This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 50,383 times.

The full price of a major purchase such as a house, boat or car is rarely financed. Most lenders for these types of loans require a down payment of some sort, usually expressed as a percentage. Additionally, mortgage loans list a different figure, "amount financed," which does not include prepaid fees paid to the lender. Knowing how to calculate an amount to be financed will help you make informed consumer decisions.

Steps

Calculating a Commercial Loan Amount to be Financed

-

1Determine the selling price. For a vehicle, boat, or another type of commercial loan purchase this will be the amount you agree to pay for your new acquisition. It does not include other aspects of the deal such as the trade-in allowance, fees, taxes, and other closing costs.

-

2Subtract any net trade-in allowance. For auto or boat purchases, among others, a dealer may offer a trade-in allowance or credit for giving them your old car or boat when you buy a new one. The value of this item, or a credit provided by the dealer, is then subtracted from what you owe on your new purchase. The net trade-in allowance is found by subtracting the amount still owed on your trade from the trade-in allowance offered by the dealership.

- If the trade-in is high enough, dealers don't typically require an extra payment, such as a down payment.

- Some dealers may allow you to use the trade-in value of your old vehicle to cover the required down payment on a new one (assuming the old one holds enough value).

Advertisement -

3Account for any cash rebates that are applied to the purchase price of the item. Dealers may also offer cash rebates as a way to incentivize purchases. These cash rebates are simply subtracted from the purchase price at closing. They also do not need to be included in the amount to be financed. Rebates may be provided to certain buyers, like students or military veterans, or may be specific to certain vehicles.

-

4Settle on a loan amount. The amount left after rebates and trade-ins is the the amount owed. This amount must be either paid in full or borrowed from a lender and paid off in installments over time. From here, you can calculate the down payment if the lender requires one. For example, a lender might require 10 or 20 percent down on your purchase. Your loan amount is then the amount remaining after the down payment is subtracted out.

-

5Use the loan amount as your amount financed. "Amount financed" is a term that is specific to home loans. All other loans simply refer to the amount financed as the total amount of the loan provided to the borrower. For these types of loans, simply use the loan amount after the down payment as calculated in this part as your amount financed.

Determining the Amount Financed for a Mortgage Loan

-

1Negotiate a price for the asset with the seller. For a home, this will be your accepted offer price. For example, you might talk a homeowner down to selling a property for $100,000.

-

2Subtract any deposits. Home purchases may have required a "good faith" deposit. Other purchases may also require a deposit be made while bidding on or reserving the item. This deposit is typically paid upon submission of an offer to purchase. This money is then subtracted from the purchase price, as you have already paid it.[1]

- Deposits are either returned (depending upon terms) or converted into the down payment amount and/or closing costs.

- For example, if you put in a $3,000 good faith deposit on a $100,000 home, you would subtract this from the $100,000 to get $97,000.

-

3Finalize the loan amount. The portion of the original purchase price remaining after these deductions is your loan amount, assuming you are planning on financing the purchase. This amount must be borrowed from a lender and then repaid over a period of time per a loan agreement. The loan amount is the amount borrowed from the lender, not the amount that will eventually be repaid in total, which also includes interest expenses.

-

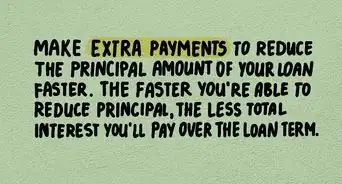

4Deduct the down payment amount. The down payment is paid in full upon closing the sale. It is generally a percentage of the total purchase price and is designed to provide security for the lender in the event of default. Therefore, it is not included in the amount financed.

- Many mortgage lenders require 20 percent down on a real estate transaction, although you may be able to secure an FHA-backed mortgage requiring as little as 5 percent down payment. A lower loan balance results in less interest expense and the possible requirement of mortgage insurance.[2]

- A lower downpayment is expected on government- guaranteed loans such as FHA or VA because the lender has recourse to the Federal government in the event of default.

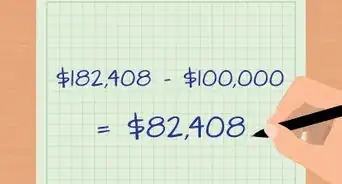

- For example, if you paid a 20 percent down payment on the $100,000 house purchase, which would be $20,000, you would subtract this from your total.

- Your good faith deposit may be applied towards your down payment. This means that the loan amount would still be the purchase price minus the down payment, which is $80,000 in this case.

