This article was co-authored by Keila Hill-Trawick, CPA and by wikiHow staff writer, Eric McClure. Keila Hill-Trawick is a Certified Public Accountant (CPA) and owner at Little Fish Accounting, a CPA firm for small businesses in Washington, District of Columbia. With over 15 years of experience in accounting, Keila specializes in advising freelancers, solopreneurs, and small businesses in reaching their financial goals through tax preparation, financial accounting, bookkeeping, small business tax, financial advisory, and personal tax planning services. Keila spent over a decade in the government and private sector before founding Little Fish Accounting. She holds a BS in Accounting from Georgia State University - J. Mack Robinson College of Business and an MBA from Mercer University - Stetson School of Business and Economics.

There are 20 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 56,024 times.

With so many traditional banks, online banks, and credit unions out there, choosing a bank that's right for you can feel overwhelming. Choosing the best bank ultimately comes down to the kinds of product and service offerings you're looking for and what makes the most sense for your situation. Things like branch location, online services, and high interest rates may be really important to you, or they may not matter at all. To find the best bank for you, start by figuring out what type of bank you want. The differences between an international bank with thousands of locations and your local regional bank can be big. Once you have that pinned down, you can start digging through account requirements and hidden fees to find the best bank for you!

Steps

Types of Banks

-

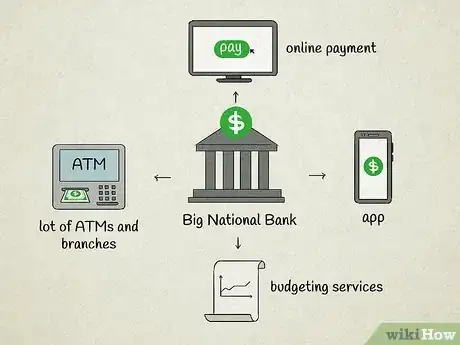

1Go for a bigger national bank if you prioritize convenience. The big names in banking offer a ton of benefits for the average consumer. Since they’re nation-wide, you’ll be able to find ATMs and branches anywhere you go. Most of these bigger banks also have apps that make it easy to check your balance from your couch. If you just want to make banking easy, a big bank is your best bet.[1]

- Bigger banks often offer services smaller banks don’t, like automatic deposits, online bill payment, and budgeting services.

- The downside of a big bank is that it can be kind of hard to get on the phone with an actual person if you have a question. You may not build a big personal relationship with the folks at your branch either.

- Examples of big national banks include Chase, Bank of America, Wells Fargo, and Citibank.

-

2Look at smaller regional banks if you want better customer service. If you care about customer service, small regional banks are going to beat the big banks. You’re probably going to see the same tellers every time you go to make a deposit, and if you run into a problem or have a question, you won’t have to fight through dozens of automated menus to talk to a person on the phone.[2]

- The other benefit of smaller banks is that they’re less bureaucratic. A big bank will rarely waive a requirement or fee, but small banks have the freedom to cut you a break or speed up an application.

- Smaller regional banks are a better option if you don’t have perfect credit and you want to apply for a loan. They take things into account that big banks don’t look at.[3]

- You also get to support a local business if you go for a smaller bank that’s specific to your city or town!

- Regional banks have names you may not know, like Western State Bank and Heritage bank. If you don’t recognize a bank’s name immediately, it’s probably a regional bank.

Advertisement -

3Consider an online bank if you want lower fees but no in-person services. Online-only banks are the new kids on the block in the world of banking, but they’re growing for a reason. Since they don’t have to spend money on physical branches, they tend to offer better interest rates with lower account requirements. If you don’t care about building a personal relationship with your bank and you prefer the computer over the phone, this is the way to go.[4]

- Online-only banks tend to have lower account requirements, which is good if you aren’t starting out with a ton of money.[5]

- The big bummer with online banks is that you can’t deposit cash. If you get paid in tips, online banks are basically off the table for you.[6]

- Online banks include Ally, CIT Bank, Chime, and Radius.

