Chapter 12

Reporting of Stockholders' Equity

By Boundless

The amount of issued stock is based on a company's authorized shares, or the maximum number of shares authorized for issue to shareholders.

An employee stock option (ESO) is a call (buy) option on a firm's common stock, granted to an employee as part of his compensation.

A stock repurchase is the reacquisition by a company of its own stock for the purpose of retirement or re-issuance.

Treasury stock is a company's issued and reacquired capital stock; the stock has not been retired and is legally available for reissuance.

In the cases of bankruptcy and dividend distribution, preferred stock shareholders will receive assets before common stock shareholders.

Common stock generally carries voting rights, while preferred stock does not; however, this will vary from company to company.

Preferred shares have numerous rights which can be attached to them, such as cumulative dividends, convertibility, and participation.

New shares can be purchased on exchanges and current shareholders will usually have preemptive rights to newly issued shares.

Preferred stock can include rights such as preemption, convertibility, callability, and dividend and liquidation preference.

Common stock, preferred stock, and debt are all securities that a company may offer; each of these securities carries different rights.

A corporation may issue two basic classes or types of capital stock, common and preferred, both of which can receive dividends.

The main purpose of a liquidation where the company is insolvent is to satisfy claims in the manner and order prescribed by law.

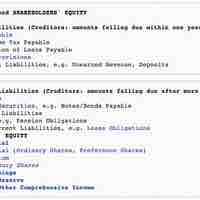

All preferred stock is reported on the balance sheet in the stockholders' equity section and it appears first before any other stock.

Change in a firm's dividend policy may cause loss of old clientele and gain of new clientele, based on their different dividend preferences.

Investors' preference for stock or cash depends on their inclinations toward factors such as liquidity, tax situation, and flexibility.

The significance of investors' dividend preferences is a contested topic in finance that has serious implications for dividend policy.

Accounting for dividends depends on their payment method (cash or stock).

Dividend decisions are frequently seen by investors as revealing information about a firm's prospects; therefore firms are cautious with these decisions.

Dividend reinvestment plans (DRIPs) automatically reinvest cash dividends in the stock.

Stock dividends are when a company gives each shareholder additional stock in lieu of a cash dividend.

Share repurchases often give an advantage to insiders and can be used to manipulate financial metrics.

Reverse splits are when a company reduces the number of shares outstanding by offering a number of new shares for each old one.

Share repurchases are beneficial when the stock is undervalued, management needs to meet a financial metric, or there is a takeover threat.

A stock split increases the number of shares outstanding without changing the market value of the firm.

A share repurchase is when a company buys its own stock from public shareholders, thus reducing the number of shares outstanding.

Equity (beginning of year) + net income − dividends +/− gain/loss from changes to the number of shares outstanding = Equity (end of year).

Earnings per share (EPS) is the amount of a company's earnings per each outstanding share of a company's stock.

The dividend-price ratio is a company's annual dividend payments divided by market capitalization, or dividend per share divided by the price per share.

Accumulated Other Comprehensive Income (AOCI) is all the changes in equity other than transactions from owners and distributions to owners.

A convertible security, such as convertible preferred stock, is any security that can be converted into another.

A stock warrant entitles the holder to buy the underlying stock of the issuer at a fixed exercise price until the expiration date.

Diluted earnings per share (EPS) takes the basic EPS formula and accounts for the effect of dilutive shares on earnings.