Issuing Company Stock

The process of issuing stock-- or shares-- of a publicly traded company involves several steps. The amount of issued stock is dependent on the authorized capital of a company, or the maximum number of shares authorized by a company's corporate documents to issue to shareholders. A portion of authorized capital tends to remain unissued, but the number can be changed by shareholder approval. When shares are issued, they are transferred to a subscriber, an action referred to as an allotment. After the allotment, a subscriber becomes a shareholder. Issued shares are the sum of outstanding shares and treasury stock, or stock reacquired by the company. Most public companies issue two major types of shares: common and preferred.

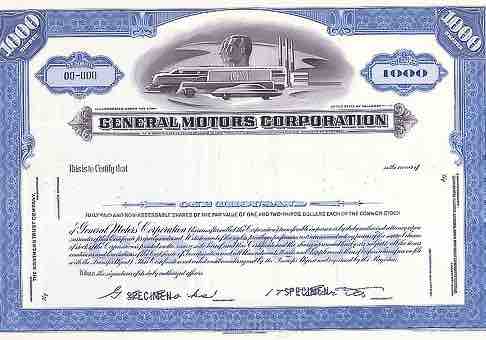

General Motors Common Stock Certificate

Public companies issue common stock to raise business capital.

Common Stock

Shares of common stock are primarily issued in the United States. Common shareholders may possess "voting" shares and have the ability to influence company decisions through their vote. Owning common stock tends to be riskier than owning preferred stock; yet over time, common shares on average perform better than preferred shares or bonds. The greater amount of risk is due to the fact that shares receive dividends only after preferred shareholders are paid and, in the event of a business liquidation, common stock shareholders are paid last, after creditors and preferred shareholders.

Preferred Stock

Preferred stock is considered a hybrid financial instrument because the shares have properties of both equity and debt. Preferred shares tend to pay dividends to shareholders, which can accumulate from one period to the next, and have priority over common shareholders when dividends are paid or assets liquidated. Similar to bonds, preferred shares are rated by credit-rating companies and are also callable by the company. Some other features associated with preferred stock include convertibility to common stock, non-voting rights, and the potential of shares to be either cumulative or non-cumulative of company dividends.

Stock Issuance and Stockholder's Equity

Both common and preferred stock issued are reported in the stockholder's equity section of the balance sheet. Each share type is reported at market value at the time the shares are purchased by investors, which is also the point in time when shares become outstanding. This value is divided between the stock's par, or stated value and additional paid in capital.