This article was co-authored by wikiHow staff writer, Jennifer Mueller, JD. Jennifer Mueller is a wikiHow Content Creator. She specializes in reviewing, fact-checking, and evaluating wikiHow's content to ensure thoroughness and accuracy. Jennifer holds a JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 1,072,942 times.

Learn more...

Sometimes it's too risky to send cash, or your recipient wants to have immediate access to the funds. If you can't pay using a debit or credit card, a money order is a cheap and relatively easy alternative to get your money where it needs to go. To cash a money order, choose the right location and prove that you are the intended recipient of the funds.[1]

Steps

Choosing Where to Cash the Money Order

-

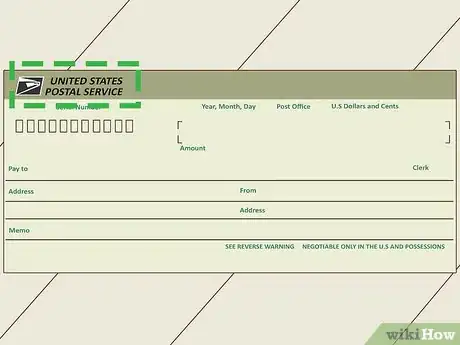

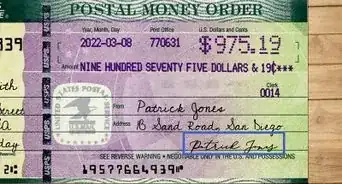

1Look for a logo on the money order. A logo or other insignia will tell you what bank or other business issued the money order. Look in the upper corners of the money order, or along the bottom for a line that says "Issuer."[2]

- You can always get a money order cashed at a branch of the bank or company that issued the money order. If there's a branch near you, that may be your best bet.

- If the money order was issued by a bank and you don't have a branch of that particular bank nearby, you still may be able to get the money order cashed at a different bank.

-

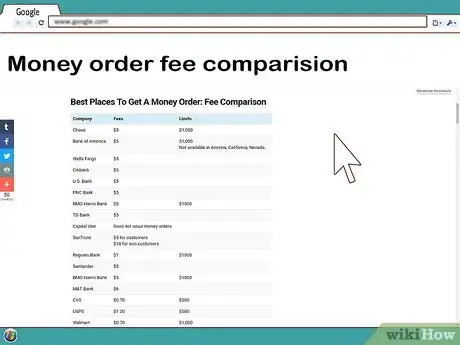

2Find out the fee. In many cases, the fee at the company or bank that issued the money order than anyone else – but this isn't always the case. You may be able to find out the fee online, but for some banks you'll have to call a branch.[3]

- It's always good to call a nearby branch and ask them. Large companies and banks with many branches may have different fees depending on the location.

Advertisement -

3Figure out any other restrictions. Some companies and banks may have a maximum amount they will cash. For example, Bank of America will cash a money order for up to $500. Find this out before you go to the location, especially if your money order is for a large amount.[4]

- Particularly in small towns and rural areas, call ahead to the specific location you plan to visit. Especially if your money order is for more than a couple hundred dollars, they may not have the cash on hand to cash it. Knowing this in advance can save you a trip.

-

4Decide when you need to cash the money order. Some places where you can get a money order cashed, especially banks, have limited hours. If you are limited as to when you can go get the money order cashed, your options also may be limited.[5]

- For example, if you can only cash the money order in the evenings, you may be limited to grocery stores or check cashing stores. Grocery stores typically will have lower fees than check cashing stores.

-

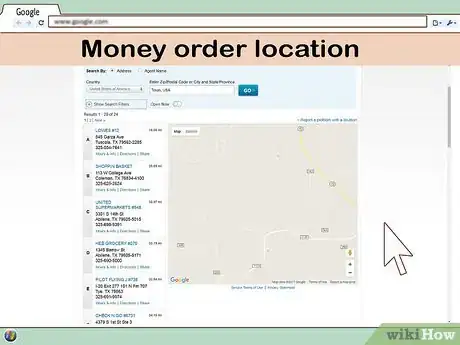

5Identify a convenient location. Depending on where you've decided to cash your money order, there may be several locations in your immediate area. Find the one you can reach most easily and make sure it will be open when you need it.[6]

- You might want to identify backup locations as well, in case the one convenient to you is unable to cash your money order.

- If your money order is for a large amount, call ahead. If they think they may not be able to cash it, they may be able to let you know who could do it.

