This article was co-authored by wikiHow staff writer, Nicole Levine, MFA. Nicole Levine is a Technology Writer and Editor for wikiHow. She has more than 20 years of experience creating technical documentation and leading support teams at major web hosting and software companies. Nicole also holds an MFA in Creative Writing from Portland State University and teaches composition, fiction-writing, and zine-making at various institutions.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 64,768 times.

Learn more...

Have you been hearing the buzz about Cash App Borrow and want to try it out? Cash App Borrow is a pilot feature that allows select users to take out small loans for a flat fee. While Cash App Borrow is not available to everyone, some users can now borrow $20 or more in Cash App and pay back the loan on a 4-week schedule or all at once. We'll teach you everything you need to know about borrowing money in Cash App, including how you can qualify to unlock Cash App Borrow on your Android, iPhone, or iPad.

Things You Should Know

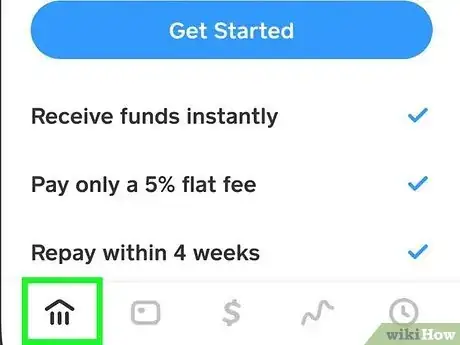

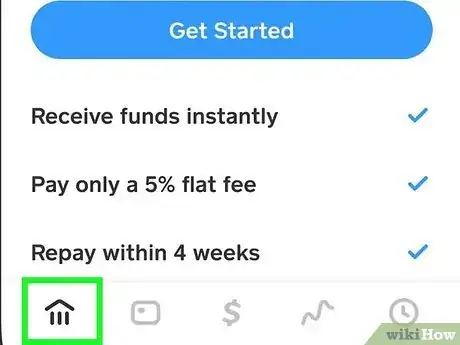

- Cash App Borrow offers small 4-week loans to users who qualify at a flat 5% fee. Additional charges apply for late payments.

- Cash App Borrow is still in its testing phase and not yet available to all users.

- If you don't see the Borrow option in the Banking tab, you currently don't qualify for Cash App Borrow.

Steps

How can I unlock borrowing on Cash App?

-

1Cash App borrowing is not yet available to all Cash App users in the United States. According to support reps at Cash App, Cash App Borrow is a pilot program that's only available to a small amount of users.[1] If you don't have the option to Borrow in the app, there's no way to unlock the feature yourself.

-

2Because the service is still in its testing phase, not much is known about eligibility requirements. While Cash App is not yet giving specifics about who can borrow money, the support area of the app states that these 4 factors affect to your eligibility:

- Residence: Borrowing is not available in all US states, but Cash App doesn't specify which states are excluded. Their agreement does include loan terms for certain states, which may indicate that borrowing is (or will be) available in these locations: California, Iowa, Kansas, Massachusetts, Missouri, New Jersey, New York, Rhode Island, Vermont, Ohio, Washington, Wisconsin, and Utah.[2]

- Having an active Cash Card: While there's no indication that having a Cash Card automatically qualifies you to borrow from Cash App, activating and using your Cash Card will improve your chances.

- Cash App usage: Cash App doesn't specify how your usage affects your loan eligibility, but they do say it's a factor.

- Credit history: While they don't list a target credit score or any other criteria, this does indicate that having a poor credit history might prevent you from borrowing from Cash App.

Advertisement -

3There might be other ways to qualify. Many Reddit users claim that once they set up direct deposit on Cash App, they qualified for Cash App loans. Other users claim that having an active debit card and credit card linked to the app contributed. Neither of these things are confirmed by Cash App.

- Still, if Borrow isn't available in your state, there is no way to activate the feature regardless of how you use Cash App.

How to Borrow Money on Cash App

-

1Open Cash App on your phone or tablet. The only way to know for sure if you can borrow money from Cash App is to look for the Borrow option in the app. Start by tapping the green-and-white dollar sign on your Android, iPhone, or iPad's app list.

-

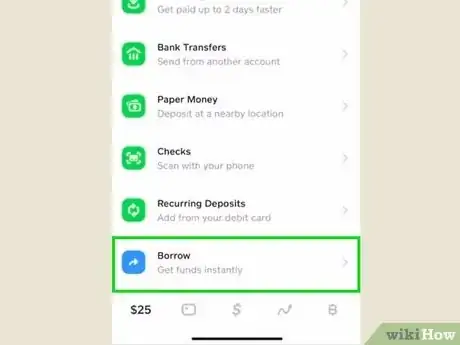

2Tap your balance or the bank icon. You'll see one of these two item at the bottom-left corner of the screen, depending on your version of the app.

-

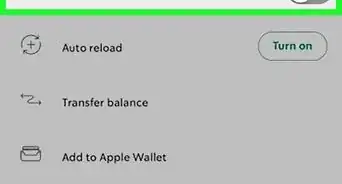

3Tap Borrow. If you qualify to borrow a loan from Cash App, you'll see this option at the bottom of the list.[4]

- If you don't see this option, you are not yet eligible to borrow from Cash App.

