This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

This article has been viewed 163,886 times.

Learn more...

A Central Know Your Customer (CKYC) number is required by law in India if you plan to invest in mutual funds or other financial assets. Having a CKYC number will show financial regulators that you are a legitimate investor and help to verify your identity. The process for getting a CKYC number is relatively easy and once you have it, you do not need to apply for it again. With a few key personal documents and the right information on the application form, you can get your CKYC number and start investing right away.

Steps

Applying for a CKYC Number

-

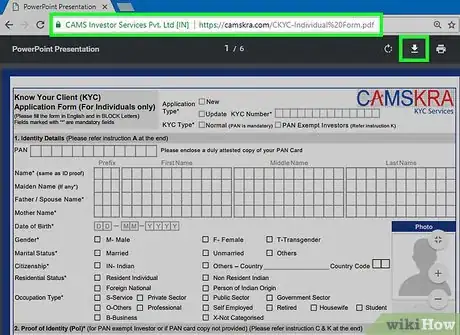

1Download and print the CKYC application form. Access the application form here: https://www.sebi.gov.in/sebi_data/commondocs/KYC_ApplForm_p.pdf. You can also get a copy of the form through your financial broker or mutual funds provider.

-

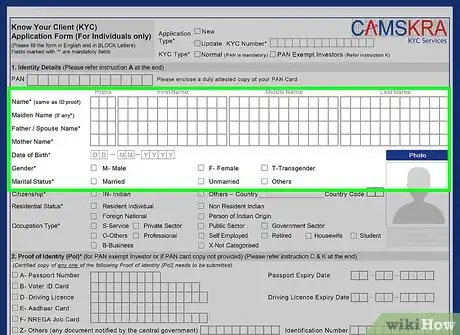

2Provide basic personal information on the form. You will need to provide your full name, as well as your father’s or spouse's full name. You will also need to list your date of birth, your gender, your occupations, and your marital status.

- You will also need to note your citizenship level and your residential status.

Advertisement -

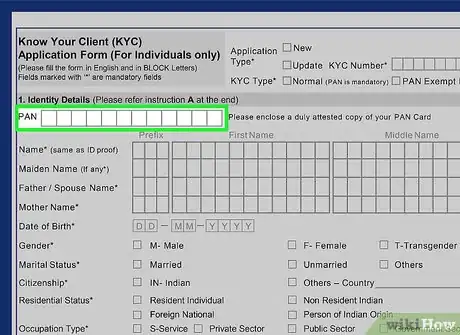

3Include your Permanent Account Number. Your PAN is a 10-digit number given to you by the federal Income Tax Department. You can apply for a PAN if you do not already have one through the government’s Income Tax Department.[1]

-

4Provide proof of identity and address information. You will need to list at least 1 of the following for the proof of identity section and the proof of address section: your passport number and the expiry date, your driver’s license number and the expiry date, your voter ID card number, or an AADHAR card number.

- You will also need to provide copies of your passport or driver’s license to prove your identity and address. You may need to provide the originals of your passport and your driver’s license, if requested during the application process.

-

5Include a recent passport size photograph of yourself. The photograph should be well-lit and standard passport size, which is 2 by 2 inches (51 by 51 mm) in India. You can get a passport photograph taken at a local photography studio or at a passport services kiosk.[2]

-

6Submit the completed form to your broker or mutual funds provider. Sign the signature line on the form. Then, bring the completed form, the passport size photograph, and a copy of your passport or driver’s license to your financial representative. They can then process your application properly.

- You can also go to a local financial registrar office in your area to submit the application.

-

7Provide a completed investment application form, if required by your broker. Some financial representatives require you to also submit an investment application, where you specify which investments you would like to pursue once you receive your CKYC number. This will help them to get a sense of how you plan to use your CKYC number and to analyze your finances in detail.[3]

- Ask your broker for an investment application form that you can complete.

Receiving and Using Your CKYC Number

-

1Wait up to 2 weeks for your application to process. You cannot pursue any investments legally until your application is approved. However, you can discuss possible investments and mutual funds you are interested in with your financial broker or advisor while you wait.[4]

-

2Get your 14-digit CKYC number by email or text message. Once your application is approved, you will receive an email or a text message that lists your CKYC number. The message will appear as: “Your KYC details have been registered with Central KYC Registry. Your CKYC identifier is 10088756711997.”[5]

- After you have saved the CKYC number in a safe place, delete the email or text message so your number cannot be stolen. A stolen CKCY number can lead to identity fraud, as others can try to use your number to make investments.

-

3Apply again if your application is rejected. If your application is rejected, you may have failed to provide the proper documentation. You can apply again for the number by filling out the application form again and following the proper guidelines. Make sure you double check your documentation to ensure your application is approved.

- You can also talk to your financial broker or advisor for guidance to ensure your application is approved on your second try.

-

4Use your CKYC number to invest in mutual funds and other financial products. Having a CKYC number will allow you to invest your money through a broker or a financial advisor. Providing your CKYC number on financial applications and forms will streamline the process.

Community Q&A

-

QuestionHow do I get a CKYC number online?

Community AnswerApply through PayTm Postpaid channel. It's an easy way to get your CKYC number as early as possible.

Community AnswerApply through PayTm Postpaid channel. It's an easy way to get your CKYC number as early as possible. -

QuestionHow do I find my CKYC number?

Community AnswerAfter 14 days from the submission of application, you will receive your CKYC number via email or text message.

Community AnswerAfter 14 days from the submission of application, you will receive your CKYC number via email or text message. -

QuestionDoes one CKYC number serve for different investments?

Community AnswerYes, once you have successfully completed the CKYC, the number will be valid and can be used for all investments purposes.

Community AnswerYes, once you have successfully completed the CKYC, the number will be valid and can be used for all investments purposes.

References

About This Article

A Central Know Your Customer (CKYC) number is a necessity in India if you want to invest in mutual funds or financial assets, and it’s relatively easy to obtain one. First, complete the CKYC application form which can be found on the Securities and Exchange Board of India website. Include all of the personal information that is asked for such as your Permanent Account Number, address information, and proof of identity. Next, submit your completed application form to your broker or mutual funds advisor. Make sure to also bring a passport-sized photograph of yourself, as well as a copy of your driver’s license or your passport. Finally, wait for up to 2 weeks before receiving your CKYC number via text or email. For more information about getting a CKYC number, such as deciding if you need to also complete an investment application form, read on.