This article was co-authored by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 29,758 times.

When you buy goods and have them shipped to you from another country, you become an importer. Depending on what you bought, you may have to pay an import duty, which is a type of tax levied by the federal government on particular imported items. Unfortunately, there's no legal way to avoid import duty—if the duty is owed, someone has to pay it. However, there are ways that you can avoid delays when importing goods from abroad and make sure you're not paying import duties that you don't actually owe. As an international seller, you have the option of covering import duties yourself to provide less hassle and greater value for your customers.[1]

Steps

Retail Sellers

-

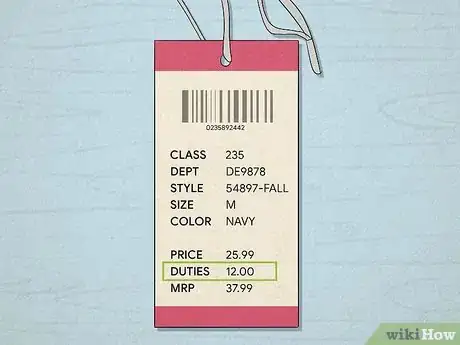

1Include duties in the price so customers don't have to pay them later. Retail customers don't like surprises. If you use an automated shipping service, it will total any taxes and customs duties for your customer when they put in their address, so they'll know exactly how much they'll pay for an item.[2]

- You can always lump in any customs duties with shipping and handling charges. This allows you to pass those costs onto the customer without them realizing it.

-

2Ship items "deliver duty paid" (DPP) so more duties aren't charged. Most automated shipping services calculate any duties owed for you based on the item you've sold and its ultimate destination. Taking care of any import duties owed means your customer will get the items they bought more quickly and not have to worry about paying import duties.[3]

- If you don't use automated shipping services, take the package to your local post office. They should be able to estimate the duties you'll owe for you based on the item, its location, and where you're sending the item.

Advertisement -

3Apply the correct customs labels to eliminate excess duties. Without the correct labels, customs might inspect the package and determine the customer owes additional import duties. Your local post office can help you ensure that you have the correct labels to avoid customs delays or additional fees for your customers. Automated shipping services usually take care of this for you as well.[4]

- If you want to double-check, go to the website for the customs authority in the country you're shipping to. There should be a section for labels that you can look at to make sure everything's in order.

-

4Arrange courier delivery for items that require special handling. If you've sold something that's one-of-a-kind or costs several thousand dollars, your customer will appreciate it if you offer courier service. Although these services can be expensive, they'll help your customer feel more secure and show that you're doing everything you can to protect your customer's purchase.[5]

- Paying these costs yourself increases value for your customer and makes the international buying process simpler. A seamless shipping experience also improves your reputation as a seller and encourages more customers to buy from you.

-

5Use parcel tracking to follow the package to its destination. Some cheaper shipping methods don't include tracking, but it's worth the cost for international deliveries. Give the tracking number to your customer and follow it yourself to make sure the package stays on track.[6]

- Some tracking services also allow you to set up alerts so you don't have to constantly check the tracking number. They'll give you updates each time the package is scanned at a new location.

- If tracking shows the package is held up in customs or some other issue has delayed the shipment, be proactive and tell your customer first—they'll appreciate it! Let them know that you're doing everything you can on your end to ensure the package gets to them as soon as possible.

Retail Buyers

-

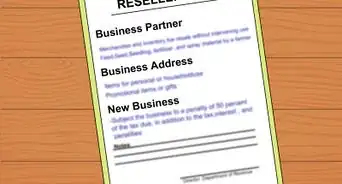

1Tell the seller explicitly that the item is for personal use. Import duties typically apply to items imported for commercial use (business or resale)—not personal or retail sales. If you're importing something for your own personal use or as a gift for someone else, you don't have to pay them.[7]

- This is especially important if you're buying items from a wholesaler or a business that primarily caters to business customers. They might automatically assume that you're buying for business use unless you say something.

-

2Request courier service if you bought a valuable or unique item. If you spent thousands of dollars or purchased something one-of-a-kind, even the strongest shipping insurance might not provide enough coverage for you to feel secure. While you'll likely have to pay for this service yourself, courier delivery ensures that your package will get to your door as quickly as possible and without any excess import duties.[8]

- For particularly valuable items, you can even hire an individual to carry the package for you by hand.

- Many popular international package delivery services, such as FedEx, offer courier services with door-to-door delivery, so it shouldn't be too hard to find one that works for you.[9]

- Compare prices for the service you want from several carriers if you're going to be paying for the service yourself. Prices can differ substantially.

-

3Use the tracking number to follow the shipment. Make sure you have trackable shipping for any international orders—otherwise you have no idea where your package is or when it will arrive. If your tracking number doesn't work, contact the seller as soon as possible.[10]

- You might be able to set up alerts that will notify you automatically whenever the package is scanned through a location, so you don't have to look up the tracking constantly.