-

4Choose a credit union if you qualify for their cheaper services. Credit unions are smaller banks that provide services for specific groups of people, like teachers, people who live in northern Wisconsin, or combat veterans. They tend to be smaller, but like regional banks they’re known for phenomenal service.[7]

- Credit unions tend to offer lower fees and interest rates, but like regional banks, you may only have 1-2 branches you can go to.

- Credit unions are technically not-for-profit organizations. As a result, they aren’t known for tricking customers or hiding fees. Most credit unions offer financial help and resources for their members.

- Some credit unions have removed their membership requirements and replaced them with things like $5 donations to a charity, or volunteer work. Examples include Alliant, First Tech Credit Union, and Consumers Credit Union.

Things to Consider

-

1Determine whether you want checking, savings, or both. Checking accounts make it easy to deposit and spend your money, and you can get a debit card attached to your account. Savings accounts are designed to save money, and you are typically restricted in how often you can take money out. Figure out what type of accounts you want before you start scouting for banks.[8]

- The interest rate—which is how much you’re paid for keeping money at the bank—are higher with a savings account.

- The third common type of account is a brokerage account, which allows you to invest in securities (stocks, bonds, etc.). These typically have higher account requirements, but you can open one with a bank that also offers checking and savings accounts. Examples include Fidelity and Charles Schwab Bank.[9]

-

2Look at the account requirements for each bank in your category. Go to a bank’s website or walk into a branch to find their account requirements. Some accounts require you to maintain a minimum balance, while others charge you a fee if you don’t deposit a certain amount every month. Depending on your personal situation, some of these requirements may not work for you.[10]

- Make sure you meet the requirements for an opening an account before anything else.

- For example, if you’re a college student who doesn’t earn a steady income and a bank charges you if you don’t make a $100 deposit every month, you’re going to lose money by opening an account with that bank.

-

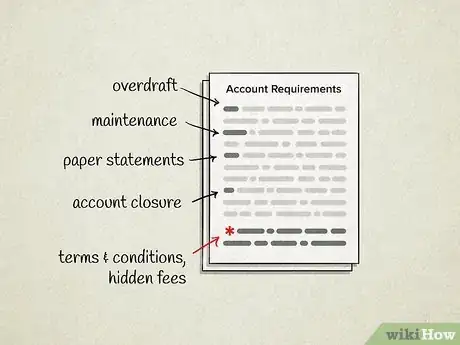

3Read through the fee structures and cost of maintaining an account. That little asterisk next to “free checking” is important. Banks often hide fees in the fine print, so read through every account’s fee structure carefully.[11] No bank has zero fees, but determining whether the fees are relevant to you or unfair is extremely important. Here are the common culprits:[12]

- Overdraft (average cost $35) – If you have $50 in your account and you take $60 out of an ATM, you will be charged an overdraft fee. Some banks have overdraft protection, which you should always turn on if it’s an option!

- Maintenance (average cost $12) – This is a regular charge for taking care of your account. Most banks waive this if you make a minimum deposit or use a debit card a certain number of times every month.

- Paper statements (average cost $2-3) – This is a charge for having statements physically mailed to you. Most banks will waive this if you enroll in online statements. Regional banks rarely charge for this.

- Account closure (average cost $25) – Some banks charge you a fee to close your account. If you plan on leaving your bank any time soon, ask about the cost of closing the account.

-

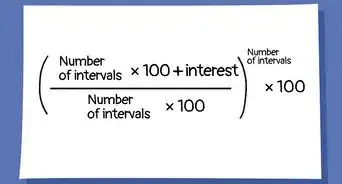

4See if their interest rates are reasonable for checking and savings. When you keep money in a bank, you earn interest. This is basically a monthly or yearly deposit that gets sent to your account. For the vast majority of accounts, the interest rate can change based on the federal interest rate. You won’t make much in interest if you don’t have a large account, so don’t base your entire decision on this if you’re just starting out.[13]

- The interest rate is often listed as APY, which stands for annual percentage yield. This is the maximum amount of interest you can earn in a year.

