wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 15 people, some anonymous, worked to edit and improve it over time.

This article has been viewed 428,929 times.

Learn more...

When you find yourself unemployed, the fear of the unknown can be overwhelming. Unlike certain other benefit programs, unemployment payments are calculated as a percentage of your past wages. To ease your mental burden during this difficult time, it can be a good idea to estimate the size of your unemployment payments in advance of your first payment so that you can prepare to budget accordingly. If you're not interested in calculating your own unemployment benefits but would like to learn how to calculate the unemployment rate of a country, read this article instead. If you'd like to calculate your own unemployment benefits, see Step 1 to get started.

Steps

Estimating Your Benefit

-

1For a definitive answer, research your state's rules. Every state has its own unemployment program run in conjunction with the federal government. The rules for calculating unemployment benefits and the requirements for claiming benefits will vary depending on the laws of the state you live in. Thus, the steps in this section may not hold true for all states. When in doubt, consult the website of your state's employment agency for information that's pertinent to you.

- For the purposes of this article, we'll calculate sample unemployment payments based on the rules for California and Texas, the two most populous states. This will demonstrate some of the subtle differences that can exist between different states when it comes to unemployment benefits.

-

2Know the information you'll need to calculate your weekly payments. As noted above, your WBA is calculated as a percentage of the income you were receiving before you lost your job. Typically, the income you'll use to calculate this is based on what you earned during the first four of the previous five business quarters. This is called your "base period". To calculate your WBA, you'll need to know how much you worked (in terms of hours) and what you made during each quarter of this base period. If you've kept your old paystubs, these can be indispensable here. Otherwise, you may need to contact your old employer(s) for information.

- The calendar year is divided into four quarters, each of which contains three months. The four quarters are Jan.-Mar. (Q1), Apr.-Jun. (Q2), Jul.-Sep. (Q3), and Oct.-Dec. (Q4). Usually, the income level you'll use to calculate your MBA is based on what you earned during the first four of the previous five business quarters.

- For example, if you're filing for unemployment in April (Quarter 2), you'll use your income from Q4, Q3, Q2, and Q1 of last year. You wouldn't use your income from Q1 of this year.

Advertisement - The calendar year is divided into four quarters, each of which contains three months. The four quarters are Jan.-Mar. (Q1), Apr.-Jun. (Q2), Jul.-Sep. (Q3), and Oct.-Dec. (Q4). Usually, the income level you'll use to calculate your MBA is based on what you earned during the first four of the previous five business quarters.

-

3Determine your wages during each quarter of your base period. Use paystubs, W2 forms, and/or records from your former employers to determine the amount of money you made in each of the business quarters of your base period. Your eventual weekly benefit is determined based on your quarterly income during this period. As a reminder, your base period is comprised of the four quarters before the most recent quarter in the past.

- For example purposes, we'll calculate unemployment payments for a hypothetical worker in both California and Texas. Let's say that this worker is applying for benefits in October. October is in Q4, so we'll use our wages from Q2 and Q1 of this year and from Q4 and Q3 of this year. Let's say, for our purposes, that our worker earned $7,000 in every quarter except Q2, in which he earned $8,000.

- Note that some states allow you to count your wages during an alternate base period if you don't have enough wages in the normal base period to apply for benefits. Depending on the state, extenuating circumstances may need to apply - for instance, in Texas, you can only do this in the case of a debilitating illness, whereas in California, there is no such restriction.[1] [2]

-

4Determine your highest-earning quarter. It's not unusual for employees to earn more during some quarters than in others, especially if their job was one that paid by the hour. Usually, depending on your state, your unemployment benefits will be calculated based on your wages during either your single highest-paying quarter or from the average of your wages during your highest-earning quarter and another quarter or quarter(s). In any case, you'll usually need to determine your highest-earning quarter to accurately estimate your benefits.

- In both California and Texas, your unemployment benefit is based on your wages during the single highest-earning quarter in your base period.[3] [4] However, this isn't the case in every state. For instance, in Washington State, an average of your wages during the two highest-earning quarters in your base period is used.

-

5Find your weekly payment by following the unique procedure for your state. Every state has its own way of calculating the size of benefit recipient's weekly payments. Usually, however, the process is as simple as multiplying your wages during your highest-earning quarter (or an average of your quarters' wages - see above) by a certain percentage, dividing your wages by a certain number, or by simply consulting a table. The end goal is the same in every state - to award you some fraction of the earnings you were "used to" in the form of regular benefits. The amount of money you receive in benefits is always less than the amount you made from working. Consult your state unemployment agency's site for precise instructions for your state.

- In Texas, weekly benefits are calculated by dividing the wages from the highest-earning quarter in your base period by 25 and rounding to the nearest dollar. In other words, you receive 1/25 of your quarterly wages per week (whereas by working at the level of your highest-earning quarter, you would receive about 1/12 of your quarterly wages per week - a little more than twice as much). In the case of our hypothetical worker, 8,000/25 = $320. This worker would receive $320 per week.

- In California, the process is slightly different. Unemployment benefits are found by matching your wages during your highest-earning quarter to preset values in a table provided by the Employment Development Division.[5] In this case, based on $8,000 earned during our highest-earning quarter, our worker would claim $308 in benefits. Note that this is about 1/26 of his quarterly earnings.

