This article was co-authored by wikiHow staff writer, Christopher M. Osborne, PhD. Christopher Osborne has been a wikiHow Content Creator since 2015. He is also a historian who holds a PhD from The University of Notre Dame and has taught at universities in and around Pittsburgh, PA. His scholarly publications and presentations focus on his research interests in early American history, but Chris also enjoys the challenges and rewards of writing wikiHow articles on a wide range of subjects.

This article has been viewed 40,530 times.

Learn more...

Financial institutions worldwide can be identified by unique BIC codes (which are interchangeable with SWIFT codes) for use during international transactions.[1] If, for instance, money is being transferred to your account from another country, the sender will need your bank's 8 or 11 character BIC code. You can search online for BIC codes worldwide, or contact your financial institution if you need to find your own bank's BIC code.

Steps

Searching for BIC Codes Online

-

1Use your favorite search engine to look up a bank's BIC code. If you enter the bank's name, the country it's located in, the city it's based in (if possible), and the phrase “BIC code” into a search string, you'll almost certainly end up with several results that provide the code.

- For instance, a Google search for “PNC Bank Pittsburgh USA BIC code” gives numerous results with the correct code of PNCCUS33 for PNC Bank, N.A., based in Pittsburgh, PA, U.S.A.

-

2Identify the BIC code in the previews of your search results. You probably won't even have to click on any links -- the webpage summaries will usually mention and list either the BIC or SWIFT code. Even if it just mentions a SWIFT code, the two codes are interchangeable.[2]

- A BIC code will be either 8 or 11 characters long. They always start with 6 letters, then a mix of letters and/or numbers for the next 2 or 5 characters.

- PNCCUS33 and PNCCUS33XXX are interchangeable, because "XXX" is just a placeholder anytime it's at the end of a BIC code.

Advertisement -

3Use a BIC code locator website instead. There are several websites, such as https://www.iban.com/search-bic.html, that enable you to search for a BIC code if you know the bank's name and location (nation and, if possible, city). Alternatively, you can scroll through alphabetical lists of banks by country to find a BIC code at https://www.theswiftcodes.com/.

- For example, both of the above websites give the BIC code for Bank of China's U.K. operations as BKCHGB2L.

Checking Your Account or Contacting Your Bank

-

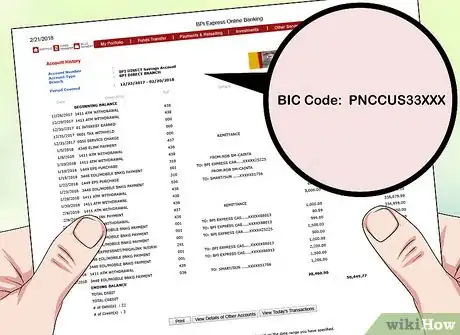

1Look over your bank statement. If you get a paper or digital bank statement each month, it may contain the BIC code somewhere in the fine print. Look for “BIC” or “SWIFT” — which, remember, are interchangeable — followed by a string of 8 or 11 characters.[3]

- BIC and SWIFT codes are assigned by 2 different organizations that have agreed to a single standard, meaning that BIC codes and SWIFT codes are essentially one and the same.[4]

-

2Log into your online banking account. With enough clicking around, you should be able to track down the BIC code for your bank. For instance, if you have an account with PNC Bank, N.A. (U.S.A.):[5]

- Log into your account with your username and password.

- Click on one of your accounts (e.g., “Interest Checking”).

- Click on “Show Account and Routing Numbers,” and re-enter your password.

- Click on “For Wire Transfers” and get the code PNCCUS33.

-

3Visit a bank branch and ask for their BIC code. The tellers at any bank branch will probably be able to tell you their BIC or SWIFT code from memory. Or, at the very least, they should be able to look it up quickly.[6]

-

4Call a bank's customer service line and ask for their code. It will probably take longer to connect to a customer service representative than it will take for them to give you their BIC code. If you track down contact information for any bank in the world that handles international transactions, you can ask for their BIC code.[7]

Recognizing and Using BIC Codes

-

1Make sure the code is either 8 or 11 characters long. Every BIC code in the world fits one of these two formats, as does every synonymous SWIFT code. Some 8-character codes will use “XXX” as placeholders at the end; for instance, you might see the code for PNC Bank, N.A. (U.S.A.) presented as either of these:

- PNCCUS33

- PNCCUS33XXX

-

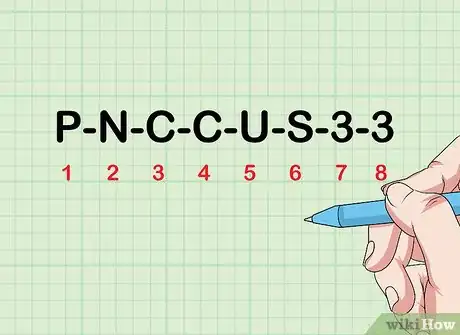

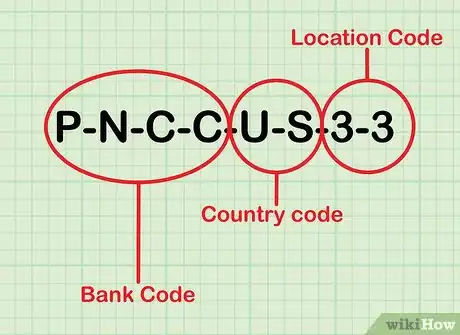

2Identity the components of BIC codes. Every BIC code is broken down into 3 or 4 sections, either “AAAABBCC” or “AAAABBCCDDD”:[8]

- “AAAA” is the bank code, and is always a string of 4 letters (no numbers).

- “BB” is the country code, which is also all letters without numbers.

- “CC” is the location code, and can be letters, numbers, or both.

- “DDD” can be letters and/or numbers and is the optional branch code, if it isn't the home office (in which case it will be excluded or represented as “XXX”).

- For example, the BIC code for the Manchester (U.K.) branch of the Bank of Baroda is BARBGB2LMAN — that is to say, BARB + GB + 2L + MAN.[9]

-

3Use the receiving bank's BIC code when transferring money internationally. Say, for instance, that you want to transfer money from your account at the Bank of China (U.K.) to your account at PNC Bank, N.A. (U.S.A.). In this case, you'll need to provide PNC's BIC code of PNCCUS33 (or possibly PNCCUS33XXX) to complete the transaction. If the money was going the other way, you'd need Bank of China's code.[10]

References

- ↑ https://www.investopedia.com/ask/answers/100214/whats-difference-between-iban-and-swift-code.asp

- ↑ https://www.commbank.com.au/support/faqs/757.html

- ↑ https://supportcentre.natwest.com/olb/your-details/cs1a/913225492/Where-can-I-find-my-IBAN-and-BIC-numbers.htm

- ↑ https://www.commbank.com.au/support/faqs/757.html

- ↑ https://www.pnc.com/en/personal-banking.html

- ↑ https://www.commbank.com.au/support/faqs/757.html

- ↑ https://www.commbank.com.au/support/faqs/757.html

- ↑ https://www.commbank.com.au/support/faqs/757.html

- ↑ https://www.theswiftcodes.com/united-kingdom/page/4/