-

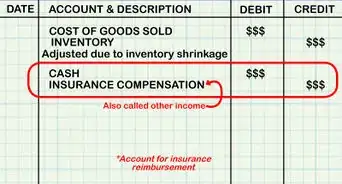

4Contact the seller if you get a notice that you owe customs duty. When your package goes through the port of entry, customs agents might determine that additional duties are owed. If the seller already paid duties, or assured you that you wouldn't owe any, call or email them and explain the situation.[11]

- Typically, you'll get a letter from the post office letting you know how much is owed and where your package is being held. The post office won't release your package to you until the duty is paid, but you do have some time to work with the seller if you want to avoid paying those duties.

-

5File a protest if you believe you were incorrectly charged import duty. Write a letter explaining why you believe the duties or customs fees charged were wrong and mail it to the address on the customs form that lists the amount you owed. If you refuse delivery of the item, you can also give this letter to the post office and they'll forward it to customs for you.[12]

- File your protest within 5 days of the date your package is delivered to your local post office. If customs determines that you paid fees you didn't have to, they'll issue a refund.

Commercial Buyers

-

1Book a customs broker to handle shipment of your items. If your seller doesn't work with a customs broker, search online for one. They have classification specialists who will figure out how to correctly classify your items, prepare them for shipment, and place them with a freight carrier. This helps you avoid paying more import duties than you absolutely have to.[13]

- Classification specialists look at the specific characteristics of the items you're shipping and classify them under a 10-digit code. Using the correct code helps you avoid paying unnecessary import duties.[14]

- While you could do all of this yourself, it takes a long time to find the correct code if you're not familiar with the system. You could also end up paying additional fees if you accidentally classify your items incorrectly.[15]

-

2Confirm that the shipment includes a detailed invoice. While you can't avoid import duties, the information on the invoice can keep you from paying too much. Ask the seller for a copy of the invoice to make sure they've included specific information about the items in the shipment (not just general categories), along with the number of units of each item and the total value of the items shipped.

- For example, instead of a single line that says "computer parts," a correct international shipping invoice lists each part specifically along with the quantity of each one and the country where each part was produced.

- The country of origin for each item included in the shipment is important because items from some countries are duty-free. The country of origin may not be the same as the country where you purchased the items. For example, you might purchase items from a company in Italy that were actually made in Israel.

- Many online shipping services offer electronic trade documentation, which submits the required invoice to customs electronically so you don't have to worry about a paper invoice getting damaged or destroyed during shipping.[16]

-

3Instruct the freight company to forward your shipment to your address. Freight companies typically don't forward shipments automatically. If you don't make arrangements for direct shipping, your items will remain at the port of entry for you to pick up.[17]

- If you happen to be near the port of entry where your items will arrive, it might be more economical for you to simply go and pick them up yourself. However, in most cases, you'll want to arrange delivery.

- If your items are not picked up or forwarded to you within 15 days of arrival, they'll be moved to a warehouse and you'll have to pay storage fees.

Warnings

- This article focuses on how to avoid import duty in the US. If you live in another country, check with the customs authority where you live.⧼thumbs_response⧽

- Never misrepresent imported items or under-declare their value. Customs can confiscate or delay the shipment and you can end up paying hefty fines for the release of your items.[20]⧼thumbs_response⧽

- Even if you claim you're buying something for personal use, customs might determine that the purchase doesn't qualify. For example, if you buy several identical handbags, customs agents can make a judgment call that you're probably planning on reselling them.[21]⧼thumbs_response⧽

References

- ↑ https://www.cbp.gov/trade/basic-import-export/internet-purchases

- ↑ https://www.entrepreneur.com/article/314469

- ↑ https://www.entrepreneur.com/article/314469

- ↑ https://www.cbp.gov/trade/basic-import-export/internet-purchases

- ↑ https://www.cbp.gov/trade/basic-import-export/internet-purchases

- ↑ https://www.cbp.gov/trade/basic-import-export/internet-purchases

- ↑ https://www.cbp.gov/trade/basic-import-export/internet-purchases

- ↑ https://www.cbp.gov/travel/international-visitors/kbyg/sending-us

- ↑ https://www.fedex.com/en-us/shipping/international-urgent-delivery.html

- ↑ https://www.cbp.gov/trade/basic-import-export/internet-purchases

- ↑ https://www.cbp.gov/travel/international-visitors/kbyg/customs-duty-info

- ↑ https://www.cbp.gov/travel/international-visitors/kbyg/sending-us

- ↑ https://www.cbp.gov/travel/international-visitors/kbyg/sending-us

- ↑ https://www.investopedia.com/terms/i/import-duty.asp

- ↑ https://www.investopedia.com/terms/i/import-duty.asp

- ↑ https://www.entrepreneur.com/article/314469

- ↑ https://www.cbp.gov/trade/basic-import-export/internet-purchases

- ↑ https://www.cbp.gov/trade/basic-import-export/internet-purchases

- ↑ https://www.cbp.gov/travel/international-visitors/kbyg/sending-us

- ↑ https://www.entrepreneur.com/article/314469

- ↑ https://www.cbp.gov/trade/basic-import-export/internet-purchases