This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 239,904 times.

The general ledger is where all of the business's transactions and expenses are recorded. Good accounting practice requires that the general ledger be "reconciled," or checked for accuracy, on a regular basis. Additionally, because the general ledger is the source of information for the four financial statements (the balance sheet, income statement, statement of cash flows, and statement of shareholder's equity), reconciliation can refer to cross-checking the balances on these statements with those in the general ledger. Reconciling the general ledger can be useful in preparation for an annual audit or can simply be used to ensure that a business owner is getting an accurate picture of the business's financial health.[1]

Steps

Ensuring General Ledger Accuracy

-

1Find and compile relevant documents. In addition to the general ledger itself, you will need all of the documents tied to each transaction in the ledger. These include relevant invoices, receipts, account statements, and any other records relating to transactions or expenses. Basically, anything that was used as a source for data for the general ledger for this accounting period must be located and assembled to be readily accessible.

-

2Check the beginning account balance. Start by choosing an account within the general ledger to reconcile first. This can be any of the businesses many accounts, from accounts receivable to inventory to interest expense. It doesn't matter where you start because you'll have to do every account eventually. When you've chosen an account, first make sure that the starting balance for the period recorded in the general ledger matches the ending balance for the same account from the last period. This ensures that any errors detected lie in this period and not in previous periods.[2]

- For example, if you chose the cash account, you would need to make sure that the ending cash balance from the last period was the same as the starting cash balance this period. Any discrepancy would mean that the cash balance was improperly reported at some point and that the business's true current amount of cash is unknown.

Advertisement -

3Match each general ledger entry with its underlying transaction. Go back and look at each transaction that affected this account. If proper accounting procedures were followed, each general ledger entry should have a reference to an invoice or receipt number that will make finding the documents simple. When you've found the documents, make sure that the transactions were recorded just once in each account, for the correct amount, and in the right accounts. Adjust any incorrect amounts and recalculate the total account balances accordingly.[3]

- For example, in the cash account, you would make sure to check transactions where any cash was received from customers or where the company paid out cash.

-

4Make sure adjustments and reversals were made properly. Adjustments, which are usually used to comply with accrual accounting standards, and reversals, which change entries made in the previous period, can both cause accounts be imbalanced if they are not implemented properly.[4] [5]

- With adjustments, it is important to check that they were recorded under the right circumstances, for example that an adjustment accounting for services billed but not earned was actually necessary under the circumstances.[6]

- For reversals, also called reversing entries, the important thing to look for is that planned reversals for the period were actually made at the right time. In other words, make sure that anything planned to be reversed was actually reversed.[7]

-

5Investigate unusual transactions. To the experience eye, some transactions will stand out as immediately unusual. These transactions are generally those that make balance adjustments that are usually not made. For example, a decrease to a revenue account is usually not made over the course of a regular accounting period. Keep an eye out for any of these unusual transactions and subject any you find to a high level of scrutiny.

-

6Verify the ending balance of the account. After any adjustments for misreported transactions, adjustments, or reversals, check and be sure that the sum of the transactions matches the ending account balance.[8] If your calculated balance doesn't match the actual balance in the account, you have miscalculated something.

-

7Repeat for other accounts. Use this same process again to reconcile the other accounts in the general ledger. When you've done so, you will have a completed and reconcile general ledger.

Checking Financial Statements

-

1Gather the current financial statements. Reconciliation in some cases can also mean making sure that the general ledger balances match the balances reported for the same accounts in that period's financial statements. Start by getting copies of the business's financial statements. You'll need to compare line items on these documents to their equivalent accounts in the general ledger.

-

2Investigate revenue and expenses account balance for the income statement. Start by checking to see that the revenue, or sales, account is the same on both the income statement and in the general ledger. If this number doesn't match, almost everything else will be incorrect. If you detect a discrepancy, you'll have to go back and review the revenue account in the general ledger again.

- Next, look at other revenue accounts, like interest income or non-operating income, if applicable. Check these balances against their reported values on the income statement.

- When you've taken care of income values, move on to expense accounts, aggregating expenses into their categories on the income statement where necessary. For example, costs of goods sold would include both the cost of materials for items produced and the direct labor cost incurred.[9]

-

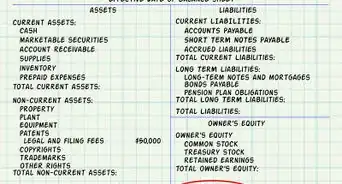

3Check asset and liability account balances on the balance sheet. Look at the reported asset amounts on the balance sheet, including cash amounts, inventory, fixed assets, and other asset categories. Make sure that these balance match those reported in the ending account balances in the general ledger. Some of these accounts are aggregated on the balance sheet. For example, cash and cash equivalents can include a number of different types of assets, from actual cash to savings and checking account balances.

