This article was co-authored by Ara Oghoorian, CPA. Ara Oghoorian is a Certified Financial Accountant (CFA), Certified Financial Planner (CFP), a Certified Public Accountant (CPA), and the Founder of ACap Advisors & Accountants, a boutique wealth management and full-service accounting firm based in Los Angeles, California. With over 26 years of experience in the financial industry, Ara founded ACap Asset Management in 2009. He has previously worked with the Federal Reserve Bank of San Francisco, the U.S. Department of the Treasury, and the Ministry of Finance and Economy in the Republic of Armenia. Ara has a BS in Accounting and Finance from San Francisco State University, is a Commissioned Bank Examiner through the Federal Reserve Board of Governors, holds the Chartered Financial Analyst designation, is a Certified Financial Planner™ practitioner, has a Certified Public Accountant license, is an Enrolled Agent, and holds the Series 65 license.

There are 8 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 23 testimonials and 100% of readers who voted found it helpful, earning it our reader-approved status.

This article has been viewed 1,553,034 times.

In bookkeeping under General Accepted Accounting Principles (GAAP), debits and credits are used to track the changes of account values. They can also be thought of as mirror opposites: Each debit to an account must be accompanied by a credit to another account (that's how the phrase "double-entry bookkeeping" gets its name).[1] Understanding debits and credits is essential for bookkeeping and analysis of balance sheets.

Steps

Learning the Terms

-

1Familiarize yourself with the meaning of "debit" and "credit." In bookkeeping, the words "debit" and "credit" have very distinct meanings and a close relationship.[2] Debits and credits balance each other out —if a debit is added to one account, then a credit must be added to the an opposite account.

- Two related terms are "equity" and "liability." Equity is what is left over after subtracting all assets, and liability is how much is owed to other parties.[3]

- In accounting, the debit column is on the left of an accounting entry, while credits are on the right.[4]

- Debits increase asset or expense accounts and decrease liability or equity. Credits do the opposite — decrease assets and expenses and increase liability and equity.[5]

- To make sense of this, take a look at the basic accounting equation, which is Assets = Equity + Liabilities. Assets are paid for by equity and/or liability —you cannot have one without the other.[6] So if you complete a transaction that increases assets (and you debit the asset account), you must also increase the equity or liability (by crediting the equity or liability account) so that Assets remain equal to Equity and/or Liability.[7]

-

2Use acronyms to remember the difference. One of the simplest ways to remember the difference between a debit and a credit is with the use of familiar acronyms.Advertisement

-

3Remember that the books must be kept in balance. Remember that if you debit one account, you're going to need to credit the opposite account.[10] Whenever there is an accounting transaction, at least two accounts will always be impacted.[11] The total amount of debits in a single transaction must equal the total amount of credits.[12]

- For example, if you pay down your Accounts Payable account (a liability) with $20,000 in cash (an asset), you'll need to adjust both accounts.

- In that case, you'll credit Cash for $20,000. That will reduce your cash amount by $20,000.

- To keep your books in balance, you'll need to debit Accounts Payable by $20,000. That will likewise reduce your Accounts Payable amount by $20,000.

Recording Debits and Credits Correctly

-

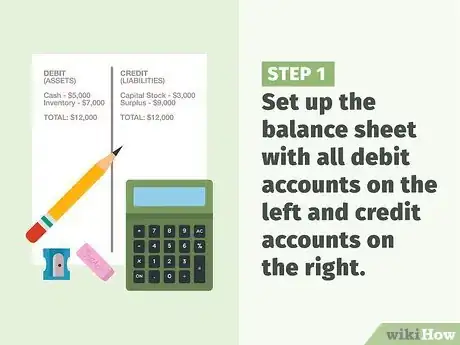

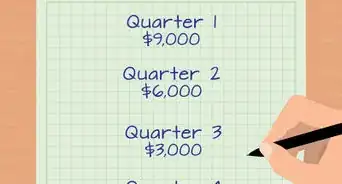

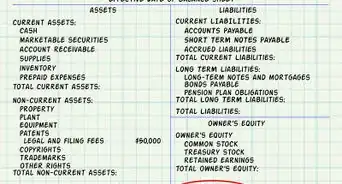

1Set up the balance sheet with all debit accounts on the left and credit accounts on the right. For illustration, assume that ABC Company has $5000 cash, $7000 inventory, $3000 capital stock, and $9000 surplus.

-

2Set up the ledgers for each account. A general ledger is a standard way of recording debits and credits for a particular account.[13]

- Place the debit balance on the left and the credit balance on the right. Remember that debit accounts have debit balances and credit accounts have credit balances.

