This article was co-authored by John Gillingham, CPA, MA. John Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 89% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 296,669 times.

Bookkeeping, like accounting, is one of the necessary evils of running a business. Despite what many may think, those two terms refer to different processes. Bookkeeping, as it will be discussed here, refers to simply collecting records of expenses and revenues, and then posting those transactions to a general ledger. Accounting is the process that follows bookkeeping, and involves converting the information in the ledger into useful business metrics and reports.[1] Luckily, bookkeeping is the simpler of the two, and can be learned by following the simple steps below.

Steps

Establishing a System

-

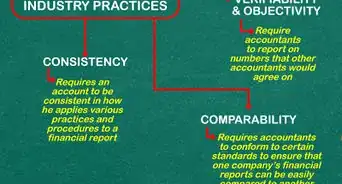

1Decide what type of system to use. The most important part of bookkeeping is being consistent. You don't want to lose receipts, forget to record transactions, or record the same transaction twice, as this could cause a misrepresentation of your business's financial health.[2] The simplest way to avoid these errors in by establishing a consistent system for both recording transactions in journals and entering them into the ledger.

- This system can be as complicated as a wired-in cash register that feeds into accounting software or as simple as a box full of receipts and notes. This will depend on the amount of transactions your company does on a daily or weekly basis.[3]

-

2Use accounting software. The simplest way to ensure that your transactions are recorded reliably is to invest in an accounting program like QuickBooks, FreshBooks, or Expensify. These will take a lot of the guesswork out of recording different types of transactions and present your information clearly. Many of these programs are available for free or on as a free trial for a limited time.[4]Advertisement

-

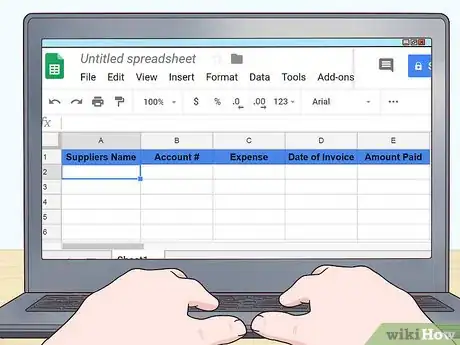

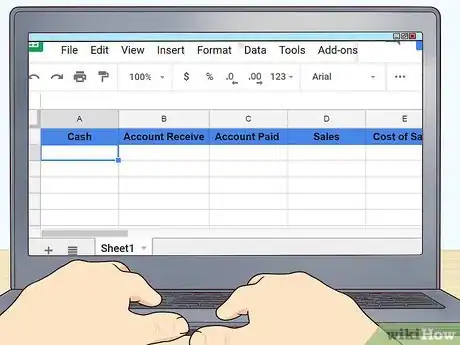

3Use a spreadsheet. For a more manual system, try setting up a spreadsheet to record transactions. This can be done either manually, with physical transaction journals, or on the computer with a spreadsheet program. The formatting of these journals is up to you, but it should include the following, at minimum:

- Supplier’s/buyer’s name

- Account number

- Expense/revenue type (e.g. office supplies, raw materials)

- Date the invoice was received/created

- Amount owed/paid[5]

-

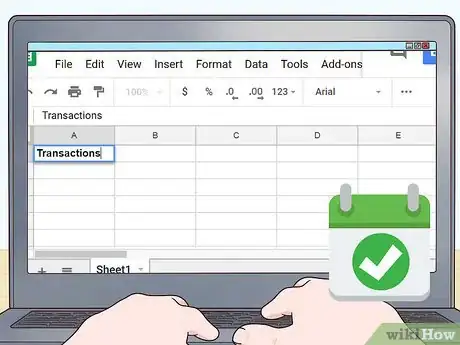

4Be consistent. For any system you use, be sure to enter your transaction data on a regular basis and in the same way each time. This is to be sure that transactions are not overlooked and that you have the most up to date picture of your business's financial health.[6] In addition, it is a good idea to establish a regular schedule for transferring information from the journals to the ledger, perhaps on a weekly or monthly basis.[7]

Recording Transactions Properly

-

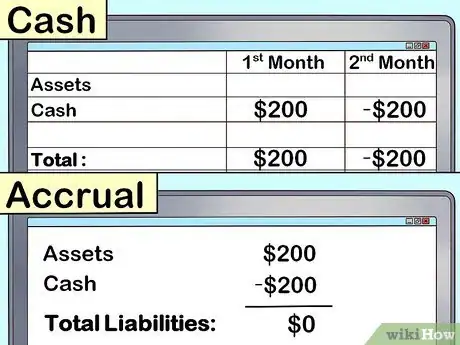

1Use the same accounting method for all entries. The two types of accounting are the cash and accrual accounting methods. In essence, the cash method records transactions when actual cash changes hands, like when a customer pays for an item or when you pay for an expense. The accrual method, however, accounts for transactions when that transaction occurs, for example when expenses are incurred or when a customers buys an item (but not necessarily when money changes hands for the transaction). Which method you choose will depend on your own goals and business strategies.[8]