-

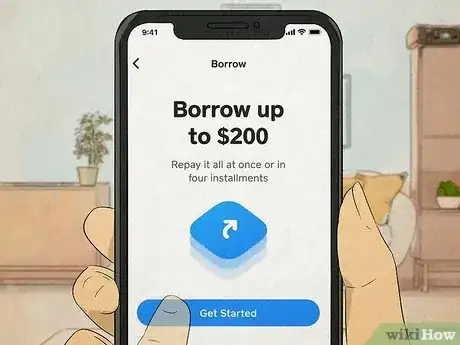

4Tap Get Started to see how much you can borrow. If you're able to borrow from Cash App, you'll see exactly how much you can borrow at the top of the screen.

- Your borrowing limit is affected by many factors, including whether you repay your loans on time, how much money you deposit into or keep in Cash App, and your recent credit history.

-

5Select an amount and choose Next. You can choose a denomination or tap the three dots to enter a custom amount.

-

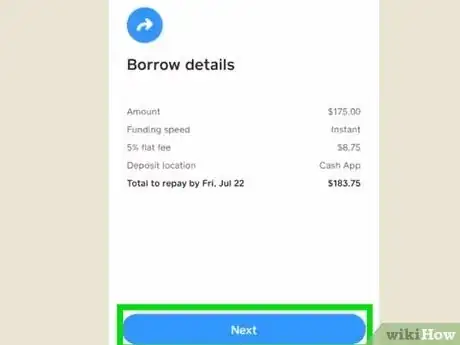

6Review your loan and tap Next. You'll see a screen that explains the flat fee of 5%, the date by which you'll need to pay the loan back, and the total amount to repay.

-

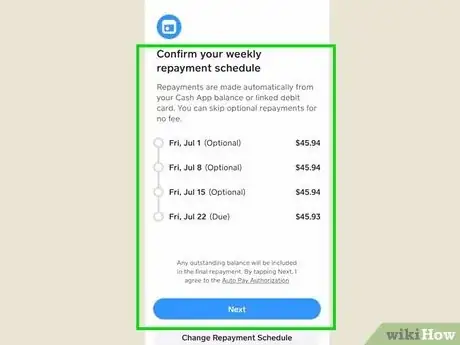

7Select a repayment method and tap Next. You'll have three options for repaying your loan:

- As you get cash: Each time you get money in Cash App, a 10% of the deposit will be set aside to pay back your loan.[5]

- 4 weekly payments: You'll pay the amount listed on the date listed each week for 4 weeks.

- All at once: You'll pay the full balance at once on or before the date listed. If you haven't paid the loan back by the listed date, the full amount will be deducted from your Cash App balance. If there's not enough in your balance to cover the amount, Cash App will deduct the amount from your linked debit card automatically.[6]

-

8Review the repayment details and tap Borrow Instantly. If you agree to the repayment terms listed in Cash App, tapping Borrow Instantly transfers the full loan amount to your Cash App balance, where you can send or spend it instantly.

- A summary of your loan details will appear, along with your due date. You can tap Done on this screen to return to Cash App.

How to Pay Back Your Loan

-

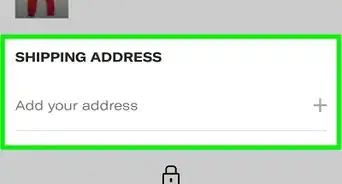

1Tap the banking tab at the bottom-left corner of Cash App. This tab will either display your balance or a bank icon.

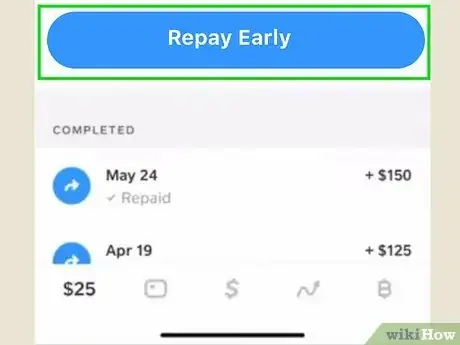

- You can pay back your loan early, but all finance charges (including the 5% fee and 1.25% additional fee for late payments) are non-refundable.[7]

-

2Tap Borrow. You'll see this at the bottom of the list. A list of your upcoming loan payments will appear.

-

3Tap the payment you want to make. All of your upcoming payments appear here. If you split your loan into 4 payments, tap your first payment to pay that amount.

- If you chose to pay the loan back all at once, you can tap Repay Early to pay the amount in full now.

-

4Follow the on-screen instructions to make your payment. You'll now be able to make an instant payment using your linked bank account or debit card.

Warnings

- Borrowing from Cash App is just like taking out a payday loan. Only borrow if you are sure you can pay back your loan on time to avoid finance charges, credit score implications, and legal repercussions.⧼thumbs_response⧽

References

- ↑ https://www.reddit.com/r/CashApp/comments/w44qbi/borrow_available_in_north_carolina/

- ↑ https://cash.app/legal/us/en-us/borrow-loan-agreement

- ↑ https://techcrunch.com/2020/08/12/square-cash-app-borrowing/

- ↑ https://www.youtube.com/watch?v=E3-5qyCMM94

- ↑ https://www.youtube.com/watch?v=4WQgZgrLfFE

- ↑ https://cash.app/legal/us/en-us/repay-plan-autopay

- ↑ https://cash.app/legal/us/en-us/agreement