-

6Try a grocery store. Unless you're planning on cashing the money order at your own bank, you'll generally have the lowest fees and the best chance your money order will be cashed at a grocery store.[7]

- Since grocery stores do a high volume of business, even in more rural areas, they typically keep more cash on hand.

- Even though the grocery store may be open 24 hours, they may not cash money orders at all hours. Check with the specific location to make sure.

-

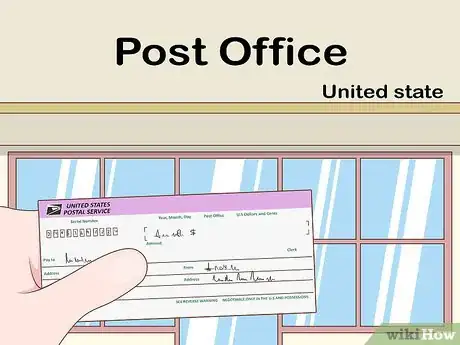

7Take USPS money orders to the USPS. If you have a USPS money order, it typically will be cheapest to take it to a U.S. Post Office and get it cashed. The Post Office usually won't charge a fee to cash a money order it issued.[8]

- There are other limitations with using the Post Office, however. Their hours are limited, and if you live in a small town or rural area, the Post Office may not have the cash on hand to actually cash your money order – especially if it is for a large amount.

- Call ahead to the location if you have any questions about cashing your money order there.

-

8Contact the sender if the money order is lost or damaged. In most cases, the issuer will replace a money order that hasn't been cashed, provided the person who bought it still has the original receipt.[9]

- For example, suppose you receive the money order and it was damaged in mailing and is torn. It's possible that a company or bank would cash it, but you may need to get it replaced.

- If you lose your money order before you can cash it, contact the sender as well as the bank or company that issued it as soon as possible.

Cashing the Money Order

-

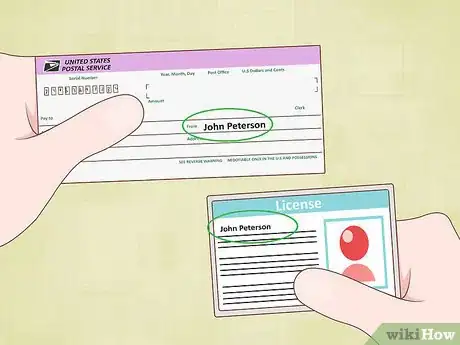

1Bring identification. The bank won't cash the money order without acceptable proof that you are the person who is supposed to receive the funds. Your name on the money order must match the name on your identification exactly.[10]

- Banks and other companies that cash money orders typically will accept a driver's license, passport, or other valid government-issued photo identification.

- Some banks and check-cashing stores also may request your right thumbprint next to your signature on the money order.

-

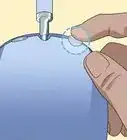

2Present the money order. Allow the cashier or teller to confirm that they have enough cash to cover the face value of your money order. Ask how much the fee will be, even if you did your research ahead of time and already know.[11]

- If they tell you something different than what you've already found out, ask about it. For example, you might say "Are you sure the fee will be $7? Your website said it would only be $4."

- It's best not to sign the money order until you are ready to hand it over to cash it. If you've already signed it and it falls into the wrong hands, they could potentially cash it. Additionally, the place that cashes the money order may want to compare the signature to the one on your ID.

- If you have a checking or savings account at a bank, you can deposit most money orders. However, depending on who issued the money order, it may be a day or two before you can access the funds.

-

3Receive your cash. You will receive the face amount of the money order, less any fee for cashing the money order. You may be able to choose the denominations of the bills you receive.[12]

- The cashier or teller will likely count the money back to you, but you should count it yourself as well to make sure it's all there.

- If you deposited the money order in your bank account, you typically can also receive at least a portion of it back in cash.

Getting a Money Order

-

1Gather information about the recipient. At a minimum, you will need to know the full legal name and address of the person to whom you're sending the money. Depending on the money order issuer you choose, you may need additional information.[13]

- When your recipient cashes the money order, the name on the money order will need to match the name on their ID. Ask them about this, especially if, for example, their name has recently changed as a result of marriage or divorce. They may not have updated their ID to reflect the change.

-

2Compare fees. You want to spend as little as possible to send a money order. If you have a bank account, start with your own bank – they'll typically have the lowest fee for you since you're a member.[14]

- It's generally a good idea to avoid check-cashing stores if at all possible. Although they may be the most convenient, they typically charge the highest fees.

- The hours of operation also come into play. If you aren't going to be able to get the money order until late at night, for example, you may not be able to use the places with the lowest fees.

