Chapter 13

Capital Structure

By Boundless

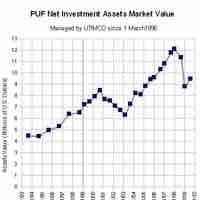

The optimal capital structure is the mix of debt and equity that maximizes a firm's return on capital, thereby maximizing its value.

Taxation implications which change when using equity or debt for financing play a major role in deciding how the firm will finance assets.

Cost of capital is important in deciding how a company will structure its capital so to receive the highest possible return on investment.

The marginal cost of capital is the cost needed to raise the last dollar of capital, and usually this amount increases with total capital.

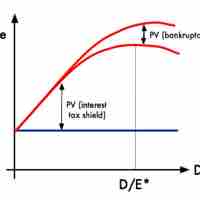

Trade-off considerations are important because they take into account the cost and benefits of raising capital through debt or equity.

Signaling is the conveyance of nonpublic information through public action, and is often used as a technique in capital structure decisions.

Managers will have their actions influenced by their firm's capital structure and the resources that it allows them to use.

In corporate finance pecking ordering consideration takes into account the increase in the cost of financing with asymmetric information.

In corporate finance, a "window of opportunity" is the time when an asset or product which is unattainable will become available.

Bankruptcy occurs when an entity cannot repay the debts owed to creditors and must take action to regain solvency or liquidate.

Bankruptcy allows debtors to either reorganize and restructure debts or liquidate assets to be used to pay off creditors.

To avoid the negative impacts of bankruptcy, individuals and companies in financial distress can implement certain financial management techniques.

Most creditors are willing to negotiate a settlement to receive a portion of their money and not risk losing everything in a bankruptcy.

Operating leverage is a measure of how revenue growth translates into growth in operating income.

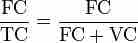

Break-even analysis tells a company how much it needs to sell in order to pay for an investment.

The relationship between fixed and variable costs, when calculated alongside sales volume, enables modeling of operational leverage.

The use of operating leverage can multiply profits when a given break-even point is reached, but it can intensify losses when it is not.

Financial leverage is a tactic to multiply gains and losses, calculated by a debt-to-equity ratio.

The use of financial leverage can positively - or negatively - impact a company's return on equity as a consequence of the increased level of risk.

Models that allow us to interpret appropriate financial leverage include the Modigliani-Miller theorem and the Degree of Financial Leverage.

To calculate total leverage, we multiply Degree of Operating Leverage by Degree of Financial Leverage.