This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 11 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 150,708 times.

"Commodities" is a broad term referring to raw materials and produce; metals like silver, gold and copper; and crops like corn, soybeans and grains. Making money in commodities is not easy. About ninety percent of commodities traders lose money rather than make it. One reason commodities trading is difficult is that there is no right time to enter or exit the market. It is essential for you to understand the market. You must also learn how economics can affect commodity prices. There are many ways to invest in commodities, including the futures market, buying options on futures contracts, the actual commodities (gold and silver are examples of easy-to-store commodities), Commodity ETFs (exchange-traded funds), and buying the stock of companies whose business model involves commodities. This article will highlight the commodities futures market. You must decide what futures contracts you want to buy, study the charts and develop your trading strategy.

Steps

Trading Physical Commodities

-

1Understand physical commodity transactions. Commodities are raw materials, agricultural products, petroleum products, and industrial and precious metals. Physical commodities are bought and sold in bulk for immediate delivery in specialized markets around the world. These markets are known as the "spot" or "cash" market. The majority of participants in the spot market are producers, and users of the commodity, able to finance and store large amounts of a commodity such as a refinery buying crude oil or a flour miller buying wheat and corn. As a consequence, individual investors rarely purchase any physical commodity except precious metals like gold, silver, platinum. or palladium. An individual taking delivery of a physical commodity must be prepared to:

- Pay a premium over the spot price, whether purchasing coins or bullion. Premiums can range up to 25% of the spot prices.

- Pay cash for the total purchase price. If an investor wishes to leverage his purchase, he must find and negotiate with a private lender who is willing to accept the metal as collateral.

- Pay extra charges for storage and insurance to protect against theft.

- Assume the risks of illiquidity. Finding a buyer for a large amount of gold, for example, might be difficult and expensive[1]

-

2Buy or sell physical commodities. You can buy physical commodities by visiting specific websites or exchanges where they are sold. They are not available through standard brokerages. Finding reputable markets to buy in can be difficult, however. Look for well-known authorities to point you towards safe places to trade physical commodities.

- For example, the World Gold Council maintains a list of reputable sites selling gold coins and bullion.[2]

Advertisement -

3Store your physical commodities. Physical commodities need to be stored in secure locations until sale. You can also buy insurance to protect you from a total loss if the commodities are stolen. Both of these increase the cost to the investor and cut into potential gains.

- Some gold-selling companies offer secure storage for buyers.[3]

Trading Commodity Futures

-

1Understand the basics about commodity futures. Commodity futures are contracts to make or take delivery of a specified amount of a commodity at a predetermined price at a specific future date. Futures trade on specialized financial markets where delivery is due on a future date. Futures contracts are available for a variety of different commodities ranging from bushels of wheat and corn to barrels of crude oil or ethanol. Each futures contract has two parties, one to make delivery of the commodity and the tether to take delivery.

- A buy order is a contract to take delivery of the commodity while a sell order is a contract to make delivery of the commodity.

- Commodity futures and spot prices are tracked in the market just like other assets. Traders make money by buying commodities (or commodity derivatives) for a certain price and then subsequently selling them for a higher price.

- The buyer of a futures contract makes money if the future market price of the commodity exceeds the market price of the commodity at the time of purchase. A seller of a futures contract makes money if the future market price is less than the market price of the commodity at the time of sale.

- Rather than making or taking physical delivery of a commodity, futures traders close their positions by implementing a contrary position to offset their liability to make or take delivery. For example, a buyer of a contract would sell the contract before delivery date while the seller of a contract would buy the contract.

-

2Learn about price changes in the commodity futures market. Commodity prices are established by market perceptions of supply and demand for the commodity. For example, a Midwestern storm can drive up the futures price of wheat due to investors' belief of substantial crop losses. Worries about an economic depression can likewise increase the price of precious metals in the belief the economies and currencies will decline and investors will turn to gold as a refuge.

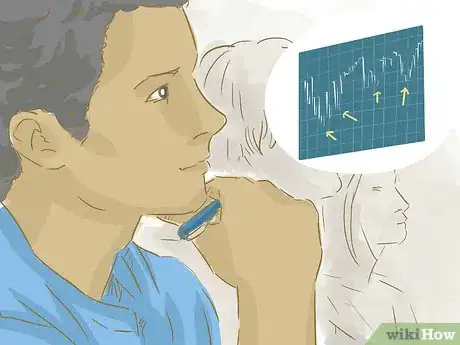

- Commodities traders made trades based on two different types of analysis that they believe help them to predict commodity prices. The first, fundamental analysis, focuses on studying world events, like weather predictions, national and international political events, and trade patterns, to predict commodity prices. For example, a forecasted increase in air travel might lead a trader to believe the price of oil will go up with the increased demand.

