This article was co-authored by wikiHow staff writer, Danielle Blinka, MA, MPA. Danielle Blinka is a Writer, Editor, Podcaster, Improv Performer, and Artist currently living in Houston, TX. She also has experience teaching English and writing to others. Danielle holds a Bachelor of Arts in English, Bachelor of Arts in Political Science, Master of Arts in English with a concentration in writing, and Master of Public Administration from Lamar University.

This article has been viewed 37,897 times.

Learn more...

Credit cards are a great way to build your credit and cover unexpected expenses, but they can also be a major temptation. If you’re a big shopper or are going through a tough time financially, your credit card may be burning a hole in your pocket. To prevent overspending, you can freeze your credit card in ice to make it hard for you to access and use. If you are worried about your credit, you may want to freeze your credit or prevent credit card fraud.

Steps

Freezing a Credit Card in Ice

-

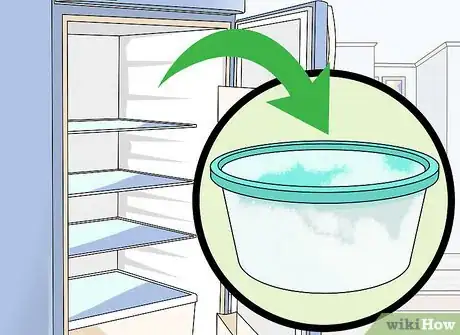

1Place the card in a freezer-safe container. You may want to use a plastic storage bag, a piece of tupperware, or even a cup. Choose an item that will either cover up your credit card number or is thick enough that the number will not be visible through the ice.

- If the number is visible through the ice, then you may be tempted to use the card number for online shopping.

- You could also cover the number with a paper towel or a small rag before freezing, but remember that it will be submerged in water.

- If you have a chip card, freezing it should not damage the chip.[1]

-

2Fill the container with water, covering the card. Your card needs to be completely covered in water so that once it freezes it will be covered in ice.[2]

- If your container has a seal, such as plastic storage bag, close it once you’ve added the water.

Advertisement -

3Place the container into the freezer and let it freeze solid. It may take several hours or even a day to freeze solid. Once it’s frozen, you’ll need to keep it in the freezer.

- Usually, you’ll want to leave it in its container. However, you may be able to pop the ice block out of a plastic container if you need the use the container for something else. This would be similar to popping ice cubes out of a tray.

Defrosting Your Frozen Credit Card

-

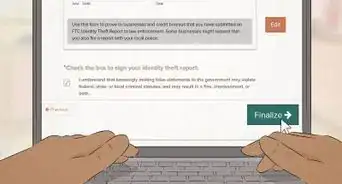

1Remove the frozen card from the freezer. You’ll need to pull it from the freezer at least 6 hours before you need the card. Defrosting will take several hours, which is the point of freezing the card. During that time, you are able to think about your purchase.

- If you are making an unplanned purchase, take this time to think about how it fits into your goals. Consider why you put the card in the freezer, and if this purchase is justified. If it isn’t, you may want to put the card back.[3]

- If you need to quickly access your card, you could speed up the process by placing it in hot water. However, this method will take more effort on your part, as you will either need to let the water run continuously over the ice or replace the hot water often, as it will quickly cool due to the ice. Be careful not to burn yourself under the hot water.

-

2Place the container or block of ice onto a towel or bowl. If the card is still in the container, then a towel may be sufficient to catch the condensation. However, using a bowl will ensure that all water runoff is collected inside a container.

-

3Wait several hours for the ice to melt. Most cards will be ready to use in a few hours, but plan for the defrosting to take at least 6. Some people prefer to pull their card out the night before they plan to use it so that it has plenty of extra time to melt.[4]

- Again, this is the time for you to rethink your purchase.

-

4Dry off your card before use. Pour the water out of the container and retrieve your card. Gently blot it dry using a clean towel. You can now use your credit card!

Maintaining Your Account

-

1Use your card every six months if the balance is zero. This will prevent the cancellation of your account. If your card is inactive, then the card issuer may cancel your account. This could damage your credit and leave you without an emergency credit card. A card with a zero balance will need to be used once every six months.[5]

- If you have a balance on your card or have bills automatically charged to the card, then you don’t need to worry about inactivity.

-

2Remove your card from the freezer at least 6 hours before it's needed. Your card will take several hours to defrost. Take it out early to prevent having to postpone using the card because it isn’t ready. If freezing your card helps you avoid using it, then you’ll want it to spend as little time as possible out of the ice.[6]

-

3Make a minor purchase or pay for regular household expenses. You don’t need to go on a shopping spree to keep your card current. Instead, just pay for a few small items or buy something you need anyway. As you spend, remember that you will need to pay the card in full if you want your balance to stay at zero.[7]

- For example, pay for your weekly groceries.

- Alternatively, you may plan your defrost around a time that you need to make a major purchase, such as replacing an appliance or purchasing a gift.

-

4Refreeze your card if you choose. After your purchase, don’t leave your credit card in your wallet unless you’re ready to put it back into use. If freezing your card helps you stick to your goals, then it should go right back into the freezer.[8]

-

5Pay off the balance when the bill comes. If you want to maintain a zero balance on your card, then you’ll want to pay the entire bill when it comes. This will be easier if you only make small, planned purchases.

- Some people believe that paying off a balance over time improves credit, but this is not true. Paying off your card every month is better for your score and helps you avoid interest.[9]

Community Q&A

-

QuestionWhy would I freeze my card?

Community AnswerFreezing your card can be an optimal solution if you find yourself struggling not to spend money that you don't have. If you can keep and use a credit card responsibly, then there's no reason to freeze the card (unless you believe the account has been compromised).

Community AnswerFreezing your card can be an optimal solution if you find yourself struggling not to spend money that you don't have. If you can keep and use a credit card responsibly, then there's no reason to freeze the card (unless you believe the account has been compromised).

References

- ↑ http://clark.com/personal-finance-credit/does-freezing-an-emv-credit-ca/

- ↑ http://clark.com/personal-finance-credit/does-freezing-an-emv-credit-ca/

- ↑ http://clark.com/personal-finance-credit/does-freezing-an-emv-credit-ca/

- ↑ http://clark.com/personal-finance-credit/does-freezing-an-emv-credit-ca/

- ↑ https://money.usnews.com/money/blogs/my-money/2012/05/24/can-freezing-a-credit-card-hurt-your-score

- ↑ http://clark.com/personal-finance-credit/does-freezing-an-emv-credit-ca/

- ↑ https://money.usnews.com/money/blogs/my-money/2012/05/24/can-freezing-a-credit-card-hurt-your-score

- ↑ https://money.usnews.com/money/blogs/my-money/2012/05/24/can-freezing-a-credit-card-hurt-your-score

- ↑ https://www.experian.com/blogs/ask-experian/better-pay-off-credit-card-full-every-month-or-maintain-balance/