This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 67,851 times.

If you are dealing with a situation involving a long-standing, sizable debt, like a mortgage, you may want to know about how a prepayment clause of your lending contract applies to your loan. Prepayment penalties are items that lenders tack onto loans in order to recoup money from lost interest if the borrower decides to pay off the loan early. Opinions differ on these types of loan agreements, with some considering them usurious ways to make sure that the borrower ends up paying a large amount of interest even with the means to pay off the loan. If you need to pay one of these prepayment penalties, here are some common steps for calculating what you may owe.

Steps

Calculating Prepayment Penalties

-

1Read your mortgage loan contract. If you want to calculate a prepayment penalty, the first step is to understand what kind of penalty applies to your loan and if it is automatically an obligation under the terms of the loan. Take your mortgage agreement or other loan document and read over it to see about whether a prepayment penalty applies. Prepayment penalties come in several forms, including:

- A percentage of outstanding principal.

- A percentage of interest paid within a certain time period.

- An interest point differential, between your interest rate and current market rates, multiplied by outstanding principal.[1]

-

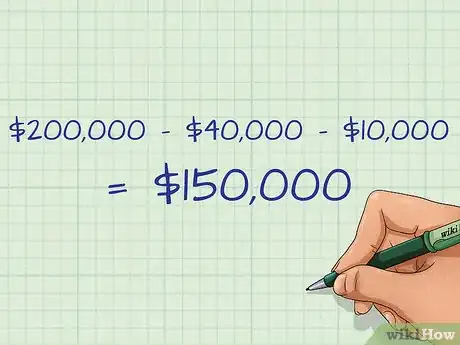

2Find your outstanding principal. The outstanding principal on your loan is the amount that you still owe the lender. Over time, borrowers pay down their loan principal (unless they are currently in a period of deferment). You will need to know how much you still owe to figure out the penalty for paying it off early.

- This amount should be on your most recent bill or on your original amortization schedule.[2]

- The outstanding principal is the amount you currently owe on the loan or house. For example, if you paid a down payment of $40,000 on a $200,000 home and have since paid an additional $10,000 towards the principal in monthly payments, your outstanding principal would be $150,000 ($200,000-$40,000-$10,000).

Advertisement -

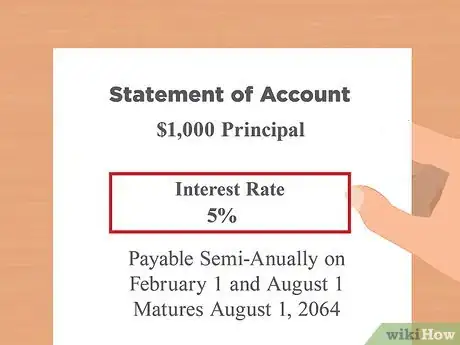

3Locate your annual interest rate. Assuming that you have a fixed interest rate on your loan, the annual interest rate is a key part of figuring out your prepayment penalty. If you have an adjustable rate, you may need help to calculate your prepayment penalty from your lender.[3]

- This information is available in your loan contract.

-

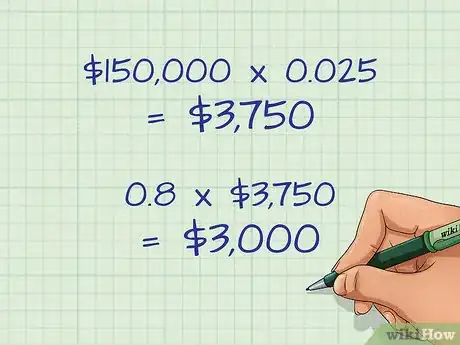

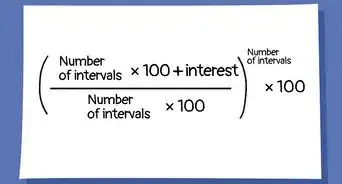

4Calculate your prepayment penalty using a percentage of interest. Many lenders charge a prepayment fee based on a percentage of interest paid within a certain time period, perhaps six months. For example, a common penalty is 80 percent of six months' interest. The interest refers specifically to the interest-only portion of the mortgage payment (the of your monthly payment used to pay interest rather than the principal).