- The second, technical analysis, focuses on analyzing historical price trends to predict future ones. It relies on identifying patterns, trends, and relationships in the market to predict prices.

- Price trends are the tangible result of the interplay between investors' perceptions about supply and demand. Fundamental analysis is a guide to long-term prices while technical analysis reflects short term investor psychology.

- Visit the CME Group, which is a collection of four futures exchanges, at http://futuresfundamentals.cmegroup.com/ and review futures fundamentals.

-

3Understand the consequences of leverage in commodities futures. The commodities futures market is characterized by its significant use of leverage. This means that the buying commitments are made using borrowed money (also called buying on margin). This practice allows investors to invest in tens or hundreds of thousands of dollars’ worth of a commodity when they’ve only deposited a few thousand dollars of their own money. For example, you can invest in a futures contract for 1,000 barrels of crude oil at $90 (a value of $90,000) with a deposit of only $5,610.[4]

- Since the contracts are so large, small price movements have major impacts on profits or losses. If you own 1000 barrels of oil and the price increases or falls $1, it is about a 1.2% move. However, it represents a 20% loss or profit on your investment[5]

-

4Know how commodities futures are used to hedge against price fluctuations. Producers and consumers of a commodity use the futures market to "hedge" against unknown price movements in the commodity. For example, a national food company knowing that they will use 100,000 bushels of wheat in six months might buy 20 wheat futures tat $5.50 per bushel for delivery in six months. The spot price is $6.00. As a consequence, they lock in a price of $5.50 regardless of future price changes.

- Hedging is possible because the futures price and the spot price will be the same on the day the contract expires. To close its position, the food company would buy physical wheat on the spot market paying the market price while selling his futures contract at the same price.

- If the spot and futures price is $7.00, the food company will pay $700,000 for his wheat on the spot market. However, having purchased 100,000 bushels on the futures market at $5.50 ($550,000), he would close his futures position by selling the contact at $7.00 ($700,000), making $150,000 to reduce his costs on the spot mark.

-

5Test your trading strategy by executing "paper" trades. First spend a lot of time studying charts of past price movements of various commodities. This will help you identify specific support and resistance levels. Then, create a trading system that includes your entry and exit signals. Make practice (paper) trades where you won't have to risk your money. Develop a list of proposed commodity purchases, and monitor the market to see how your choices would have fared over time if you had actually bought them. You will then learn about your system’s strengths and weaknesses. Find out where you would have made money and study the areas where you would have lost money.

- Recognize that the results you have with "paper trading" can be misleading since it does have not an emotional component. Being at risk to make or lose your investment complicates decision-making.

-

6Learn trading strategies from successful futures traders. Study how traders develop and execute their strategies and how well they work. You might want to incorporate some of those trading ideas into your own system. Start by searching online for any well-reviewed books about commodities trading. There are also a number of online training courses that can prepare you for commodities trading. Search for these courses and then look for reviews of each course before starting or purchasing it.

-

7Consider hiring a professional commodities trading advisory firm. Such a firm invests money in commodities funds for you. Major commodities trading firms include the Vitol Group, Cargill, Glencore and Archer Daniels Midland. One advantage is that you don't have to commit a large sum of money in order to own a share of a diversified commodities portfolio. The firm will pool your money with that of other investors. Secondly, commodities funds can bargain for lower commissions than if you were to buy futures contracts on your own.

- The fund team's expertise should allow them to make choices that may make you money. Also, they have the expertise to knowledgeably diversify the investments, potentially moderating the risk of a single commodity holding. [6]

-

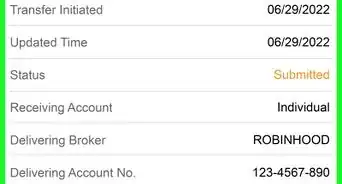

8Open a commodity account with a futures broker. Opening a futures account is similar to opening a brokerage margin account. However, most brokerage firms will require a potential futures trader to have a minimum net worth and income as well as several years of experience in investing. In addition, the brokerage firm will expect the client's written acknowledgement of the risks in commodity futures and that he is capable and willing to assume such risks, including the loss of his investment.[7]

- Clients are required to make minimum deposits of $5,000 to $10,000 in commodity accounts and are subject to initial and maintenance margin rules established by the commodity exchanges.