- For a savings account, anything over 0.5% is great. For a checking account, anything over 0.3% is really good. What’s considered “high” changes from year to year, though.

-

5Check out the bank’s policy on key services, like direct deposit. Basically every bank is going to offer a handful of other services you may need, but you should still double-check to find if there are added benefits. For example, every bank can offer direct deposit, where your job deposits money directly into your account. However, you may want a bank that sends you a text notification every time you get a direct deposit.[14] Other common services include:

- Wire transfers (average cost $15-25 for domestic, $15-45 for international) – Wire transfers are a fast way to transfer money to another bank. Some banks offer discounts on these if you do it online.[15]

- Automatic bill pay – Automatic bill payment is what it sounds like, and it can make it easier to budget. If you’re opening a small account, look for a bank that offers overdraft protection if you plan on doing this.[16]

- Identity theft/fraud protection – Most banks have solid security measures in place for this. If you want extra protection, look for a bank that offers additional security subscriptions, which can range from $7-20 a month depending on how much protection you want.

- Remote/ATM deposit – Some banks offer deposits at ATMs, and some allow you to deposit checks by taking photos from your phone. This is free everywhere except U.S. Bank, but not every bank offers these services.[17]

-

6Pull up reviews for the bank to see how their customers feel. Go online and poke around to pull up branch reviews, consumer complaints, and expert opinions. If a bank is being trashed online for ripping people off, stay away. If it looks like people are generally happy with the bank’s services, it may be a good fit for you.[18]

- There can be a lot of variety from branch to branch when it comes to national banks. If you plan on frequenting a specific branch location because it’s near your home or job, look at online reviews for that specific branch.

-

7Check the branch locations to see if they’re convenient for you. If you aren’t using an online bank, check to see where their branches and ATMs are located. It may be worth it to open an account with slightly higher fees if it’s one block away. On the other hand, if you have to drive an extra 15 minutes to go to the bank with better interest rates, that may be worth it![19]

- Check your branch’s hours as well. If you work 9-5 pm during the week and your branch is closed on weekends, how will you show up to make deposits and withdrawals!

- If you may be moving in the near future, a bigger national bank is going to be a better choice. You can find a Chase branch in basically any city, for example.

- Some people rarely have to visit a branch. They check their account online, have direct deposit, and use the bank’s app or website to access services. If this sounds like you, don’t put a ton of importance on location.

-

8Look for low interest rates and rewards if you want a credit card. Banks offer all sorts of credit cards. If you don’t want a separate credit account, check to see what kind of credit cards they offer before opening an account. Some credit cards give you cashback on purchases or frequent flyer miles. Just make sure the interest rate isn’t high if you think you may not pay it off on time every month.[20]

- You want a high interest rate for savings and checking accounts, and a low interest rate for credit cards. On credit, interest refers to the amount added to your bill if you don’t pay it off in full every month.

- Typical interest rates range from 14-26%. Some of this depends on your credit, though. If you have no credit history, you won’t be able to find super low rates.[21]

- Be very careful with credit if you’re starting your financial journey. Credit card bills can really add up if you aren’t careful. If you do take a credit card out, try to pay the bill in full every month.

-

9Check to make sure the bank is FDIC insured. The FDIC (Federal Deposit Insurance Corporation) is basically protection for your account. If the bank were to disappear tomorrow, you would get your money back if the bank is FDIC insured. FDIC insurance is also a sign of legitimacy, since only reputable banks are insured by this government agency.[22]

- Some banks offer identity and fraud protection that you can pay a monthly fee for, but this is typically unnecessary if you’re with a reputable bank and you’re careful with your information.[23]

- You can look up whether a bank is insured by going to https://research2.fdic.gov/bankfind/ and entering the name of the bank.

