This article was co-authored by Gina D'Amore. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

This article has been viewed 104,022 times.

When you put money into a savings account, the bank generally reports the annual percentage rate (APR) and the frequency of compounding interest. A lower interest rate with more frequent compounding could result in higher earnings. Calculating annual percentage yield (APY) tells you how much you can expect to earn by the end of the year. Using the formula will let you calculate the APY if you know the interest rate and compounding frequency.

Steps

Calculating APY by Hand

-

1Gather the necessary data. You need to know two pieces of information to perform this calculation:[1]

- Interest rate (r). This is the interest rate that the bank quotes for savings accounts of your type. Pay attention to the different rates for different types of accounts. For example, a money market account will generally have a higher interest rate than a savings account, and a savings account will have a higher interest rate than a checking account (if the checking account earns any interest at all). The rate should be expressed as a decimal, so a number like 3% would be used as 0.03.

- Compounding frequency (n). Ask a lending official at the bank how often the bank compounds interest per year.

-

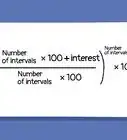

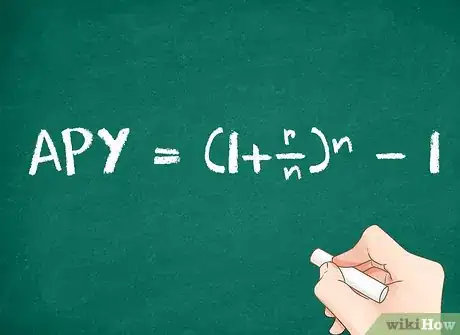

2Use the APY formula. There is a fairly simple formula for calculating the APY, based on the annual interest rate and the number of times interest is compounded. This formula is:[2]Advertisement

-

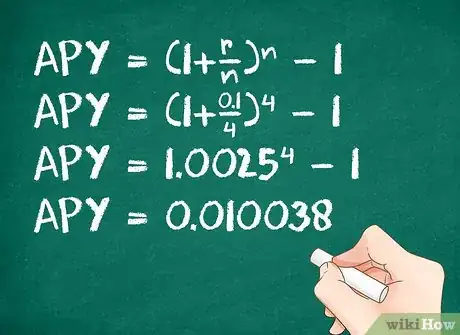

3Apply the data and perform the calculation. Suppose, for example, your bank advertises a 1% interest rate on savings accounts and compounds interest quarterly. This means that and . Apply these figures to the calculation as follows:[3]

- You probably need an advanced calculator to perform the exponent function for this calculation. Most simple calculators have, at most, a button for squaring a number. You will need a more advanced calculator with a “^” button to raise the number to any chosen exponent.

-

4Interpret the result. Notice that, for this example, the APY result is very nearly the same as the bank's interest rate. The increase is only 0.0038%. Even so, if you have a large amount of money, invested over time, this increase can add up.[4]

-

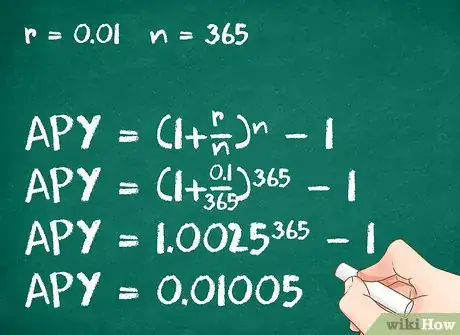

5Try a different example. Suppose, as a second example, the bank offers the same 1.0% interest rate but compounds the interest daily rather than quarterly. In this case, the rate is the same, , but .[5]

- Technically the number of days in a year is probably more accurately represented as 365.25. That difference could become meaningful with large amounts of money. For this example, however, just use .

-

6Interpret the new result. When the same interest rate is compounded daily, rather than quarterly, the APY increases from 1.0038% to 1.005%. Again, when working with large amounts of money, over time, this difference gains higher significance.[6]

Calculating APY Based on Actual Savings

-

1Collect information about your savings. Another way to calculate the APY is to work backward from your actual savings, to determine the rate that you earned. To perform this calculation, you need the following information:[7]

- Interest. This is the amount of interest that you earned over a specified period of time. You will need good bank records or a periodic bank report to get this number.