Trading Commodity Futures Options

-

1Understand commodity futures options. A futures option is the right to assume a futures position at a specific price (strike price) for a specific term of time. The strike price is the underlying commodity’s price if the option is exercised. The option gives its holder the right to either buy (take delivery) or sell (make delivery) of a single futures contract. The right can be exercised at any time before it expires, usually the end of the month preceding the delivery month of the futures contract.

- Options have significant profit potential due to the extreme leverage (the option represents a small percentage of the total value of the futures contract) and limited risk (the cost of the option).

- The option price tracks the price of the underlying futures contract which, in turn, tracks the price of the underlying commodity. For example, an option to buy a Dec Corn contract at $3.50 a bushel will reflect the price of the futures option while the futures option will reflect the spot price of corn with a premium for the remaining duration period.

- If the spot price of corn is $3.75, the futures price may be $4.00 (the spot price plus a $0.25 premium). In this case, the option price will be $0.50 ($4.00 - $3.50) or more.

- Option holders usually liquidate their option positions rather than exercising them. Liquidation results when the holder of the option sells the option or the writer of the option buys the option (contrary transactions to the initial).[8]

- With options, you are not obligated to take or make delivery of the commodity with an option (called "exercising" the option). However, options expire on a specific date.[9]

-

2Select an option trading strategy. Futures Options are available as puts, which give the right to sell the underlying commodity at a specific price or calls, which give the right to buy the underlying commodity. In addition, traders can either buy or sell (known as writing the option) a put or call futures option.

- Writing a futures option means assuming the risk of delivering a futures contract to the option buyer. While writing a futures options can be more profitable than buying an option, the writer also assumes the greater risk that the option might be exercised, requiring the writer to deliver the futures contract.

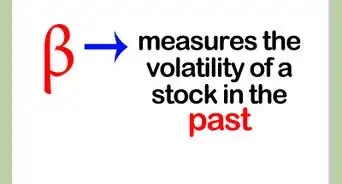

- The price of a futures option depends upon the volatility of the prices of the underlying commodity as well as the term of the option. Premiums are highest when the strike price is near the spot price and the time value (duration or length of period during which the option can be exercised) is long.

- Futures options can be sold when the strike price is far out of the money and unlikely to be exercised. As a consequence, short term price moves of the futures contract have less impact on the options price.

-

3Confirm the liquidity of a futures contract before initiating a position. Be sure that the underlying futures contract has substantial daily trading volume and open interest to ensure that liquidation is readily available. Most of the major futures contracts life financials, sugar, grains, gold, natural gas, and crude oil have several thousand open contract per strike price.

-

4Buy commodities options. You can purchase them from a commodities brokerage firm or through an online broker. You can always buy “mini” option contracts that are smaller than the full contracts bought and sold by institutional investors.

- Options spreads may allow you to offset the cost of your investment by selling options to other investors while you purchase options for a later date.

Trading Commodity-Related Stocks

-

1Understand commodity-related stocks. Commodity stocks are those stocks that have prices that move with underlying commodity prices. This correlation is stronger for some stocks than for others. The important thing is that the company be related to the production or use of the underlying commodity. For example, rather than investing in aluminum futures, you could buy stock in companies that mine it. This way you lower your risk but are still participating in the commodities markets.

- Commodity stock prices will not move directly with commodity prices and may be influenced by other factors like company performance or underlying reserve values.

- Stocks are far less volatile than futures and they are easy to buy and sell. You could also consider buying mutual funds that invest in a variety of commodity-related stocks.[10]

- Stocks and bonds are long term and have no expiration date like those of commodities or options.

-

2Identify a commodity-related stock. Start looking for commodity stocks to invest in by first locating a commodity that you want to invest in. You can identity this commodity either by simply choosing one that interests you or by following market news for information on potential price volatility. Locate related companies by searching for them on market websites. You can start by looking for companies that produce, refine, or ship your chosen commodity. Alternately, you can look for companies that use your chosen commodity as a primary input to production.

- Commodity-related stocks can be analyzed fundamentally or technically. Use fundamental analysis to determine if the company is a good value and likely to prosper in the future.

- Once you've chosen a stock, identify buying opportunities by watching the price movements of the stock to determine the optimum purchase and sale opportunities.[11]

-

3Open an account with a broker. Any type of online brokerage account will give you access to buying and selling stocks. Simply place an order for the amount of shares of the commodity stock you want to buy or sell. After you've bought it, track the stock's price and the price of the underlying security to determine when to sell.[12]

- Cash and margin accounts are available. The latter provides an ability to sell stocks short as well as the ability to borrow money from the brokerage firm. Be aware that leverage increases the profit potential of a trade as well as its risk.

