This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 76,387 times.

Learn more...

ATM skimmers are fake card readers and cameras attached to a real ATM. When you put your card into the fake card reader, it can steal your information. Because skimmers can look so realistic, it may not be immediately apparent that a skimmer is there. To protect your card information, start checking an ATM for tampering before you use it. Perform a visual examination and physically test the machine for loose or unusual parts. There is no foolproof way to completely detect a skimmer. With safe ATM habits, however, you can reduce your risk.

Things You Should Know

- A skimmer refers to a fake card reader and camera used to steal your credit card information at an ATM.

- Try jiggling the card reader to see if it’s loose, and look for signs of glue around the reader to spot a skimmer.

- If the keypad feels “off” or the buttons are unusually spongey or uneven, the keypad may be fake.

- There are apps that can scan the area for Bluetooth signals associated with skimmers.

Steps

Identifying Signs of a Skimmer

-

1Examine the card reader for signs of tampering. Card readers should be sturdily attached to the machine. Anything unusual or out of place may be a sign that it has been tampered with. In particular, be wary if:[1]

- There are glue marks around the reader.

- There is tape sticking out from under the reader.

- The reader is skewed or hanging off to the side.

- A loose piece of plastic or equipment is sticking out from the reader.

-

2Look around for a hidden camera. Small cameras are often attached to the ATM to get your PIN number after you enter your card. Cameras may be hidden above the PIN pad, above the display screen, or in nearby structures, like a rack or shelf.[2]

- If you see a small pinhole drilled into the ATM, be careful, as it could be a small camera.

- If you see something like a pack of cigarettes, book, deck of cards, or mug sitting on or near the ATM, move it aside to see if it is hiding a camera.

- Legitimate cameras installed by the bank are usually very noticeable. They may be large, and there may be a sign indicating where they are. Card skimmer cameras are usually very small or hidden.

Advertisement -

3Check the top of the ATM for unusual plastic pieces. These are usually shaped as a rectangular bar. It will usually be glued or taped onto the ATM itself. This bar may contain a camera and other equipment to get your card info.[3]

- Look for a small pinhole in the bar. If you see one, it likely contains a small camera.

- If it is attached to the light, be especially wary. Normally, there should nothing covering the ATM’s light.

- If you’re uncertain about a piece of equipment on the ATM, try wiggling it with your hand. If it budges or moves, it is likely a skimmer.

-

4Examine the key pad for larger keys or unusual thickness. Sometimes, thieves will put a fake key pad over the real pad to capture your PIN number. A fake key pad may have larger or thicker keys than usual. It may also be raised up from the rest of the ATM.[4]

-

5Check to see if lines, arrows, and other graphics are covered up. If a graphic is partially covered or doesn't align properly, it may be because there is a fake case attached over them. Normal ATMs should not have skewed, covered, or cut-off graphics and shapes.[5]

- Look at the space under the card reader. If there are arrows, make sure that they are not covered partially. There should be a space between any arrows and the card reader itself.

- If the instructions next to the card reader are partially covered or cut off, it is likely that there is a plastic skimmer attached over them.

-

6Pay attention to anything unusual on your normal ATM. If you use a certain ATM often, stay alert for any unusual changes. If you see something off—whether it is a strange piece of plastic or a new plastic mold over the card reader—trust your gut and go to a new ATM. Watch out for:[6]

- Unusual colors on your ATM, especially on the card reader itself.

- A card reader that juts out more than usual.

- Cracks around the receipt slot, speakers, audio jack, or cash dispenser.

- No flashing indicator where there was one before.