-

3Find a convenient location. Once you've decided what bank or company you want to use to buy your money order, you'll need to find the best location that is open at a time when you can get there.[15]

- When you've found the specific location, it's worth calling in advance to confirm any information you already know. Fees and hours may vary depending on the specific location, especially in more rural areas.

-

4Purchase your money order. For the company or bank to issue a money order, you'll have to pay them the face value of the money order plus their fees. Different issuers accept different methods of payment.[16]

- In most cases, your best bet will be to pay for your money order with cash, personal check, or debit card.

- Some money order providers accept a credit card for the purchase of money orders, but doing so may result in additional fees from your credit card company. Only purchase a money order with a credit card as a last resort.

-

5Keep your receipt. When you purchase your money order, you'll get a receipt. It may include information you can use to track the money order and confirm when it's cashed. If the money order is lost or damaged, you'll need the receipt to get it replaced.[17]

- Don't send the receipt along with the money order. If the money order is lost or damaged, the receipt likely will be too, and then you'll be unable to do anything.

Community Q&A

-

QuestionI lost some money orders that weren't filled out. Is there any way to get them cancelled or my money back?

DonaganTop AnswererIf they were left blank, they may not be negotiable. Go to the institution where you bought them, tell them what happened. Show receipts, if you have them, and ask to cancel the orders.

DonaganTop AnswererIf they were left blank, they may not be negotiable. Go to the institution where you bought them, tell them what happened. Show receipts, if you have them, and ask to cancel the orders. -

QuestionWhy do I have to pay to cash a money order?

Community AnswerIt's because the institution is providing a service, whereas if there was no charge, there would be no way to make a profit. Who would even bother cashing it unless there was something to benefit? Alternatively, find one that doesn't charge to cash it but gives you a worse rate, meaning they're charging you invisibly.

Community AnswerIt's because the institution is providing a service, whereas if there was no charge, there would be no way to make a profit. Who would even bother cashing it unless there was something to benefit? Alternatively, find one that doesn't charge to cash it but gives you a worse rate, meaning they're charging you invisibly. -

QuestionI failed to deposit money order just about three years old. It was just found the other day. It was a rental payment, and be difficult to locate the tenant. Can I still deposit it?

DonaganTop AnswererThe money order is still good unless it says otherwise on the face.

DonaganTop AnswererThe money order is still good unless it says otherwise on the face.

Warnings

- If you have a money order from another country, check the currency for which it was issued. You'll have a much easier time getting a domestic bank to cash it if it's payable in domestic currency.[18]⧼thumbs_response⧽

References

- ↑ https://www.nerdwallet.com/blog/banking/money-orders/

- ↑ https://www.nerdwallet.com/blog/banking/money-orders/

- ↑ http://firstquarterfinance.com/where-can-i-cash-a-money-order/

- ↑ http://firstquarterfinance.com/where-can-i-cash-a-money-order/

- ↑ http://firstquarterfinance.com/where-can-i-cash-a-money-order/

- ↑ http://firstquarterfinance.com/where-can-i-cash-a-money-order/

- ↑ http://www.wisegeek.org/how-do-i-cash-a-money-order.htm

- ↑ https://www.usps.com/shop/money-orders.htm

- ↑ https://www.westernunion.com/us/en/money-order.html

- ↑ https://www.nerdwallet.com/blog/banking/money-orders/

- ↑ http://firstquarterfinance.com/where-can-i-cash-a-money-order/

- ↑ https://www.nerdwallet.com/blog/banking/money-orders/

- ↑ https://www.usps.com/shop/money-orders.htm

- ↑ https://www.nerdwallet.com/blog/banking/money-orders/

- ↑ https://www.nerdwallet.com/blog/banking/money-orders/

- ↑ https://wallethub.com/edu/can-you-buy-a-money-order-with-a-credit-card/20407/

- ↑ https://www.nerdwallet.com/blog/banking/money-orders/

- ↑ http://www.wisegeek.org/how-do-i-cash-a-money-order.htm

About This Article

To cash your money order, bring it to a bank along with some ID. The bank that issued the money order will usually have the lowest fees, but search online for the cheapest fee. For example, USPS money orders are generally free to cash from the USPS. Keep in mind that some banks have a maximum amount they will cash, so if you’re money order is for over 500 dollars, check the restrictions for different banks. Whichever bank you go to, make sure bring a valid form of ID, like a driver’s license or passport. Give it to the teller with your money order. For more tips, including how to purchase a money order, read on!