- When buying stocks of any kind, diversification reduces the risk of loss present in a single company. Consider buying multiple companies in the same industry to reduce the risk of owning a single company; buy companies in different industries to reduce the risk of owning a single industry.

Trading Commodity Mutual Funds and ETFs

-

1Understand commodity futures mutual funds. Like their stock counterparts, futures mutual funds are a diversified portfolio of different commodity futures managed by a professional advisor for a fee. Managers determine which futures to buy or sell and the timing of the transactions. Most funds are highly leveraged to increase return. The portfolio might be broad including all commodity classes or limited to specific types such as grains or precious metals. Management fees typically are 1.5% or higher of the fund’s asset value.

- Mutual funds let investors participate in the commodities market without having to get directly involved with trading highly leveraged commodities. Also, since commodity mutual funds also make investments in stocks related to the commodities, sometimes they still perform well even if a commodity itself is experiencing a negative price movement.

- For example, stocks in a mining company may rise even though the price of the commodity they mine is falling. This is because the stock value of the companies related to the commodities are affected not only by the price of the commodity, but also by their own debt and cash flow.[13]

- Major investment companies that sell commodity index funds include Pimco Real Return Strategy Fund, Oppenheimer, Barclays and JP Morgan.

- Commodity mutual funds are advantageous because they are professional managed and diversified, providing a full package to inexperienced investors.[14]

-

2Understand commodity-related Exchange-Traded Funds (ETFs). A Commodity ETF is a managed portfolio of physical commodities or commodity futures designed to track either the spot price such as precious metals or an index of a specific commodities. For example, a Gold ETF might purchase and store gold in the form or coins or bullion while a Futures ETF would contain a series of futures contract designed to replicate the price movement of an index like the Dow Jones-USB Grains Subindex Total Return or the SummerHaven Dynamic Commodity Index Total Return. While assets within the ETF are rebalanced periodically to track the index more closely, active management is less intensive than a commodity mutual fund and less expensive with expense ratios of 1% or less.

- Commodity ETFs trade like a common stock on a stock exchange and undergo price changes frequently as they are bought and sold.

- ETFs usually have lower fees than mutual fund shares.

- However, ETFs also introduce credit risk, as their issuer may not be able to repay the promised amount under certain circumstances.[15]

-

3Buy commodity mutual fund shares or ETFs. Both commodity mutual funds and ETFs can be purchased through a regular online brokerage or an in-person broker. Mutual funds may have management fees and/or minimum investment amounts. Check with your brokerage for details.[16]

References

- ↑ http://commodityhq.com/2011/commodity-investing-physical-vs-futures/

- ↑ http://www.moneyobserver.com/how-to-invest/how-to-invest-commodities-beginners-guide

- ↑ http://www.moneyobserver.com/how-to-invest/how-to-invest-commodities-beginners-guide

- ↑ http://www.wikinvest.com/wiki/Futures_specify

- ↑ http://budgeting.thenest.com/much-leverage-involved-commodity-futures-28147.html

- ↑ http://www.profutures.com/article.php/390/

- ↑ http://finance.zacks.com/futures-vs-commodities-5663.html

- ↑ http://www.investopedia.com/articles/investing/051414/difference-between-options-and-futures.asp

- ↑ http://www.investopedia.com/articles/mutualfund/09/commodity-mutual-funds.asp

- ↑ http://www.investopedia.com/articles/optioninvestor/08/invest-in-commodities.asp

- ↑ http://www.wallstreetsurvivor.com/find-stocks/interest/commodities

- ↑ http://www.investopedia.com/articles/optioninvestor/08/invest-in-commodities.asp

- ↑ http://www.investopedia.com/articles/investing/100615/top-3-commodities-mutual-funds.asp

- ↑ http://www.investopedia.com/articles/optioninvestor/08/invest-in-commodities.asp

- ↑ http://www.investopedia.com/articles/optioninvestor/08/invest-in-commodities.asp

- ↑ http://www.investopedia.com/articles/optioninvestor/08/invest-in-commodities.asp

About This Article

To make money in commodities, start by buying or selling physical commodities, like agricultural products and precious gemstones, through reputable markets and storing your commodities in secure locations. Alternatively, to trade commodity futures, like bushels of wheat or barrels of crude oil, learn about price changes in the market and the consequences of leverage in commodities futures. In order to test your trading strategies, create a trading system with practice paper trades that you can compare with the market. To learn how to trade commodity-related stocks, keep reading!