This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

This article has been viewed 54,851 times.

Accessing old tax returns may be necessary if you need to look up specific information about your income or your expenses. You can also use old tax returns as proof of your financial history for a mortgage or loan application. As a taxpayer, you are able to access a transcript or an official copy of old tax returns in just a few easy steps. A transcript is free to access, but each official copy of your old tax returns will cost you $50 USD as of March 2019.

Steps

Accessing a Transcript of Old Tax Returns

-

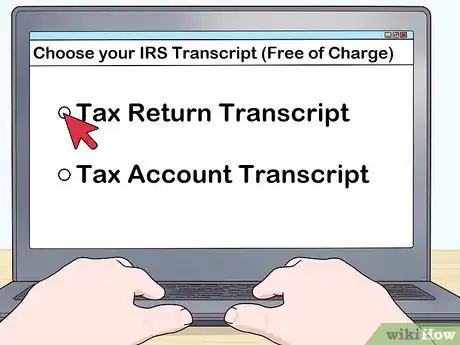

1Determine which type of transcript you need. The IRS offers several different transcript types free of charge. The broadest type is the Tax Return Transcript, which is available for the current year and any returns processed within the past 3 years. It is the best option if you are using the old tax returns to apply for a mortgage or a student loan.[1]

- Another option is to request the Tax Account Transcript, which contains information like the return type, marital status, gross income, and payment types in your old returns going back 3 years. It also shows changes you made after you filed your original return.

-

2Register online with the IRS. You can register with the IRS free of charge here: https://www.irs.gov/individuals/get-transcript. You will need to provide your Social Security Number, date of birth, filing status (single, married, etc.), phone number, and a mailing address. You will also need to provide your personal account number from a credit card, mortgage, home equity loan, or home equity line of credit.[2]

- If you want to access the transcript online, you will also need to provide your email address.

- If you want a transcript mailed to you, you do not need to provide a personal account number from a credit card, mortgage, home equity loan, or home equity line of credit, or a phone number.

- Having an online account with IRS also allows you to check on the status of your taxes and do other tax-related tasks through the online portal.

Advertisement -

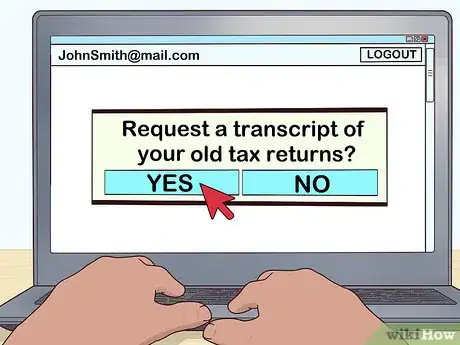

3Request a transcript of your old tax returns online. Once you register online with the IRS, you can send in a request for the transcript type that suits your needs. The transcripts are free of charge, so you do not need to include a payment with your request.[3]

-

4View the transcript online or receive it by mail. If you choose to view the transcript online, it will appear within a few minutes so you can access it on your computer. You can then download and print it if you’d prefer a hard copy.[4]

- If you choose to receive the transcript by mail, it should arrive within 5-10 days to the mailing address you provided when you set up an account with the IRS.

Getting an Official Copy of Old Tax Returns

-

1Ask your federal tax preparer for a copy of your old returns. Your accountant or tax preparer can give you a photocopy of your old returns, usually at no charge. Some accountants may charge a small processing fee or add the cost of copying old returns into the fee for filing your current return.[5]

-

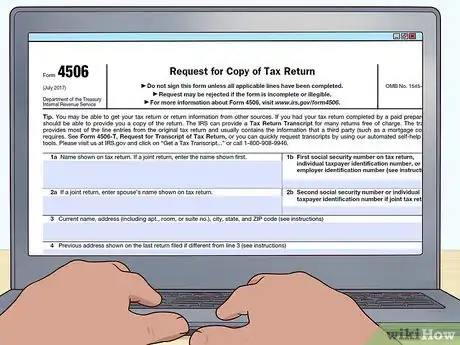

2Complete Form 4506 to request a copy from the government. Access the form here: https://www.irs.gov/pub/irs-pdf/f4506.pdf. You can request official copies of tax returns going back 6 years. The form is 1 page long and requires you to provide basic personal information like your name, date of birth, social security number, and the year or years of the tax returns you need.

- You will also need to provide a current mailing address so the old tax returns can be mailed to you.

-

3Include a check or money order for the $50 USD processing fee. Make the check or money order payable to “The United States Treasury.”[6]

- The IRS charges $50 USD per tax return you request. If you need more than 1 copy of an old tax return or tax returns for different years, you will need to fill out a separate Form 4506 for each 1 and include a $50 USD fee for each 1.

- If the IRS cannot find the tax return for the year you requested, they will refund the fee.

-

4Mail the form and fee to the IRS office in your state or area. There is a list of addresses on the second page of Form 4506. Find the address for the IRS office for the state or area where you lived when you filed the return. Include the correct postage for the form and the fee so it gets to the IRS safely.[7]

-

5Receive your old tax returns in the mail. It can take up to 75 days for the IRS to process your request for an official copy of an old tax return and send you a copy of the return. Make sure you send in your request as soon as possible, especially if you are in a hurry to get a copy of your old tax returns.[8]

- Keep in mind that as part the package from the IRS, you will also receive any old W-2s and Form 1099s that apply to the tax year you requested.

References

- ↑ https://www.irs.gov/individuals/tax-return-transcript-types-and-ways-to-order-them

- ↑ https://www.irs.gov/individuals/get-transcript

- ↑ https://www.irs.gov/individuals/get-transcript

- ↑ https://www.irs.gov/individuals/get-transcript

- ↑ https://www.irs.com/articles/how-to-get-an-exact-copy-of-a-past-tax-return

- ↑ https://www.irs.com/articles/how-to-get-an-exact-copy-of-a-past-tax-return

- ↑ https://www.irs.com/articles/how-to-get-an-exact-copy-of-a-past-tax-return

- ↑ https://www.irs.com/articles/how-to-get-an-exact-copy-of-a-past-tax-return