-

3Consider what is being exchanged when entering a transaction. Whenever a transaction occurs, something is being exchanged for something else. For example: Does the transaction change the amount of cash, the amount of receivables, the inventory value, or add to an expense? Suppose the company in our example has subsequently sold on credit $4,000, which cost it $2,800, and incurred various expenses totaling $500 paid in cash. So this transaction impacted the following accounts: Accounts Receivables, Inventory, Cash, and Surplus (for simplicity, all all profit and loss as credit or debit will be logged in the Surplus account).

- If the transaction increases a debit account, record a debit entry in that debit account, and simultaneously a credit entry in an appropriate credit account.

- Continuing with our example, you would debit Accounts Receivables $4,000, then credit Surplus with a corresponding $4,000.

- If the transaction decreases a debit account, record a credit entry in that debit account, and simultaneously a debit entry in an appropriate credit account.

- The cost of goods sold of $2,800 decreases the inventory, and is therefore a credit entry. It will have a corresponding $2,800 debit entry from Surplus. The $500 expenses paid in cash decreases the debit account Cash, so you would enter $500 credit in the Cash account. It will have a corresponding $500 debit entry from Surplus.

-

4Calculate the ending balance in each account and update the balance sheet. Remember, your balance sheet is appropriately named because it must always stay in balance.[14] The overall value of your assets must equal the value of your liabilities plus the value of your equity.

Debits vs. Credits Comparison Chart

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionWhat's the difference between equity and liability?

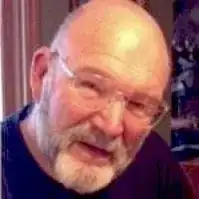

Ara Oghoorian, CPAAra Oghoorian is a Certified Financial Accountant (CFA), Certified Financial Planner (CFP), a Certified Public Accountant (CPA), and the Founder of ACap Advisors & Accountants, a boutique wealth management and full-service accounting firm based in Los Angeles, California. With over 26 years of experience in the financial industry, Ara founded ACap Asset Management in 2009. He has previously worked with the Federal Reserve Bank of San Francisco, the U.S. Department of the Treasury, and the Ministry of Finance and Economy in the Republic of Armenia. Ara has a BS in Accounting and Finance from San Francisco State University, is a Commissioned Bank Examiner through the Federal Reserve Board of Governors, holds the Chartered Financial Analyst designation, is a Certified Financial Planner™ practitioner, has a Certified Public Accountant license, is an Enrolled Agent, and holds the Series 65 license.

Ara Oghoorian, CPAAra Oghoorian is a Certified Financial Accountant (CFA), Certified Financial Planner (CFP), a Certified Public Accountant (CPA), and the Founder of ACap Advisors & Accountants, a boutique wealth management and full-service accounting firm based in Los Angeles, California. With over 26 years of experience in the financial industry, Ara founded ACap Asset Management in 2009. He has previously worked with the Federal Reserve Bank of San Francisco, the U.S. Department of the Treasury, and the Ministry of Finance and Economy in the Republic of Armenia. Ara has a BS in Accounting and Finance from San Francisco State University, is a Commissioned Bank Examiner through the Federal Reserve Board of Governors, holds the Chartered Financial Analyst designation, is a Certified Financial Planner™ practitioner, has a Certified Public Accountant license, is an Enrolled Agent, and holds the Series 65 license.

Certified Financial Planner & Accountant

-

QuestionDoes the income go to Debit and Account Receivable go to Credit?

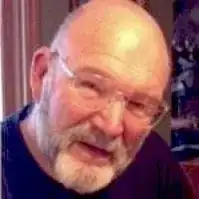

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor

-

QuestionHow do I prepare a bank reconciliation statement?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor Follow the steps outlined in WikiHow's How to Prepare a Bank Reconciliation

Follow the steps outlined in WikiHow's How to Prepare a Bank Reconciliation

References

- ↑ https://www.kashoo.com/blog/what-is-a-debit-and-credit-in-accounting

- ↑ http://www.accountingcoach.com/debits-and-credits/explanation

- ↑ Ara Oghoorian, CPA. Certified Financial Planner & Accountant. Expert Interview. 11 March 2020.

- ↑ http://www.accountingtools.com/debits-and-credits

- ↑ http://www.accountingtools.com/debits-and-credits

- ↑ http://www.accountingtools.com/debits-and-credits

- ↑ http://www.accountingtools.com/debits-and-credits

- ↑ https://www.accountingcoach.com/debits-and-credits/explanation

- ↑ https://www.accountingcoach.com/debits-and-credits/explanation

About This Article

To understand debits and credits, know that debits are expenses and losses and that credits are incomes and gains. You should also remember that they have to balance, meaning that if a debit is added to an account, then a credit is added to another account. To keep debits and credits in balance, keep a ledger with credits on one side and debits on the other. Then, use the ledger to calculate the ending balance and update your balance sheet. For advice from our Financial Reviewer on how to set up a ledger, keep reading.