This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

This article has been viewed 221,677 times.

When running a business, it is very common for multiple expenses - rent and insurance, for example - to be paid for in advance. These expenses that are paid for in advance are known as pre-paid expenses. Knowing how to account for pre-paid expenses involves firstly an understanding of some key accounting principles, followed by the recording of a few simple journal entries.

Steps

Understanding Pre-Paid Expenses

-

1Familiarize yourself with accrual-based accounting. In order to understand the accounting for pre-paid expenses, it is important to understand the basic principle of accrual-based accounting. Quite simply, in accrual-based accounting, revenues are reported on the income statement when they are earned, not when the cash is received. [1]

- For example, if you provide a service worth $1,000 in June, and do not receive the cash for the service until August, the income will be reported on the income statement as $1,000 of revenues in June. In August, the income statement would show no revenues (assuming there were no other revenues from the business). This is because you earned the revenues in June.

- This differs from cash-based accounting, whereby the revenues are recorded when the cash itself is provided, not when the revenues are earned.

-

2Learn the definition of pre-paid expenses. A pre-paid expense is simply a future expense that is paid for in advance. Typically, it involves an expenditure during one accounting period, followed by the consumption of whatever the pre-payment was for, over multiple periods. Common examples of pre-paid expenses include insurance premiums, rent, and any business contracts that require payment in advance.

- For example, with insurance, you may pay your premium six months in advance (which is common). Then, over a period of six months, that premium will be "used".

Advertisement -

3Familiarize yourself with the link between accrual accounting and pre-paid expenses. Accrual accounting requires that revenues be recognized in the period for which they are earned (not when cash is received), and the same principle applies to expenses. Expenses, in the same way, are not recognized when cash is paid out (or when the pre-paid expense is paid for), and are rather recognized over time as the thing that was pre-paid is used.[2]

- As an example, if you are paying rent six months in advance, the pre-paid expense would not be recorded in the month when you send the check to the landlord. Rather, the expense would be recorded over the six month period as the expense is "used up". In this case, every month for the six month period, one sixth of the total rent amount will appear on the income statement.

- Something known as the matching principle is what governs the treatment of prepaid expenses. This principle dictates that expenses should be recorded when the associated goods or services have been used, not when they are paid for, so that the expense matches the revenues that the expense helped to earn.

Accounting for Pre-Paid Expenses

-

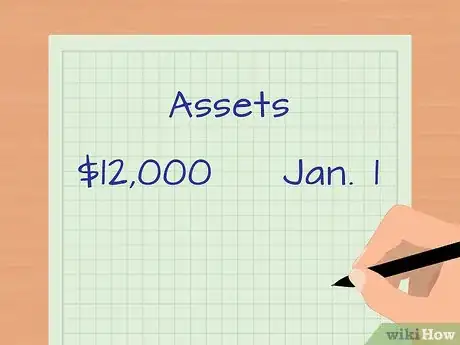

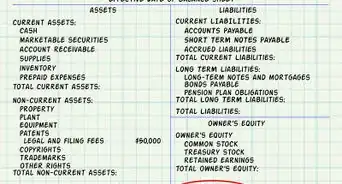

1Understand the basic accounting process for pre-paid expenses. The basic process of accounting for pre-paid expenses involves placing the pre-paid expense on the balance sheet as an asset when the expense is paid, and then gradually charging it as an expense over the period it is being used.

- This means that if you prepay $12,000 worth of rent for 1 year on January 1st, it would first be placed on the balance sheet as an asset. Then, over the course of the year, it would gradually be charged as an expense, reducing the asset balance as time goes on.

- At the end of January, for example, the asset account would reduce by $1,000 (reflecting 1/12th of the yearly payment being used), and the expense account on the income statement would increase by $1,000.

- Why are pre-paid expenses initially placed on the balance sheet as an asset? This is because the company now has the right to receive the good or service, in this case, rent. Because the pre-paid expense has value ($12,000) it is considered to be an asset.

-

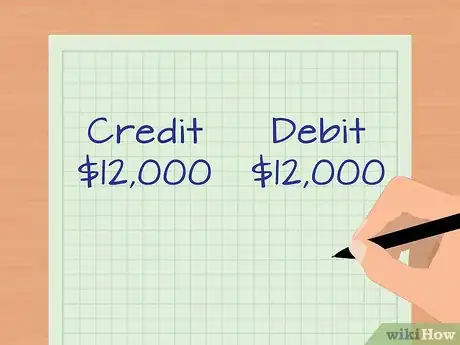

2Record the journal entry for making the pre-paid expense payment. The first step begins when you pay out the cash for the pre-paid expense. There must be an entry in the general journal to reflect this activity. For example, consider a firm that pays $12,000 for a year's worth of insurance coverage on January 1.