- Credit unions aren’t eligible for FDIC insurance. Check to see if they’re insured by the NCUA, instead. This is basically the same thing, but the NCUA only insures credit unions.

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionWhich checking account is best for me?

Keila Hill-Trawick, CPAKeila Hill-Trawick is a Certified Public Accountant (CPA) and owner at Little Fish Accounting, a CPA firm for small businesses in Washington, District of Columbia. With over 15 years of experience in accounting, Keila specializes in advising freelancers, solopreneurs, and small businesses in reaching their financial goals through tax preparation, financial accounting, bookkeeping, small business tax, financial advisory, and personal tax planning services. Keila spent over a decade in the government and private sector before founding Little Fish Accounting. She holds a BS in Accounting from Georgia State University - J. Mack Robinson College of Business and an MBA from Mercer University - Stetson School of Business and Economics.

Keila Hill-Trawick, CPAKeila Hill-Trawick is a Certified Public Accountant (CPA) and owner at Little Fish Accounting, a CPA firm for small businesses in Washington, District of Columbia. With over 15 years of experience in accounting, Keila specializes in advising freelancers, solopreneurs, and small businesses in reaching their financial goals through tax preparation, financial accounting, bookkeeping, small business tax, financial advisory, and personal tax planning services. Keila spent over a decade in the government and private sector before founding Little Fish Accounting. She holds a BS in Accounting from Georgia State University - J. Mack Robinson College of Business and an MBA from Mercer University - Stetson School of Business and Economics.

Certified Public Accountant

-

QuestionDo I need a business bank account if I own a company?

Keila Hill-Trawick, CPAKeila Hill-Trawick is a Certified Public Accountant (CPA) and owner at Little Fish Accounting, a CPA firm for small businesses in Washington, District of Columbia. With over 15 years of experience in accounting, Keila specializes in advising freelancers, solopreneurs, and small businesses in reaching their financial goals through tax preparation, financial accounting, bookkeeping, small business tax, financial advisory, and personal tax planning services. Keila spent over a decade in the government and private sector before founding Little Fish Accounting. She holds a BS in Accounting from Georgia State University - J. Mack Robinson College of Business and an MBA from Mercer University - Stetson School of Business and Economics.

Keila Hill-Trawick, CPAKeila Hill-Trawick is a Certified Public Accountant (CPA) and owner at Little Fish Accounting, a CPA firm for small businesses in Washington, District of Columbia. With over 15 years of experience in accounting, Keila specializes in advising freelancers, solopreneurs, and small businesses in reaching their financial goals through tax preparation, financial accounting, bookkeeping, small business tax, financial advisory, and personal tax planning services. Keila spent over a decade in the government and private sector before founding Little Fish Accounting. She holds a BS in Accounting from Georgia State University - J. Mack Robinson College of Business and an MBA from Mercer University - Stetson School of Business and Economics.

Certified Public Accountant

-

QuestionIs it good to have a special account?

Keila Hill-Trawick, CPAKeila Hill-Trawick is a Certified Public Accountant (CPA) and owner at Little Fish Accounting, a CPA firm for small businesses in Washington, District of Columbia. With over 15 years of experience in accounting, Keila specializes in advising freelancers, solopreneurs, and small businesses in reaching their financial goals through tax preparation, financial accounting, bookkeeping, small business tax, financial advisory, and personal tax planning services. Keila spent over a decade in the government and private sector before founding Little Fish Accounting. She holds a BS in Accounting from Georgia State University - J. Mack Robinson College of Business and an MBA from Mercer University - Stetson School of Business and Economics.