Testing the ATM

-

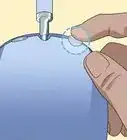

1Wiggle the card scanner to see if it moves or budges. If the card reader moves or jiggles at all, there is probably a skimmer attached. ATMs are very sturdily constructed, and none of their parts should budge. Skimmers, however, are often attached with tape, glue, or other unstable methods.[7]

-

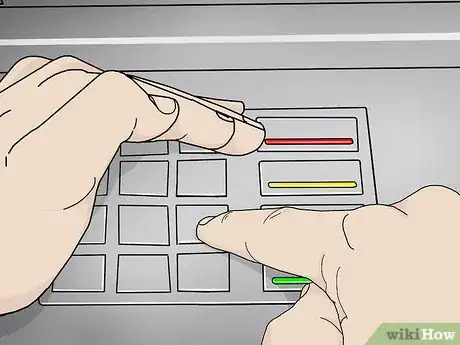

2Press down on the key pad to see if it feels sticky or spongy. Press a few random keys. If it feels spongy, sticky, or rigid, there may be a fake pad attached.[8]

-

3Use Skimmer Scanner on your phone to test for skimmers. This app uses Bluetooth to see if the ATM is sending information out to another phone or computer. You can download the app for Android phones for free from the app store.[9]

-

4Stop using the ATM if it is difficult to enter your card. Normal ATMs should easily and quickly accept your card. If the ATM is slow or if it is difficult to get your card in the reader, stop what you are doing. Report the ATM to the bank or business.[10]

Protecting Yourself from Skimmers

-

1Use ATM machines in busy and populated areas. Thieves are more likely to install skimmers in isolated areas where they won’t be caught. While no ATM is completely risk-free, it is better to use skimmers inside of buildings or in densely populated areas.[11]

- If you use an indoor ATM, check the location. If it is located somewhere an employee can see it easily, it is safer than an ATM stuck in a back corner or hidden by furniture.

- If you use an outdoor ATM, make sure it is close to the door of a building or facing a busy street.

-

2Cover the keypad with 1 hand when you enter your PIN. This will prevent a camera from catching your PIN after you enter your card. Keep in mind, however, that this will not protect your PIN if there is a fake keypad attached.[12]

-

3Go to the ATM on a weekday. Criminals often install skimmers on the weekends, when banks are closed. Your chances of finding a skimmer are lower on weekdays.[13]

-

4Monitor your bank account several times a week. If you find suspicious activity on your account, your bank may be able to return the money to you as long as you report it right away. Check your bank account 2-4 times a week to make sure there is no one else accessing your money.[14]

- To give you extra peace of mind, sign up for your bank’s fraud alert system. Usually your bank will text you if they notice suspicious activity.

-

5Use another ATM if you are in doubt. There is no foolproof way to tell if there is a skimmer attached to your ATM. If you have the slightest doubt, use a different ATM. Always trust your gut.[15]

References

- ↑ https://bucks.blogs.nytimes.com/2011/02/01/more-on-spotting-a-t-m-skimmers/

- ↑ https://www.tomsguide.com/us/how-to-spot-atm-skimmers,news-17615.html

- ↑ https://consumerist.com/2009/04/19/heres-what-a-card-skimmer-looks-like-on-an-atm/

- ↑ https://www.creditcards.com/credit-card-news/gas-pump-atm-skimmers.php

- ↑ https://www.pcmag.com/article2/0,2817,2469560,00.asp

- ↑ https://bucks.blogs.nytimes.com/2011/02/01/more-on-spotting-a-t-m-skimmers/

- ↑ https://www.pcmag.com/article2/0,2817,2469560,00.asp

- ↑ http://blog.aarp.org/2017/07/28/5-ways-to-spot-skimmer-scams-before-you-use-an-atm-or-gas-pump/

- ↑ https://www.creditcards.com/credit-card-news/gas-pump-atm-skimmers.php

- ↑ https://www.creditcards.com/credit-card-news/gas-pump-atm-skimmers.php

- ↑ https://www.pcmag.com/article2/0,2817,2469560,00.asp

- ↑ https://www.pcmag.com/article2/0,2817,2469560,00.asp

- ↑ https://www.tomsguide.com/us/how-to-spot-atm-skimmers,news-17615.html

- ↑ https://www.pcmag.com/article2/0,2817,2469560,00.asp

- ↑ https://www.tomsguide.com/us/how-to-spot-atm-skimmers,news-17615.html