Striking Agreements To Avoid Bankruptcy

In general, creditors understand that bankruptcy is an option for debtors with excessive debt. Therefore, most creditors are willing to negotiate a settlement so that they receive a portion of their money, instead of risking losing everything in a bankruptcy. Negotiation is a viable alternative if the debtor has sufficient income, or has assets that can be liquidated so the proceeds can be applied against the debt. Negotiation may also buy the debtor some time to rebuild finances.

Debt Restructuring

Debt restructuring is a process that allows a company or individual in financial distress to reduce and renegotiate its delinquent debts in order to improve or restore liquidity and continue its operations. Out-of court restructurings, also known as workouts, are becoming increasingly common. A debt restructuring is usually less expensive than bankruptcy. The main cost associated with debt restructuring is the time and effort required to negotiate with creditors. Debt restructurings typically involve a reduction of debt and an extension of payment terms. A debtor and creditor could also agree to a debt-for-equity swap, wherein a company's creditors generally agree to cancel some or all of the debt in exchange for equity in the company. These deals typically occur with large companies in financial distress, and often result in these companies being taken over by their principal creditors.

Debt Consolidation

Debt consolidation typically involves borrowing from one lender at a low rate of interest in order to repay a number of higher interest rate obligations. By consolidating debts, the debtor replaces payments to many different creditors with a payment to one creditor. This simplifies the debtor's obligations and can result in faster debt repayment. This is a common course of action for individuals owing large sums on multiple credit cards .

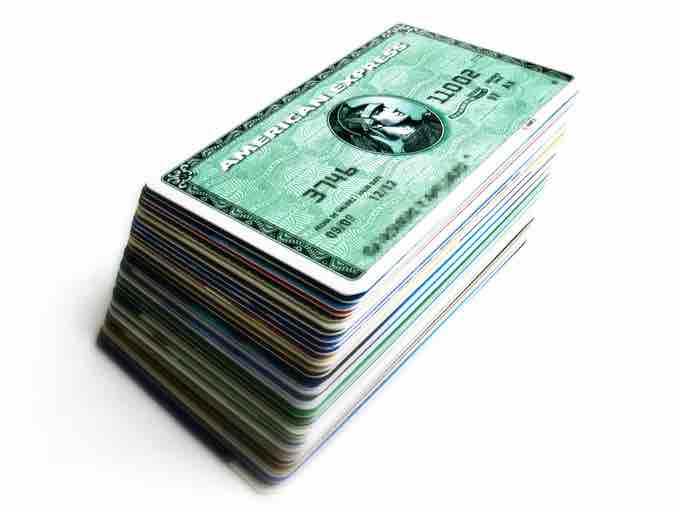

Too Much Credit

Debt consolidation is one option for individuals owing large sums on multiple credit cards.