to your top companies and compared the quotes, it’s time to enroll! Call and speak to a customer service representative or enroll online. Now, rest easy knowing that your pet is covered!

FAQs

-

1What is pet insurance? Pet insurance covers a percentage of the bill for medical treatments and procedures. Having pet insurance helps manage the costs associated with maintaining your beloved pet’s health and deal with emergencies.

-

2How much does pet insurance cost? How much you pay for pet insurance varies depending on the type of pet you have and the level of coverage you choose. Premiums can range from as low as $10 to over $100 per month, though for a plan with a decent level of coverage you can expect to pay between $20 and $50 per month.

-

3What does pet insurance cover? There are three main types of pet insurance plans, which have varying premiums, coverages, and exclusions:

- Wellness: Covers preventative care, such as routine appointments and vet exams.

- Illness: Covers treatment for minor and major illnesses, such as allergies, stomach issues, and cancer.

- Accident: Coverage for accidental injuries, such as bites, wounds, bone breaks, or ingestion of harmful substances.

-

4Does pet insurance cover vaccines? It’s not the norm for pet insurance plans to cover routine vaccines as it is a form of preventative care. However, most insurers require you to have up-to-date vaccinations to keep your policy valid.

Pros and Cons of Pet Insurance

-

1Pros: Pet insurance is customizable and can cover unexpected expenses. Pet insurance gives you peace of mind knowing that should your pet have an accident or develop a medical condition, you have the coverage to pay for necessary treatment. If you don’t have coverage, it can be really expensive to cover the costs to keep your pet by your side. If you’re still on the fence about whether or not pet insurance is right for you, consider the following benefits of investing in a policy.

- Financial relief: Depending on your level of coverage, your pet insurance can take away some of the financial burdens of unexpected veterinary costs. Coverage significantly reduces the price of many surgeries and treatments, with some plans reimbursing 90-100% of the cost.

- Visiting your own vet: Unlike health insurance, which requires you to visit an in-network doctor, pet insurance typically allows you to visit your preferred licensed veterinarian or animal hospital for care.

- Customizable coverage: Most pet insurance providers give you the flexibility to create a plan that meets your pet’s specific needs. You can usually combine different levels of coverage (e.g., illness and accidents). You’ll also be able to choose your deductible amounts based on your personal budget.

- Confidence: Knowing your pet is in pain or injured and not having the money to pay for the procedure they need is heartbreaking. No one wants to have to make the awful choice of paying their bills or losing their furry companion. Pet insurance can prevent you from ever having to make that choice, or from putting a price limit on your pet’s life.

-

2Cons: Pet insurance may not cover all of your expenses, and you may not need it. While there are several benefits to pet insurance, there are also some drawbacks.

- Routine vet visits may not be covered: Many pet insurance policies don’t include preventative visits, such as vaccinations, or routine exams (i.e. check-ups). This means, as well as paying for insurance, you’ll also have out-of-pocket expenses for routine vet visits. Your insurer may offer additional coverage for preventive or wellness visits, but it will increase your monthly premium.

- You might still incur costs: As the majority of policies only cover a percentage of eligible claims, you’ll still pay a portion of the bill. If you don’t have that money in the bank, you might end up in some financial trouble. Furthermore, most plans have a maximum benefit limit, and if your pet’s care goes beyond this limit, you’ll have to pay the complete vet bills.

- Your pet may not be eligible: If you have an older pet or your pet has a pre-existing condition, such as hip dysplasia or diabetes, you’re unlikely to be approved for a pet insurance policy. If this is the case for you, it's a good idea to put money aside each month in a savings account just for your pet’s healthcare costs.

- Benefits may go unused: Some policies may cover everything from chemotherapy to acupuncture, which you may not use, but you’re still paying for “just in case.” On the other hand, if you don’t maximize your coverage, you might end up paying more for your pet’s health care than you would without insurance.

- You pay upfront: With pet insurance, you’re responsible for paying 100% of the cost upfront, and instead of the vet’s office submitting a claim, you have to submit your own claim for reimbursement directly. Therefore, you still need to have the funds to pay your vet bills before your insurer processes your claim.