Keila Hill-Trawick, CPAKeila Hill-Trawick is a Certified Public Accountant (CPA) and owner at Little Fish Accounting, a CPA firm for small businesses in Washington, District of Columbia. With over 15 years of experience in accounting, Keila specializes in advising freelancers, solopreneurs, and small businesses in reaching their financial goals through tax preparation, financial accounting, bookkeeping, small business tax, financial advisory, and personal tax planning services. Keila spent over a decade in the government and private sector before founding Little Fish Accounting. She holds a BS in Accounting from Georgia State University - J. Mack Robinson College of Business and an MBA from Mercer University - Stetson School of Business and Economics.

Certified Public Accountant There are a lot of banks with special accounts that require a certain amount being in your account at all times. Some accounts require an average daily balance. If you know you'll never have a problem maintaining these thresholds, go for it. Just make sure you'll be able to keep it in good standing!

There are a lot of banks with special accounts that require a certain amount being in your account at all times. Some accounts require an average daily balance. If you know you'll never have a problem maintaining these thresholds, go for it. Just make sure you'll be able to keep it in good standing!

Warnings

- Actually read the terms and conditions before you open an account. Banks hide all kinds of information in the fine print, and it’s important that you don’t get burned by random fees after opening an account.[24]⧼thumbs_response⧽

- Don’t base your decision on the one-time perks a bank offers. A free $50 for opening an account sounds enticing, but it’s not worth it if they’re going to charge you $100 a year in maintenance fees.[25]⧼thumbs_response⧽

References

- ↑ https://www.fool.com/investing/general/2014/11/16/heres-when-it-makes-sense-to-choose-a-big-bank.aspx

- ↑ https://bucks.blogs.nytimes.com/2013/04/25/bigger-banks-vs-smaller-in-customer-satisfaction/

- ↑ https://us.accion.org/resource/business-banking-10-tips-choosing-right-bank/

- ↑ https://www.businessinsider.com/personal-finance/what-is-difference-between-online-banks-traditional-banks

- ↑ https://www.marketwatch.com/story/4-benefits-of-online-only-banks-2013-07-01

- ↑ https://www.businessinsider.com/personal-finance/what-is-difference-between-online-banks-traditional-banks

- ↑ https://money.usnews.com/banking/articles/benefits-of-credit-unions

- ↑ https://www.cnbc.com/select/checking-vs-savings/

- ↑ https://www.forbes.com/advisor/investing/what-is-a-brokerage-account/

- ↑ https://www.fdic.gov/consumers/consumer/news/cnsum16/cn_summer2016_final_bw_high.pdf

- ↑ https://www.fdic.gov/consumers/consumer/news/cnsum16/cn_summer2016_final_bw_high.pdf

- ↑ https://money.usnews.com/banking/articles/pesky-bank-fees-and-how-to-avoid-them

- ↑ https://www.cnbc.com/select/why-high-yield-savings-account-interest-rates-fluctuate/

- ↑ https://www.forbes.com/advisor/banking/your-complete-guide-to-direct-deposit/

- ↑ https://www.nerdwallet.com/article/banking/wire-transfers-what-banks-charge

- ↑ https://www.forbes.com/advisor/banking/how-automatic-bill-payment-works/

- ↑ https://www.consumerreports.org/cro/magazine/2014/10/pros-and-cons-of-mobile-check-deposit/index.htm

- ↑ https://www.bankrate.com/banking/savings/8-tips-for-choosing-a-new-bank/

- ↑ https://us.accion.org/resource/business-banking-10-tips-choosing-right-bank/

- ↑ https://www.moneycrashers.com/how-to-choose-bank/

- ↑ https://www.businessinsider.com/personal-finance/what-is-a-good-interest-rate-on-a-credit-card

- ↑ https://www.fdic.gov/consumers/consumer/news/cnfall14/misconceptions.html

- ↑ https://share.america.gov/how-u-s-institutions-keep-money-safe/

- ↑ https://www.fdic.gov/consumers/consumer/news/cnsum16/cn_summer2016_final_bw_high.pdf

- ↑ https://us.accion.org/resource/business-banking-10-tips-choosing-right-bank/