- Principal. This is the amount of money that you held in your account to earn the interest. If the amount of principal changes over time, you will need to perform separate calculations for each time period that the principal is constant, and add them together.

- Days. This is the number of days that the Principal remained in the account when the interest accrued.

-

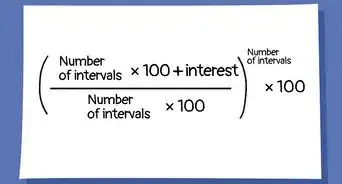

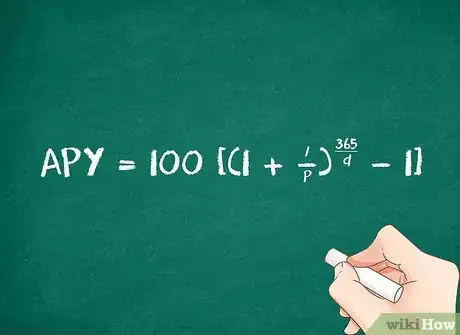

2Use the alternate APY formula. When you know the amount of money in your account and the amount of interest that you earned, you can calculate the APY with the following formula:[8]

-

- is the interest earned

- is the amount of principal

- is the number of days

-

-

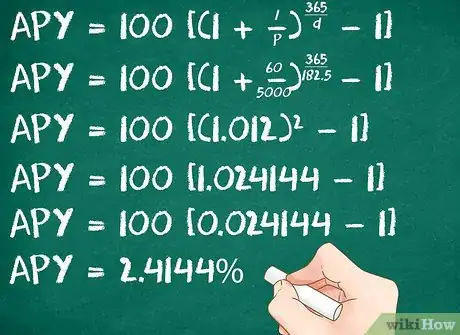

3Insert the data and perform the calculation. Suppose you learn that you earned $60 interest on a savings account that started with $5,000, over half a year (182.5 days). Use this information to calculate the APY that you received:[9]

- The final step of the calculation, multiplying by 100, is just to transform the decimal figure into a percentage.

Using an Online APY Calculator

-

1Search the Internet. While the calculations for APY are not too difficult, you can simplify the job even more by using an APY calculator online. Many banks or other websites offer this simple service. Run a search for “APY calculator,” and you should find what you want. The calculation is standard, so you will want to choose one that has a style and presentation that you can read easily.[10]

- Be careful to read the calculator site carefully. Some offer to help you calculate APY, while others offer to calculate your savings after you enter the APY. Either is fine, as long as you know what you are using. This article focuses on calculating the APY itself.

-

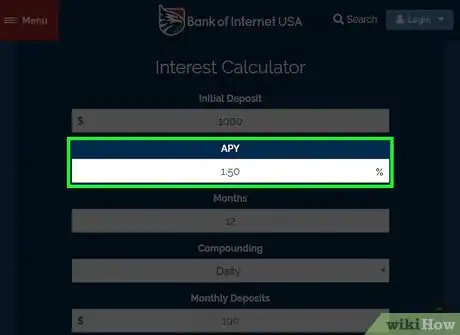

2Enter the advertised percentage rate. The first box of the online calculator will usually ask you to enter the bank's interest rate. Usually, you will be prompted to enter the figure as a percentage, rather than a decimal.[11]

- For example, if the calculator asks you to enter a percentage (%), you will enter the number 1 for a 1% interest rate. If you were asked for a decimal, then you would have to convert it to 0.01.