- After checking assets, move on to liabilities, looking at the reported short and long term liabilities on the balance sheet. Make sure these match the ending balances recorded in the general ledger.[10]

-

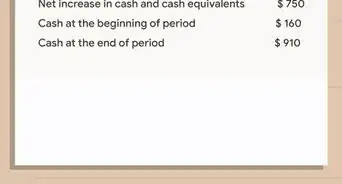

4Check balances in the other financial statements. The other financial statements will depend largely on the balances recorded in the first two statements. Make sure to mark if any discrepancies were noticed in the income statement or balance sheet and where any changes to these account might affect the statement of cash flows or shareholder's equity.

-

5Make adjustments if accounts still are not equal. If you notice discrepancies, go back and investigate the underlying transactions tied to the general ledger entries. Prove the account balance to be correct first and then make the change on the financial statement. Then, update the other balances affected by this change if your accounting software or spreadsheet doesn't do this for you.

Correcting an Unbalanced General Ledger

-

1Construct a trial balance. Sometimes, a general ledger can have a final balance that is unevenly split between credits and debits. Ideally, this balance should be zero, as the credit value should match the debit value. If this is not the case, one or a number of transactions have been recorded improperly. To see if there is such a problem, create a trial balance by adding up all of the credits and debits recorded in each account. This calculated balance is called a trial balance.[11]

- Before going further, recheck your math adding the credit and debit columns together. If it is still unbalanced, make sure that you didn't place any values in the wrong column.[12]

-

2Investigate credit to debit balances in each account. Compare the balances for each account to the transactions that make up that account. If you find an error, go through again and recalculate the account balance using the credit or debit values from each transaction.[13]

- Follow each transaction to the other account that it effects and make sure an equivalent value for credit was reported for each debit to the original account and vice versa.

-

3Correct imbalances in each account, if they still exist. If working from the transactions still fails to balance the accounts, you may have an error in transaction reporting. In this case, you will need to go back to the source material (receipts, invoices, etc.) to locate the source of the imbalance. Check that the transaction in the source material was recorded correctly in every account that it affects. For example, for a customer purchase with cash, check that equivalent entries were made in cash, sales, inventory, and cost of goods sold and that these entries balance to zero.

-

4Verify that the trial balance is now zero. After locating all errors you can find and adjusting them to their correct places and values, run another trial balance calculation to make sure that you've fixed the problem. If you haven't, go back and repeat the process, checking back over your work from the first time.

Warnings

- Don't simply copy the general ledger; a listing that just shows the activity in and out of the account is not really a reconciliation. The purpose of the reconciliation is to substantiate that the balance is correct! The listing of all activity just shows what the balance is.⧼thumbs_response⧽

References

- ↑ http://www.accountingtools.com/questions-and-answers/how-to-reconcile-the-general-ledger.html

- ↑ http://www.accountingtools.com/questions-and-answers/how-to-reconcile-the-general-ledger.html

- ↑ http://www.accountingtools.com/questions-and-answers/how-to-reconcile-the-general-ledger.html

- ↑ http://www.accountingcoach.com/blog/reversing-entries

- ↑ http://www.accountingtools.com/questions-and-answers/what-are-accounting-adjustments.html

- ↑ http://www.accountingtools.com/questions-and-answers/how-to-reconcile-the-general-ledger.html

- ↑ http://www.accountingtools.com/questions-and-answers/how-to-reconcile-the-general-ledger.html

- ↑ http://www.accountingtools.com/questions-and-answers/how-to-reconcile-the-general-ledger.html

- ↑ http://www.investopedia.com/terms/c/cogs.asp

- ↑ http://www.accountingtools.com/questions-and-answers/how-to-reconcile-the-general-ledger.html

- ↑ http://www.accountingtools.com/questions-and-answers/how-to-reconcile-the-general-ledger.html

- ↑ http://college-cram.com/study/accounting/accounting-cycle/balancing-an-unbalanced-trial-balance/

- ↑ http://college-cram.com/study/accounting/accounting-cycle/balancing-an-unbalanced-trial-balance/

About This Article

Since a general ledger is where all of your business’s transactions and expenses are recorded, you’ll want to reconcile it, or check it for accuracy, on a regular basis. Start by gathering the ledger as well as all of the documents tied to each transaction, like invoices, receipts, and statements. Then, pick an account to begin with and match each entry with the proper documents. Ensure that all of the information was recorded correctly and that the correct adjustments were made. Finally, double-check the ending balance before moving on to the next account. For more tips from our Accounting co-author, including how to correct an unbalanced general ledger, keep reading!