-

5Understand how amount financed differs from the loan amount. "Amount financed" is a term set by the 1968 Truth in Lending Act to describe how much credit is provided to a borrower when they take out a home loan. It is calculated by subtracting prepaid fees and finance charges from the loan amount, since these fees are paid at closing simultaneously with the execution of the loan documents. This means that the amount financed is always less than the actual loan amount. The amount financed is provided to borrowers on the Truth in Lending Disclosure Statement, which is supplied after you apply for a home loan.[3]

-

6Add up prepaid fees. Prepaid fees are subtracted from the loan amount to arrive at the amount financed. These fees include prepaid points, homeowners association fees, mortgage insurance, and escrow company fees. They also include lender fees like underwriting fees, tax service, process fees, and prepaid interest. Add all of these fees up to arrive a total prepaid fees amount.[4]

-

7Subtract total prepaid fees from the loan amount. Subtract all of the prepaid fees from the loan amount to get your amount financed. This information will also be available on your Truth in Lending Disclosure Statement.[5]

Using the Amount Financed

-

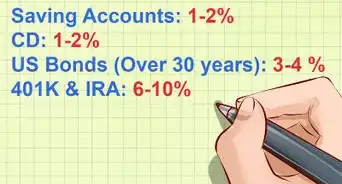

1Compare different lenders. If you have the amount financed for a mortgage loan, you can use this information to compare different lenders by looking at the associated fees and interest rates. This information is provided on the Truth in Lending Disclosure Statement, which is provided by all lenders to loan applicants. If you instead are financing another purchase, you can use your amount of financing required to apply to a variety of loans and look for the best combination of fees and interest rate.[6]

-

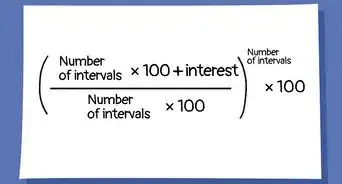

2Calculate the amount of interest you will pay. Your loan will likely be charged compound interest as you pay it off. Compound interest paid increases with the loan duration, the interest rate, and the compounding frequency (how often the compound interest is calculated each year). When you have the amount financed, you can use online interest calculators to determine how much interest you will pay on loans with different loan terms. A longer, higher-interest loan will end up costing you much more money in the long run than a shorter-term, low-interest loan.

- For more information, see how to calculate interest payments.

-

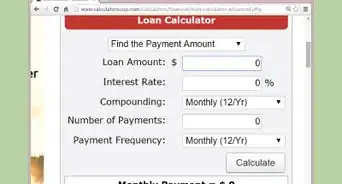

3Calculate loan payments. If you know how much you need to borrower (your loan amount), you can use this information to check for loan rates online. Check loan aggregator sites to find interest rates for the type and size of loan that you need. Then, input this information into an online loan calculator to figure out what your monthly payments might be. The Financial Industry Regulatory Authority (FINRA) provides a good calculator at https://tools.finra.org/loan/.

-

4Assess your ability to afford a purchase. Once you have an idea of the monthly loan payments, you can use this information to figure out how much you can afford to take out in a loan. Assess your ability to afford the loan by starting with your monthly after-tax income. Then, subtract any existing debt payments (mortgage, auto, etc.), monthly expenses like utilities and food, and savings or contributions to an emergency fund. The amount left is money that you can afford to pay towards a new loan's monthly payment.

- Most financial planners suggest limiting house payments plus taxes and insurance to 25 to 28 percent of take-home income.

- For example, if your household net income is $7,000 per month, your total outlay for housing should be no more than $1,960 per month.

-

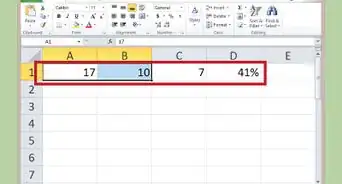

5Determine mortgage APR. Your actual mortgage annual percentage rate (APR) is calculated using your amount financed, rather than the loan amount. That is, your actual APR will be higher than the interest rate listed on your loan. To calculate your actual APR, find your monthly payment by using your stated interest rate, loan term, and loan amount and entering them into a loan calculator. Then, record your monthly payment and find a loan calculator that allows you to input your monthly payment, loan duration, and loan amount and receive an interest rate as the output. The output will be your actual APR.[7]

- A good calculator for this purpose can be found at http://www.thecalculatorsite.com/finance/calculators/interest-rate-calculator.php.

Warnings

- The purchase agreement used by many car dealerships is notoriously complicated and confusing. Be certain that you understand every line item in the agreement before signing it when buying a new or used vehicle.⧼thumbs_response⧽

References

- ↑ http://www.quickenloans.com/about/quicken-loans-deposit

- ↑ http://money.usnews.com/money/blogs/my-money/2014/02/20/how-much-will-that-low-down-payment-cost-you

- ↑ http://www.investopedia.com/terms/a/amount-financed.asp

- ↑ http://massrealestatelawblog.com/2011/03/28/truth-in-lending-disclosure-statement-how-about-confusion-in-lending/

- ↑ http://massrealestatelawblog.com/2011/03/28/truth-in-lending-disclosure-statement-how-about-confusion-in-lending/

- ↑ http://www.investopedia.com/terms/a/amount-financed.asp

- ↑ http://massrealestatelawblog.com/2011/03/28/truth-in-lending-disclosure-statement-how-about-confusion-in-lending/