- For a mortgage with $150,000 remaining and a 5 percent interest rate, start by finding the interest-only payments in six months. First, divide the annual interest rate in half to get 2.5 percent. Then, multiply this value by the outstanding balance to get interest paid in six months. This would be $150,000*0.025, or $3,750.

- Then, multiply this result by 80 percent to find the prepayment penalty. This would be 0.8*$3,750, or $3,000.[4]

-

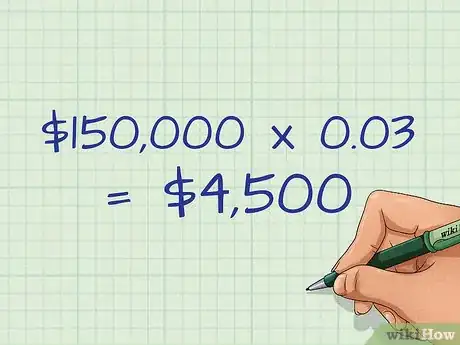

5Find your prepayment penalty using a percentage of remaining principal. Some prepayment penalties are based on remaining principal multiplied by a percentage. For example, a lender may charge anywhere between 1 and 4 percent of the remaining loan balance. This number may decrease during the life of the loan or remain constant.

- Your lender may use a calculation to determine your penalty, rather than simply using a stated penalty. If your lender uses what's called an interest rate differential to derive your prepayment penalty, you will need to find the difference in interest rates by subtracting the interest rate you are currently paying from the current interest rate for a similar loan.

- For example, if you have a 7 percent loan, but current prices for the same loan are 4 percent, the interest rate differential, and thus the prepayment fee, would be 3 percent (7 percent - 4 percent) of the outstanding principal.

- In either case, find the penalty by simply multiplying the remaining principal by the stated percentage. So, for a loan with $150,000 remaining and a 3 percent penalty, the penalty would be $150,000*0.03, or $4,500.[5]

Deciding to Prepay Your Loan

-

1Know the benefits of prepayment. Prepayment allows a borrower to both repay their loan faster and save money on interest. This is because paying off a loan faster gives interest less time to accrue on the principal. The higher your interest rate and remaining principal, the more you stand to benefit from prepayment.

- For example, a $150,000 remaining balance on a mortgage loan with a 5 percent interest rate would take almost 20 years to pay off with a monthly payment of $1,000. The borrower would also pay about $86,000 in interest alone during this period.

- However, if the borrower paid just $200 more per month, they would shorten their repayment by 5 years and pay only about $62,000 in interest.

- For a more extreme example, if the borrower doubled their monthly payment, they would repay the loan in 7.6 years and only pay about $30,000 in interest.[6]

- Partial prepayments are usually allowed under loan contracts. These can be up to 20 percent of the balance per year and do not require the penalty to be paid.[7]

-

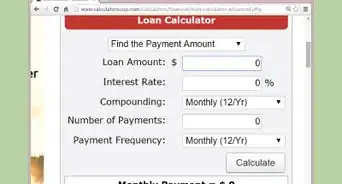

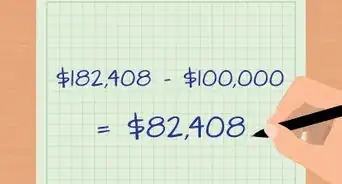

2Calculate the penalty versus interest saved. Figure out how much more you are able to pay on your mortgage each month and then calculate your interest savings using an online prepayment calculator. These calculators can be found by searching for "loan prepayment calculator" on a search engine. Your interest savings will be the difference between your current interest paid estimation for the life of your loan and the interest paid estimate for your new monthly payment amount. Compare this figure to your calculated prepayment penalty.

