Chapter 13

Detailed Review of the Income Statement

By Boundless

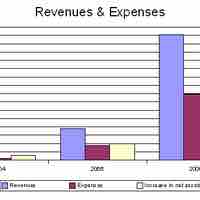

Revenue refers to the mechanism by which income enters a company.

Gross profit or sales profit is the difference between revenue and the cost of making a product or providing a service.

Operating expenses and non operating expenses are deducted from revenue to yield net income.

Income statements are commonly prepared in two formats: multiple-step and single-step.

Revenue is recognized when earned and payment is assured; expenses are recognized when incurred and the revenue associated with the expense is recognized.

Transactions that result in the recognition of revenue include sales assets, services rendered, and revenue from the use of company assets.

Companies can recognize revenue at point of sale if it is also the date of delivery or if the buyer takes immediate ownership of the goods.

Accrual accounting allows some revenue recognition methods that recognize revenue prior to delivery or sale of goods.

There are three methods that recognize revenue after delivery has taken place: the installment sales, cost recovery, and deposit methods.

Accrual accounting does not record revenues and expenses based on the exchange of cash, while the cash-basis method does.

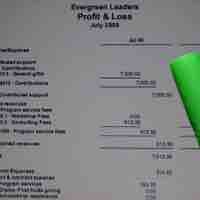

Expense recognition is an essential element in accounting because it helps define how profitable a business is in an accounting period.

For an expense to be recognized under the matching principle, it must be both incurred and offset against recognized revenues.

Accrued and deferred expenses represent the two possibilities that can occur due to timing differences under the matching principle.

The accrual method ensures proper reporting on the income statement because the operating cycle doesn't coincide with the accounting cycle.

Irregular items are reported separately from the income statement proper so that users can better predict future cash flows.

Irregular items require special reporting procedures, and include discontinued operations, extraordinary items, and the reporting of the resultant EPS.