-

2Compare the two accounting methods. The cash method of accounting is more commonly used in small businesses because it gives an accurate representation of the cash balance of the company.[9] As the business grows, however, it may become less important to know the exact cash balance of the company and focus instead on its current health. This is where the accrual method comes in. By tracking expenses when they occur and revenues when they are earned, rather than paid for, the accrual method negates the effects of payment delays in determining the financial health of the company.

-

3Decide on which method to use. Legally, a company may choose either accounting method as long that company has less than $5 million in revenue each year or, if it sells products to the public, has less than $1 million in gross receipts (all revenues). Any company with revenues over those levels is required, by law, to use the accrual method.[10]

-

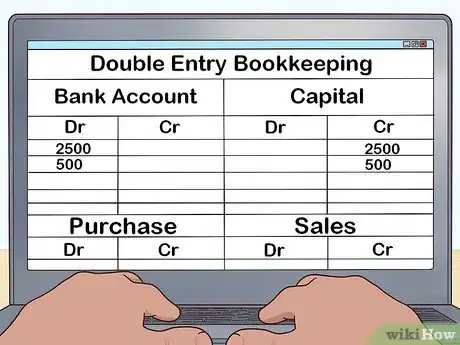

4Use double-entry bookkeeping. Many small businesses make the mistake of using single-entry bookkeeping. That is, they only record transactions as movements of money to or from a single account. However, every business transaction takes place in at least two accounts, and must be recorded as such for accuracy. This is called double-entry bookkeeping. This allows you to see exactly where your money is coming from and where it's going.

- For example, a purchase of inventory using cash would be recorded as an increase in inventory and a decrease in the cash account. Alternately, a sale of that inventory to a customer paying in credit would be recorded as a decrease in inventory and an increase in accounts receivable.

- In the world of accounting, these would be recorded using the official terms, as debits and credits to various accounts. As a bookkeeper, though, it is most important that you use a consistent system that makes sense to you.[11]

-

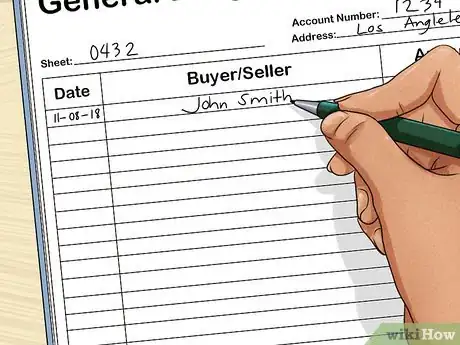

5Record transactions in journals. At first, transactions need only be entered into daily or weekly journals, depending on your transaction volume. These entries will include information on the transaction, including the buyer/seller, amount, date, and type of transaction. Later, this information will be categorized and added to the ledger. However, for now it is only important to record the information for later use. Entries should be made according the company's chosen accounting method (cash or accrual).

- The introduction of accounting software has made the two-step process of journals and ledgers almost obsolete. The software will automatically update the ledger, making the process one of simply inputting transactions as they occur. However, some businesses still choose to use the journal-ledger method.[12]

Posting Transactions to a Ledger

-

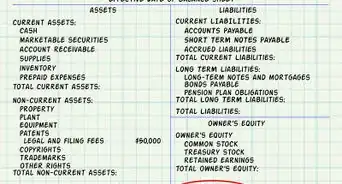

1Separate transactions into accounts. The best way to track your transactions is to separate them into different accounts within the ledger. By starting out with set accounts and adding or subtracting from them with each transaction, you gain a clearer picture of where money is coming in and going. These accounts can be as generic as sales or as specific certain types of inventory. For example, it may be reasonable for an auto garage to reserve an entire account for oil inventory. Accounts will vary between businesses, but at minimum should cover the following:

- Cash

- Accounts Receivable (money due from customers paying on credit).

- Accounts Payable (money you owe to suppliers).

- Sales (the revenue you make from primary operations).

- Inventory

- Cost of sales (supplies you buy for production or your business).

- Payroll Expenses (wages).

- Owners’ Equity (the amount that owners have put into the business).