- If the prepayment penalty is lower than your interest savings, taking the prepayment penalty is a good idea.

- For example, using the previous example, your interest savings by paying $200 more per month would be $86,000-$62,000, or $24,000. If your prepayment penalty is less than this (odds are it will be), you should take the prepayment penalty and pay off your loan early.

-

3Consider refinancing. Refinancing can also incur a prepayment penalty. However, refinancing to a significantly lower rate might make the paying the prepayment penalty worth it. This is especially true if you are refinancing to a traditional 15 or 30 year loan.

- Taking a prepayment penalty may be your best option for refinancing out of an expensive balloon loan (a loan with a large lump sum payment at the end).[8]

-

4Wait for a lower penalty if possible. Some loan contracts stipulate that the amount of the loan penalty decreases over the life of the loan. For example, your loan might charge a 3 percent penalty if you pay off your loan within five years, but the fee might drop to 1 percent after that time. If this is the case, consider waiting until the drop in the prepayment penalty if you are close enough to it.[9]

Getting Out of Prepayment Penalties

-

1Determine your prepayment penalty type. For mortgage loans, there are two major types of prepayment penalties that charge the penalty under different circumstances. A "hard" prepayment penalty charges a penalty if the borrower refinances or sells their house. A "soft" penalty, on the other hand, only charges the penalty if the borrower refinances. In other words, a soft penalty gives the borrower the chance to get out of the loan by selling, whereas a hard one does not. Look over your loan terms to find out which type you have.[10]

-

2Call your loan officer. Start by calling into your lender and getting your loan office on the phone. You may have to speak to their manager if the individual loan officer can't do anything for you. Just ask whoever can help you what they can do to lower or eliminate your prepayment penalty. It's very unlikely that they will waive the fee, but perhaps they can lower it early. For example, if you are close to a scheduled reduction in prepayment fee from 4 percent to 2 percent (say, at two years into your loan's life), you can argue for an immediate drop to the 2 percent rate.[11]

- This is useful if you need to refinance or sell the house immediately.

-

3Write down every detail. Make sure that you ask the person you talk to on the phone to send any negotiated changes to you in writing. While on the phone, write down the names and positions of every person you talk to. In addition, write down any terms you talk about and the date of the call. Having this in writing can help to prove your case later if the bank claims they don't know about the rate change.[12]

-

4Get support behind you. Odds are, getting the lender to reduce or waive the prepayment fee will be difficult. However, if you and a group of borrowers in a similar situation believe that the original loan terms were unfair, you may be able to act as a group and get the loans rewritten. This may require the assistance of a local community group or organization.[13]

References

- ↑ http://homeguides.sfgate.com/calculate-prepayment-penalty-mortgage-7571.html

- ↑ http://homeguides.sfgate.com/calculate-prepayment-penalty-mortgage-7571.html

- ↑ http://www.thetruthaboutmortgage.com/prepayment-penalty-mortgage/

- ↑ http://www.thetruthaboutmortgage.com/prepayment-penalty-mortgage/

- ↑ http://homeguides.sfgate.com/calculate-prepayment-penalty-mortgage-7571.html

- ↑ http://michaelbluejay.com/house/prepayments.html

- ↑ http://www.mtgprofessor.com/A%20-%20Options/prepayment_penalty.htm

- ↑ http://www.bankrate.com/finance/mortgages/6-steps-to-a-lower-prepayment-penalty-2.aspx

- ↑ http://www.bankrate.com/finance/mortgages/6-steps-to-a-lower-prepayment-penalty-1.aspx

- ↑ http://www.thetruthaboutmortgage.com/prepayment-penalty-mortgage/

- ↑ http://www.bankrate.com/finance/mortgages/6-steps-to-a-lower-prepayment-penalty-2.aspx

- ↑ http://www.bankrate.com/finance/mortgages/6-steps-to-a-lower-prepayment-penalty-2.aspx

- ↑ http://www.mtgprofessor.com/A%20-%20Options/prepayment_penalty.htm