This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 158,174 times.

Nonprofit organizations are tax-exempt organizations that are charitable, educational, scientific, religious or literary, and use all revenue in service to the public. A nonprofit organization can reduce fundraising costs and attract more donors by enabling online donations. The two methods for accepting online donations include opening a merchant account with a financial institution or working with a third-party payment processor. The method a you choose may depend on your total operating budget, your goals for branding your company and how convenient and automated you want the process to be. To learn more about starting a nonprofit, check out How to Start a 501(c)(3) Nonprofit Organization.

Steps

Setting Up an Online Merchant Account

-

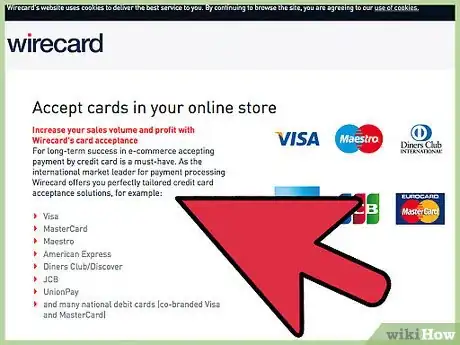

1Sign up for a merchant account. A merchant account is a bank account that allows you to accept credit card payments.[1] The bank has a processing relationship with the credit card companies.[2] A nonprofit organization can establish a merchant account with any bank or credit card company. Merchant accounts often have various fees attached to them.

-

2Choose how you want to accept payments. Decide which credit card brands you want to be able to accept, such as Visa, MasterCard and American Express. Also, you may want to allow your donors to submit debits directly from their checking accounts. Anticipate the volume of donations you expect to received and whether or not you will be processing recurring donations.[3]Advertisement

-

3Understand merchant account fees. Merchant account providers charge many different kinds of fees. The kinds of fees and the amounts charged vary. Compare different financial institutions to find one with a fee structure that suits your needs.[4]

- Merchant accounts charge two types transaction of fees. The first is a per-item flat rate that you will be charged for each credit card transaction. The second is a percentage fee, which charges you a percentage of each transaction.[5]

- Percentage transaction fees may be assessed in a tiered fashion. Different types of transactions are classified into specific tiers, each with its own rate.

- Other fees associated with a merchant account may include set up fees, address verification, monthly and annual maintenance fees and gateway access fees.

-

4Evaluate merchant account providers. In addition to considering the fees they charge, evaluate merchant account providers based on the services they provide. Different merchant account providers have different software requirements and customer support options.[6]

- Some institutions provide you with software and payment acceptance options, while others require you to purchase these separately from a different provider.

- Find out how easily you can customize your website, invoices, payment forms and payment communications. If you don’t have a lot of technical expertise, you want these processes to be as automated as possible.

- Choose a merchant account provider with a proven reputation of secure transactions that protect your donors’ financial information.

-

5Apply for the merchant account. Once you have chosen a provider, understand that they may put you through a rigorous application process before allowing you to accept credit card payments. Expect to provide financial records and information about your business model. In addition, you may be asked for personal financial information. You should also expect them to run a credit check on you.[7]

-

6Understand the advantages and disadvantages of a merchant account. With a merchant account, the name of your organization appears on all financial transactions, so donors see your name on their credit card statements, which is important for branding. Also, funds arrive in your account quickly. The disadvantages of a merchant account are the expensive fees and the complicated set-up process. [8]

-

7Begin accepting payments. Log in to your merchant account software. Enter your donor’s payment information. Click on the collect payment button. The credit card transaction will then be processed, and the funds will be deposited into your account.[9]

Choosing a Third-Party Processor

-

1Choose a third-party processor. If you don’t want to deal with setting up a merchant account, a third-party processor will use their merchant account to accept credit card donations on your behalf. You will be charged a processing fee by the third-party processor. Also, expect delays in transferring the money to your account.[10]

- The fees charged by a third-party processor are typically a percentage of each transaction.

-

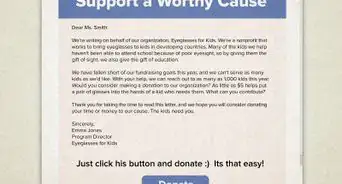

2Find a third-party processor that specializes in working with nonprofits. Popular companies who work with nonprofits include Network for Good and Democracy in Action. These companies have centralized websites to which donors are referred. They not only provide credit card processing, but they also send acknowledgement notices to donors. Their acknowledgement communications include information about your nonprofit organization and your cause.[11]

