Section 5

Thinking About Financial Leverage

Book

Version 3

By Boundless

By Boundless

Boundless Finance

Finance

by Boundless

4 concepts

Defining Financial Leverage

Financial leverage is a tactic to multiply gains and losses, calculated by a debt-to-equity ratio.

Impacts of Financial Leverage

The use of financial leverage can positively - or negatively - impact a company's return on equity as a consequence of the increased level of risk.

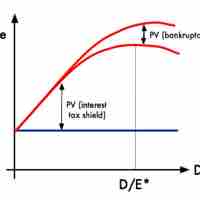

Leverage Models

Models that allow us to interpret appropriate financial leverage include the Modigliani-Miller theorem and the Degree of Financial Leverage.

Combining Operating Leverage and Financial Leverage

To calculate total leverage, we multiply Degree of Operating Leverage by Degree of Financial Leverage.