This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 125,913 times.

Deferred compensation is a term used in the United States to refer to a portion of an employee's pay that is disbursed well after it is earned. Stock options and pensions are the two most common forms of deferred compensation. This type of pay arrangement is generally reserved for top executives and employees in managerial positions, and can have advantageous tax implications. Learning how to account for deferred compensation requires an understanding of the Generally Accepted Accounting Principles (GAAP) underlying the treatment, as well as the portion of the Internal Revenue Code (IRC) that applies.

Steps

Calculate the Present Value of the Compensation

-

1Determine the terms of the deferred compensation package. Understanding the structure of the pay package is essential to executing the proper accounting treatment. For example, consider a compensation plan issued in 2015 that will pay out a lump sum of $100,000 to an employee in 2020.

-

2Get the interest rate used for the present value calculation. To calculate the present value, you'll need an interest rate that represents a low-risk investment. The current interest rate on treasury bonds is typically an excellent choice for a present value interest rate. For our purposes, we'll keep things simple and use an interest rate of 1 percent.Advertisement

-

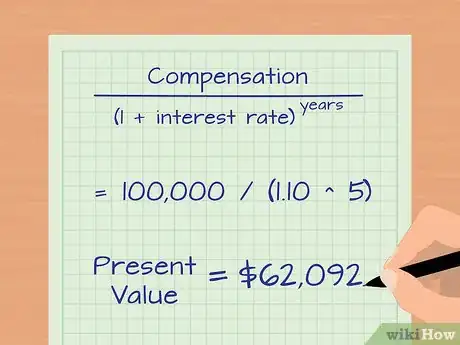

3Calculate the present value of the pay plan. Because the amount will be paid out in the future, you'll need to calculate the present value of the compensation that will eventually be paid. The present value takes into account the difference between receiving money now and receiving the same amount at some point in the future.[1]

- Calculate the present value using the following formula: Present Value = Compensation / ((1 + interest rate) ^ years) until compensation. So, for our purposes that means Present Value = 100,000 / (1.01 ^ 5) or $95,147.

- You can also use your favorite spreadsheet to calculate the present value by just plugging in the compensation amount, interest rate, and number of years into the formula.[2]

Recording the Journal Entries

-

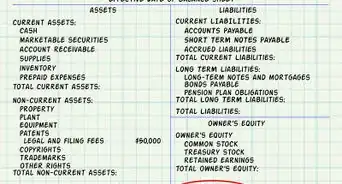

1Set up the proper accounts. Whether you're using accounting software or an old-school ledger, you'll need to have the appropriate accounts set up. Specifically, you'll need these accounts: Deferred Compensation Expense and Deferred Compensation Liability.

- The Deferred Compensation Expense account operates just like any other expense account. It's a charge against your revenue that reduces your net income.

- The Deferred Compensation Liability account is used because you're not paying the employee right away but you owe the employee the money eventually. Effectively, it's payable.

-

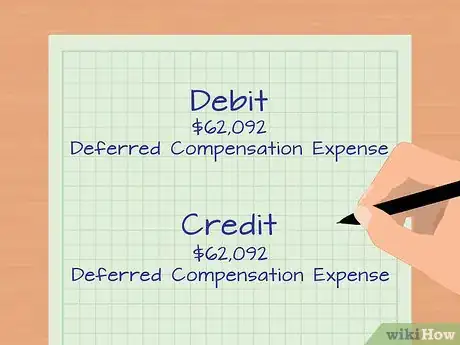

2Record the journal entries for the establishment of the deferred compensation plan. When the plan is established (in 2015), it represents a liability; that is, an obligation to pay the employee. An entry must be recorded in the general journal to reflect the establishment of the pay plan.

- To record the journal entry, debit Deferred Compensation Expense for $95,147 and credit Deferred Compensation Liability (a long-term liability account) for $95,147.

-

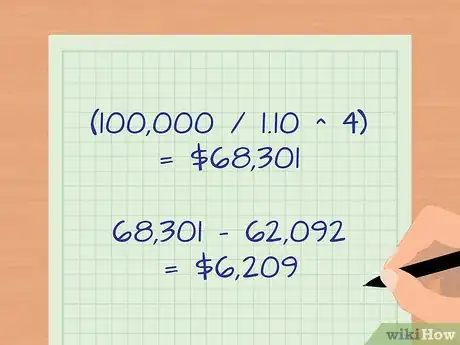

3Adjust the value of the deferred compensation plan each year. Because the journal entry above was made using a discounted valuation, the account balances will have to be adjusted upward each year to reflect the updated present value.

- For example, after the first year, the new total value of the compensation plan is (100,000 / 1.01^ 4) or $96,061. The difference between this value and the initial value is ($96,061 - $95,147) or $914.

- To record the adjusting entry, debit Deferred Compensation Expense for $914 and credit Deferred Compensation Liability for $914.

-

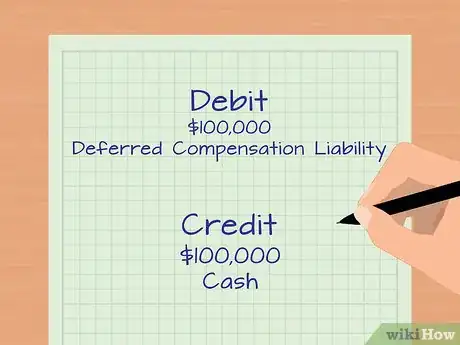

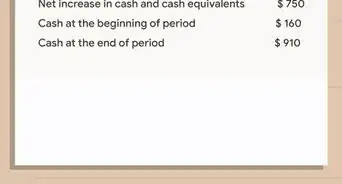

4Record the journal entry upon disbursement of cash to the employee. In 2020, the deferred compensation plan matures and the employee is paid. The journal entry is simple. Debit Deferred Compensation Liability for $100,000 (this will zero out the account balance), and credit Cash for $100,000. Taxes on the payment will be paid at this point (by both the corporation and the employee).