Revenue Recognition Concepts

The revenue recognition principle is a cornerstone of accrual accounting together with the matching principle. They both determine the accounting period in which revenues and expenses are recognized. According to the principle, revenues are recognized if they are realized or realizable (the seller has collected payment or has reasonable assurance that payment on goods will be collected). Revenues must also be earned (usually occurs when goods are transferred or services rendered), regardless of when cash is received. For companies that don't follow accrual accounting and use the cash-basis instead, revenue is only recognized when cash is received .

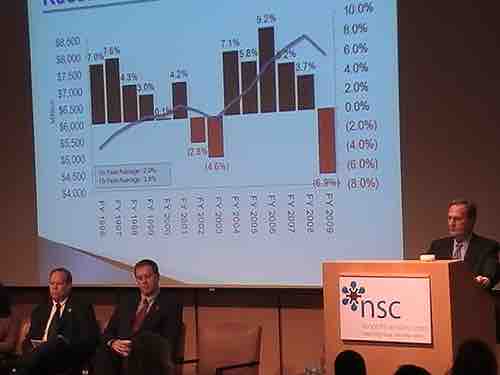

Presentation of Revenue Trends over Time

Guidelines for revenue recognition will affect how and when revenue is reported on the income statement.

Transactions that Recognize Revenue

Transactions that result in the recognition of revenue include:

- Sales of inventory, which are typically recognized on the date of sale or date of delivery, depending on the shipping terms of the sale

- Sales of assets other than inventory, typically recognized at point of sale.

- Sales of services rendered, recognized when services are completed and billed.

- Revenue from the use of the company's assets such as interest earned for money loaned out, rent for using fixed assets, and royalties for using intangible assets, such as a licensed trademark. Revenue is recognized due to the passage of time or as assets are used.

The Matching Principle

The matching principle's main goal is to match revenues and expenses in the correct accounting period. The principle allows a better evaluation of the income statement, which shows the revenues and expenses for an accounting period or how much was spent to earn the period's revenue. By following the matching principle, businesses reduce confusion from a mismatch in timing between when costs (expenses) are incurred and when revenue is recognized and realized.