-

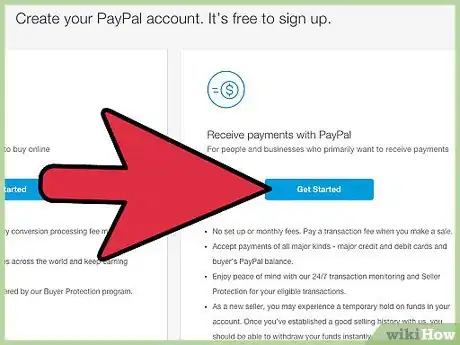

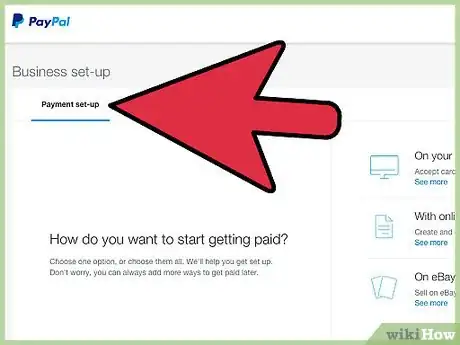

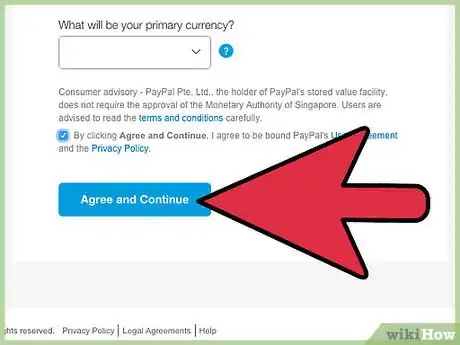

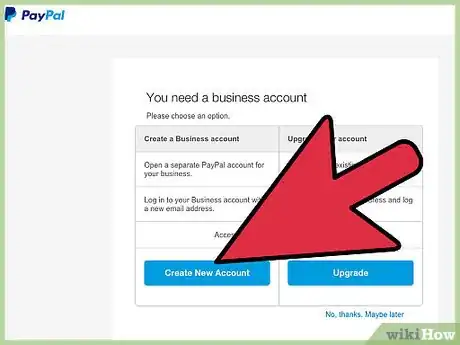

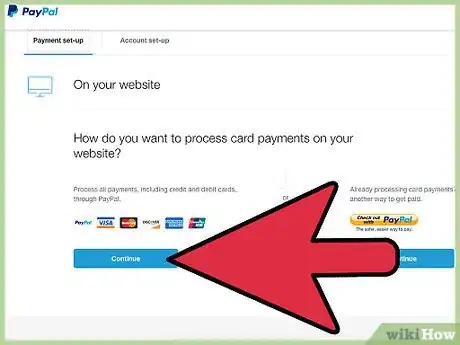

3Consider using PayPal. PayPal also offers opportunities for nonprofits to accept donations online. They have a donate button that nonprofits can easily integrate into their websites. They also offer widgets that organizations can put on their social networking sites like Facebook and Twitter. They offer low transaction fees for nonprofits, and they don’t charge any set up or recurring monthly fees.[12]

- To be eligible for this option with PayPal, an organization must have a documented 501(c)(3) status.

-

4Understand the advantages and disadvantages of a third-party processor. Third-party processors are easy to set up and manage and inexpensive to maintain. If you go with a well-known company, you can have confidence that your transactions will be processed quickly and accurately. However, your name does not appear on financial transactions on the donor’s credit card statement. Also, you should expect a delay of a few days before funds are transferred into your account.[13]

Registering with the State

-

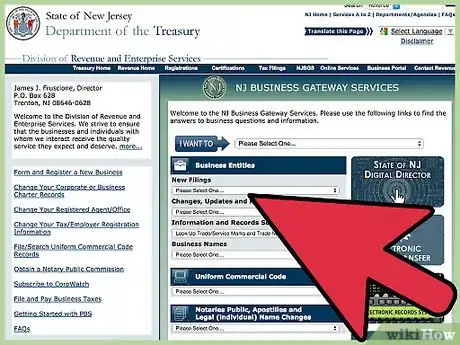

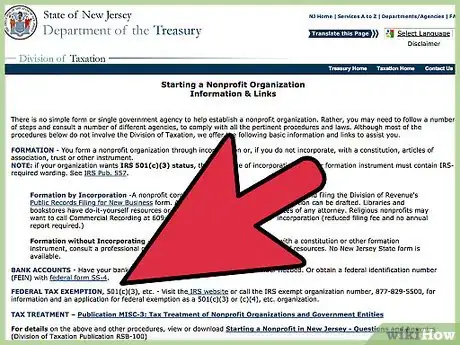

1Know which states in which to register your nonprofit organization. If you solicit donations from residents of a state, you will have to register your nonprofit organization with that state. Therefore, you may need to register your organization in more than one state. States may impose fines or penalties if you fail to register. Also, you may have to cease activity in that state until you register there.[14]

-

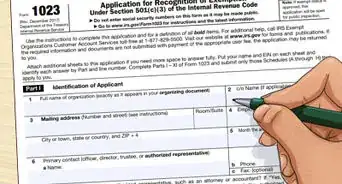

2Fill out an initial registration application. Contact the appropriate state agency to file the registration. Requirements and fees for the application vary from state to state. In some states the registration is referred to as a registration statements. Other states may refer to it as a license, solicitation permit, or certificate.[15]

- Some states also require an annual renewal and financial reporting requirement.