- Retained Earnings (profits reinvested in the company).[13]

-

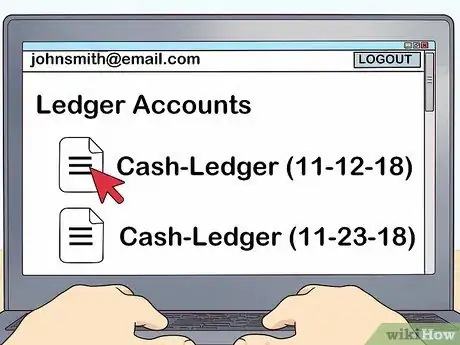

2Post transactions regularly. How often you post transaction to the ledger from the journals will depend on your transaction volume. It can be daily, weekly, or even monthly. However, this should be done consistently to ensure that you are not suddenly overwhelmed with work at the end of an accounting period. Again, accounting software will help you stay up-to-date on these processes.[14]

-

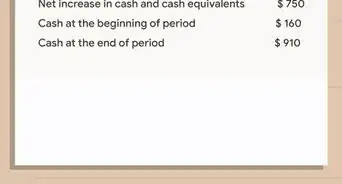

3Analyze your ledger accounts. Ledger accounts are mainly useful for quantifying the financial health of the company. While true financial reports are best left to professional accountants, anyone can compare ledger accounts to create simple comparisons or reports. For example, compare sales to expenses to get a general idea of how your company has fared recently. Obviously, if sales are higher than expenses, you are making a profit. For more complex reports, turn to an accountant or accounting program.[15]

- For more information on posting to a ledger and creating simple reports, see how to write an accounting ledger.

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionWhat are some common bookkeeping mistakes people should be aware of?

John Gillingham, CPA, MAJohn Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

John Gillingham, CPA, MAJohn Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

Certified Public Accountant & Founder of Accounting Play A common mistake people make is not looking at the balance sheet so that they can get an idea of the profit, losses, money, and expenses. Many make the mistake of not being cognizant of what the ending cash balances are at the end of the month, and by extension, don't understand what the ending loan balances are and what that means for them as taxpayers.

A common mistake people make is not looking at the balance sheet so that they can get an idea of the profit, losses, money, and expenses. Many make the mistake of not being cognizant of what the ending cash balances are at the end of the month, and by extension, don't understand what the ending loan balances are and what that means for them as taxpayers.

References

- ↑ http://www.accountingcoach.com/bookkeeping/explanation

- ↑ John Gillingham, CPA, MA. Certified Public Accountant. Expert Interview. 3 March 2020.

- ↑ https://www.sba.gov/blogs/bookkeeping-basics-part-1-how-set-and-manage-accounts-payable

- ↑ https://www.sba.gov/blogs/bookkeeping-basics-part-1-how-set-and-manage-accounts-payable

- ↑ https://www.sba.gov/blogs/bookkeeping-basics-part-1-how-set-and-manage-accounts-payable

- ↑ John Gillingham, CPA, MA. Certified Public Accountant. Expert Interview. 3 March 2020.

- ↑ http://www.nolo.com/legal-encyclopedia/bookkeeping-accounting-basics-29653.html

- ↑ http://www.nolo.com/legal-encyclopedia/cash-vs-accrual-accounting-29513.html

- ↑ http://www.nolo.com/legal-encyclopedia/cash-vs-accrual-accounting-29513.html

- ↑ http://www.nolo.com/legal-encyclopedia/cash-vs-accrual-accounting-29513.html

- ↑ http://business.tutsplus.com/tutorials/bookkeeping-101-what-you-need-to-know-to-run-your-business--cms-21996

- ↑ http://www.accountingcoach.com/bookkeeping/explanation

- ↑ http://business.tutsplus.com/tutorials/bookkeeping-101-what-you-need-to-know-to-run-your-business--cms-21996

- ↑ http://www.nolo.com/legal-encyclopedia/bookkeeping-accounting-basics-29653.html

- ↑ http://www.nolo.com/legal-encyclopedia/bookkeeping-accounting-basics-29653.html

- ↑ https://www.sba.gov/blogs/bookkeeping-basics-part-1-how-set-and-manage-accounts-payable

- ↑ https://www.sba.gov/blogs/bookkeeping-basics-part-1-how-set-and-manage-accounts-payable

About This Article

If you're wondering how to establish a bookkeeping system for your business, start by deciding whether you want to use an accounting software or a manual spreadsheet. When noting transactions, use double-entry bookkeeping to see exactly where your money is coming from and going to. For example, if you purchase inventory using cash, record it as an increase in inventory and a decrease in cash. Then, when that inventory sells, note it as a decrease in inventory but an increase in accounts receivable. To learn how to post transactions to a ledger, keep reading!