-

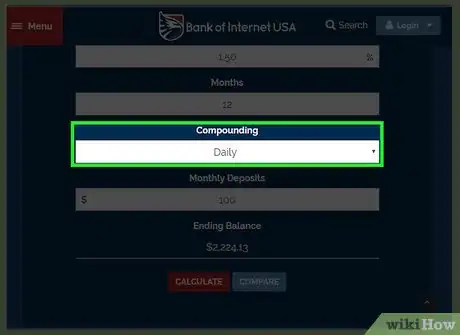

3Enter the compounding frequency. You may be asked to enter the number of times that the interest is compounded. In that case, you enter a number. Alternatively, you may be asked for a compounding frequency, with options like “Daily,” “Monthly,” or “Quarterly.” Read the choices carefully and select the correct one.[12]

- For example, if you are working with a bank that compounds interest quarterly, then you would either enter the number 4, for 4 times a year, or the word “quarterly.” You will have to read the instructions on the website to make the correct choice.

-

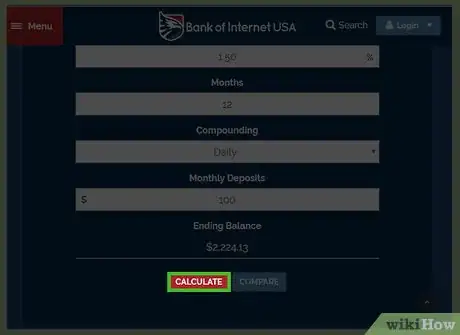

4Press the button to “Calculate.” After you enter the information, you should find a “Calculate” button. When you press that, the equivalent APY should appear.[13]

Expert Q&A

-

QuestionAre there different ways interest might be compounded on my savings account?

Gina D'AmoreGina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

Gina D'AmoreGina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

Financial Accountant Yes, there definitely are, so it's important to check with your bank and ask about the type of savings account you have. For example, you might have an annual percentage rate or a monthly percentage rate. You might even have a percentage rate that's compounded on the third of every month. Confirm what type of savings account you have. That way, you'll have the most accurate information about the amount of money you're earning with interest over time.

Yes, there definitely are, so it's important to check with your bank and ask about the type of savings account you have. For example, you might have an annual percentage rate or a monthly percentage rate. You might even have a percentage rate that's compounded on the third of every month. Confirm what type of savings account you have. That way, you'll have the most accurate information about the amount of money you're earning with interest over time. -

QuestionHow much interest would I earn on a $500 investment on a 30 month CD with a 1.4 APY and a 1.393 interest rate?

DonaganTop AnswererJust under $18.

DonaganTop AnswererJust under $18. -

QuestionWhat is the account balance on 1.00 APY and interest earned of $5.84?

DonaganTop AnswererIf the APY is 1.00%, the principal would be $584.00.

DonaganTop AnswererIf the APY is 1.00%, the principal would be $584.00.

References

- ↑ http://www.investopedia.com/terms/a/apy.asp

- ↑ http://www.investopedia.com/terms/a/apy.asp

- ↑ http://www.investopedia.com/terms/a/apy.asp

- ↑ http://www.investopedia.com/terms/a/apy.asp

- ↑ http://www.investopedia.com/terms/a/apy.asp

- ↑ http://www.investopedia.com/terms/a/apy.asp

- ↑ http://www.free-online-calculator-use.com/apy-calculator.html

- ↑ http://www.free-online-calculator-use.com/apy-calculator.html

- ↑ http://www.free-online-calculator-use.com/apy-calculator.html

![{\text{APY}}=100[(1+{\frac {I}{P}})^{{{\frac {365}{d}}}}-1]](./images/1978343430-edd3f8672b041d1b6d0d736c31c9b47e4246eedc.webp)

![{\text{APY}}=100[(1+{\frac {60}{5000}})^{{{\frac {365}{182.5}}}}-1]](./images/1657872160-77264c14e56c4d4921da690ab28d20cb55d92878.webp)

![{\text{APY}}=100[(1.012)^{{2}}-1]](./images/1891311561-55c1ff8561065deb8c75be40d610ccb33a3c36a2.webp)

![{\text{APY}}=100[(1.024144-1]](./images/1498160792-5788c5450623d41c6b385e9a670eb5316e670566.webp)

![{\text{APY}}=100[0.024144]](./images/2234195929-8bfbabd7c42f60d724feccb83b7728028140874b.webp)