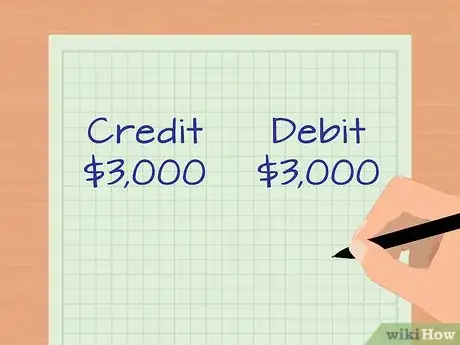

- To do this, open whatever accounting software you are using, and select (or create) the prepaid insurance account. You can then debit this account for $12,000, and credit the cash account for $12,000

- Since prepaid insurance is an asset account, the above entries would essentially add $12,000 to assets, and subtract $12,000 from cash.

- Asset balance is unaffected as the initial transaction if from one asset account to another.

-

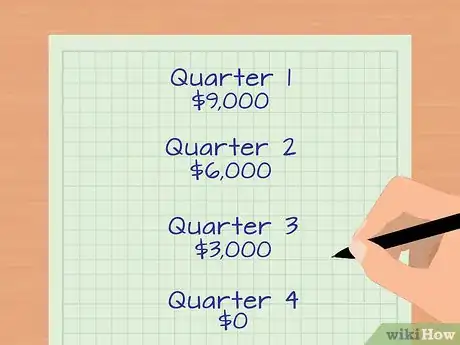

3Record the journal entry to expense the prepaid asset. At the end of each accounting period, the portion of the prepaid asset that has been used should be expensed to the income statement. In the example above, assume that the company releases financial statements quarterly.

- On March 31, the end of the first quarter, a fourth of the prepaid insurance needs to be expensed. To record the journal entry, debit Insurance Expense for $3,000 and credit Prepaid Insurance for $3,000.

- The entry above reduces the account balance of Prepaid Insurance, and moves that balance to the income statement as an expense. This is because 3 months' worth of the insurance coverage has now been provided by the insurer and can be recognized as an expense.

-

4Expense the prepaid asset until the end of its life. Make the journal entry above at the end of each accounting period until the account balance of Prepaid Insurance is 0. If the firm uses the year as its accounting period, only 1 journal entry will be needed to record the expense, which should be recorded on December 31.[3]

- For example, if the accounting period is quarterly, for the $12,000 pre-payment, each quarter would see $3,000 move from the Prepaid Insurance asset account, to the Insurance Expense account. After quarter 1, the Prepaid Insurance account would have a value of $9,000, and by the end of the fourth quarter, the Prepaid Insurance account would have a balance of 0.

- This concludes the process of accounting for a pre-paid expense, since the expense was gradually used up over the course of the year.

Expert Q&A

-

QuestionWhat is the adjusting entry for prepaid insurance?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor As the insurance coverage that was prepaid is consumed or "used up", an entry is made to debit insurance expense and to credit prepaid insurance for the amount to be recognized in the income statement.

As the insurance coverage that was prepaid is consumed or "used up", an entry is made to debit insurance expense and to credit prepaid insurance for the amount to be recognized in the income statement. -

QuestionHow are prepaid expenses recorded in the financial statements?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor A prepaid expense is reported in the current assets section fo the balance sheet.

A prepaid expense is reported in the current assets section fo the balance sheet. -

QuestionDo prepaid expenses go on the income statement?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor Prepaid expenses recorded under the accrual accounting method would be included in the income statement only to the extent that the prepayment benefits the current reporting period. For example, a full year's worth of rent is paid in advance on January 1. January's income statement would report 1/12 of that expense.

Prepaid expenses recorded under the accrual accounting method would be included in the income statement only to the extent that the prepayment benefits the current reporting period. For example, a full year's worth of rent is paid in advance on January 1. January's income statement would report 1/12 of that expense.

Things You'll Need

- Accounting software

References

About This Article

Prepaid expenses are those paid for in advance, such as insurance or rent. To account for them in your business, record the payment in your accounting software as an asset when it's paid. Then, gradually charge the asset as an expense over the period it's used, reducing the asset accordingly. For example, if you paid $12,000 up front for rent, you would reduce the asset $1,000 each month and increase the expense account by the same amount until the end of its life. For more tips from our Financial co-author, including how to understand accrual-based accounting, read on!