-

3Know if your nonprofit is exempt from registration. Depending on your organization's size and type, you may be exempt from having to register with the state. Also, the number of state residents who donate to your organization may exempt you from registration requirements. Be aware that while you may be exempt in one state, you may not qualify for exemption in another.[16]

- In some states, hospitals, educational, and religious institutions and very small nonprofit companies are exempt from registration requirements.

-

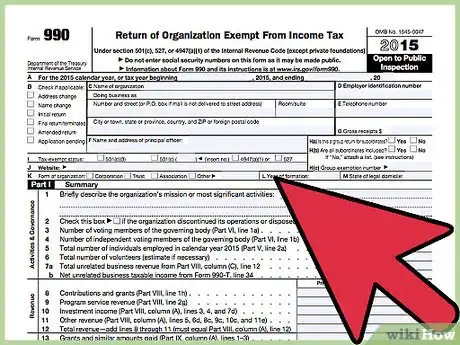

4Submit IRS form 990. Even though nonprofit organizations do not file federal income taxes, they still need to a federal income tax return with the IRS. IRS form 990 allows the IRS and the public to evaluate how your organization operates. It provides information about the organization's mission, programs, and finances. It also discloses potential conflicts of interest and compensation of board members.[17]

- IRS form 990 also requires nonprofits to include information about their registration with the state.

- You should provide donors with a written communication or acknowledgement of donation if they wish to claim a charitable donation on their tax return.[18]

Setting Up Your Website

-

1Understand the importance of good website design. Jakob Nielsen, a webpage design expert, researched the efficacy of website design in getting donors to submit donations to different charities online. His research determined that bad website design leads to fewer donations. Donors not only expect a user-friendly experience, but they also want information about the organization's mission and how the funds will be used.[19]

-

2Include information about your mission. Before donors commit to submitting a donation, they want to see information about your goals and work. Write a mission statement and display it prominently on the homepage of your website. Include details about the work you have done and your future goals. Donors want to give to organizations that share their ideals and values. But they also want to know how you plan to achieve your goals.[20]

-

3Provide details about how you use donations. List any pertinent details about how the funds you receive are to be used to accomplish your goals. Donors want reassurance that their money is going to the cause they want to support. They are more likely to donate if they know your organization is trustworthy.[21]

-

4Make your site user-friendly. Make sure all of your content is clearly written and doesn’t include confusing terms or have missing information. Donors want to be able to have all of their questions answered before donating. If you are part of a larger parent site, make your site look and operate similarly to the parent site. It’s confusing if your site is completely different. Also, make it easy for donors to find the donate button.[22]

References

- ↑ http://www.investopedia.com/terms/m/merchant-account.asp

- ↑ https://paysimple.com/blog/how-to-set-up-a-merchant-account/

- ↑ https://paysimple.com/blog/how-to-set-up-a-merchant-account/

- ↑ https://paysimple.com/blog/how-to-set-up-a-merchant-account/

- ↑ https://paysimple.com/blog/how-to-set-up-a-merchant-account/

- ↑ https://paysimple.com/blog/how-to-set-up-a-merchant-account/

- ↑ https://paysimple.com/blog/how-to-set-up-a-merchant-account/

- ↑ http://www.thenonprofittimes.com/news-articles/online-payment-systems/

- ↑ https://paysimple.com/blog/how-to-set-up-a-merchant-account/

- ↑ https://www.bluepay.com/blog/3-credit-card-processing-alternatives-non-profits/

- ↑ http://www.networkforgood.com/

- ↑ https://www.paypal.com/webapps/mpp/donations

- ↑ https://www.bluepay.com/blog/3-credit-card-processing-alternatives-non-profits/

- ↑ http://www.nolo.com/legal-encyclopedia/fundraising-registration-does-nonprofit-need-33598.html

- ↑ http://www.nolo.com/legal-encyclopedia/fundraising-registration-does-nonprofit-need-33598.html

- ↑ http://www.nolo.com/legal-encyclopedia/fundraising-registration-does-nonprofit-need-33598.html

- ↑ http://www.guidestar.org/rxg/help/faqs/form-990/index.aspx#faq1942

- ↑ https://www.irs.gov/pub/irs-pdf/p1771.pdf

- ↑ http://www.nngroup.com/articles/non-profit-websites-donations/

- ↑ http://www.nngroup.com/articles/non-profit-websites-donations/

- ↑ http://www.nngroup.com/articles/non-profit-websites-donations/

- ↑ http://www.nngroup.com/articles/non-profit-websites-donations/