Why Organizations Leverage Finances

At its simplest, leverage is a tactic geared at multiplying gains and losses. Leveraging existing assets to get exponentially more return can be a risk intensive process, and represents a significant aspect of financial strategy and capital structure. Achieving leverage can enable significant competitive advantages despite the risk, however, as it can accelerate the speed of revenue acquisition exponentially.

The standard way to accomplish leverage is through borrowing, via debt and equity, to invest at a much higher scale than one's current assets would allow. In order to borrow substantial amounts of capital, firms must pursue a variety of financial sourcing and be able to back up their debts with valuable assets (collateral). Even with a great deal of collateral, borrowing big means risking big. Interest rates ensure that the strategic discussions around expanding leverage take into account the risk and return trade offs.

Measuring Leverage

In finance, the best definitions come in equation format. The standard definition of financial leverage is as follows:

In short, the ratio between debt and equity is a strong sign of leverage. As you may already know, equity is ownership of the organization and pays out fairly significant dividends. Debt is often lower cost access to capital, as debt is paid out before equity in the event of a bankruptcy (thus debt is intrinsically lower risk for the investor).

Leverage and Capital Costs

The debt to equity ratio plays a role in the working average cost of capital (WACC) as well, as the overall interest on financing represents the break-even point that must be obtained to achieve profitability in a given venture. WACC is essentially the overall average interest an organization owes on the capital it has borrowed for leverage.

Let's say equity represents 60% of borrowed capital and debt is 40%. This results in a financial leverage calculation of 40/60, or 0.6667. The organization owes 10% on all equity and 5% on all debt. That means that the weighted average cost of capital is (.4)(5) + (.6)(10) - or 8%. For every $10,000 borrowed, this organization will owe $800 in interest. Profit must be higher than 8% on the project to offset the cost of interest and justify this leverage.

Leverage and the 2007-2009 Recession

A word of caution: Leverage is exponentially more risky the more it is utilized. A useful way to view leverage is the overall existing assets of an organization compared to the amount of money they owe. For example, say you own a company with an overall net worth of $1 million. If you were to be leveraged at a total of 1.5 times (i.e. financed at $1.5 million), this would put you at some risk. Arguably a reasonable amount.

Before Lehman Brothers went bankrupt, they were leveraged at over 30 times ($691 billion in financial leverage compared to $22 billion in assets). A mistake of this scale (on both the lenders and the Lehman Brothers) threatened to topple the global economy itself. It's important to keep responsibility, accountability, and risk in mind when considering leverage options.

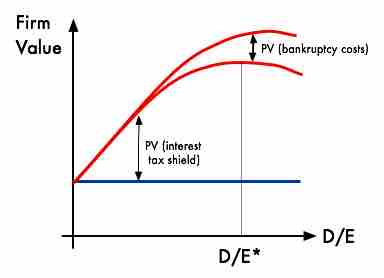

Financial Leverage Firm Value Implications

This graph illustrates a theoretical firm value maximizing curve when it comes to a debt-to-equity ratio. All this means is that each organization has the ideal balance between debt and equity, and finding the 'sweet spot' is a useful strategic aspect of financial leverage decisions.