-

6Be prepared for your actual weekly benefit to be subject to deductions. Take your weekly benefit amount as a maximum possible value, rather than a concrete representation of how much you'll actually receive. In reality, there are various reasons why you may not be able to "keep" all of the money you'll receive in weekly benefits. For example:

- Unemployment payments are considered part of a person's taxable income and thus can have tax withheld.[6]

- Unemployment payments can be garnished to pay child support, outstanding debts, etc.

- Certain types of work may be subject to unique rules when it comes to unemployment benefits. For instance, in California, if a school employee files a claim between terms but has a reasonable assurance of returning to work the next term, benefits may be withheld. However, if she is eventually denied from returning to work, these "back payments" may be made retroactively.[7]

-

7Expect not to receive less than your state's minimum benefit amount or more than its maximum. Different states have different "ranges" for their weekly benefit amounts - basically, the state won't pay more or less than certain set amounts per week. If your calculated unemployment benefit is less than your state's minimum amount, expect to receive the minimum amount and vice versa if you calculated a benefit greater than its maximum.

- For example, in California, the maximum weekly benefit is $450. If our worker was fabulously wealthy and made $800,000 during his highest-earning quarter, rather than $8,000, he would still only collect $450 dollars per week, not 800,000/25 = $32,000.

- In Texas, the maximum weekly benefit is $454, so our worker would receive, at most, this.

-

8Calculate your maximum benefit amount as a multiple of your weekly benefit amount. No state will give weekly unemployment benefits indefinitely. Usually, unemployment benefits "cap" after a certain dollar amount has been paid out. After this point, to continue receiving benefits, the out-of-work person usually must re-apply or file for an extension. Usually, your maximum benefit amount is either your weekly benefit amount times a certain predetermined number or some percentage of your base period wages.

- In Texas, a recipient's maximum benefit amount is 26 times the weekly benefit amount or 27% of all wages earned during the base period - whichever is smaller. Our hypothetical worker's weekly payment is $320 - 320 × 26 = $8320. His total base period wages are $29,000. 29,000 × 0.27 = $7,830. The latter is smaller, so we can say that his maximum benefit amount is $7,830.

- In California, a recipient's maximum benefit amount is 26 times the weekly benefit amount or half of all wages earned during the base period - whichever is smaller. Our hypothetical worker's weekly payment is $308 - 308 × 26 = $8008. His total base period wages are $29,000. 29,000/2 = $14,500. The former is smaller, so we can say that his maximum benefit amount is $8,008.

Understanding the Basics of Unemployment Insurance

-

1Know what to expect in terms of payment frequency and size. Usually, a person receiving unemployment benefits receives payments each week, rather than every two weeks or every month, like most paychecks. The size of each weekly payment is usually called the Weekly Benefit Amount or Weekly Benefit Rate (WBA or WBR). The WBA for a given unemployment claim varies based on the size of the recipient's previous income - the more you used to make, the more you'll receive in unemployment benefits.

- Though the only way to be absolutely sure how much you'll receive in unemployment benefits each week is to actually file a claim, typically, you can expect to make about 40-60% of your previous income (depending on where you live).

-

2Know that unemployment benefits are subject to certain rules and limitations. To prevent fraud and misuse of benefits, state governments usually require benefit recipients to look for full-time work as a condition of receiving benefits. Occasionally, benefit recipients may be asked to provide proof that they are doing so by submitting a current resume, records of correspondence with potential employers, job applications, etc. Recipients may also need to attend meetings or employment workshops.

- Additionally, the amount of unemployment benefits one person receives isn't unlimited. Your Maximum Benefits Payable or Maximum Benefit Amount (MBP or MBA) is the total amount the state will pay you in unemployment benefits during the term of your claim (often one year). When you've received this amount, you may need to re-apply and/or undergo an eligibility interview to continue receiving benefits. MBP varies from state to state.

-

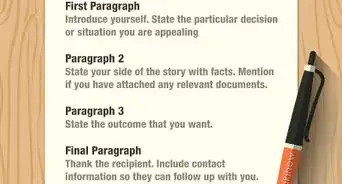

3Know that different states will have different unemployment requirements. To receive unemployment payments, you'll usually have to meet certain eligibility requirements. The unemployment agency usually verifies that you're eligible by contacting both you and your employer, so don't lie about your eligibility. To be eligible, you'll need to have lost your job for reasons beyond your control - for instance, you can't have been fired for incompetence or quit your job because you didn't like it and file an unemployment claim. A few other common requirements that you may need to contend with, depending on your state, are:

- You must have earned more than a certain amount during your base period. Usually, this is a fairly small amount - even with a minimum wage job, if you've worked for most or all of your base period, you should be fine. This is to prevent people who worked only very little during their base period to claim benefits.

- Your hypothetical weekly benefit must be more than a certain fraction of your total earnings during part or all of your base period. As above, this is to prevent people who worked very little from claiming benefits.

- You must have worked a certain amount of days or hours during your base period. See above.

Community Q&A

-

QuestionHow much can I receive weekly for unemployment?

Community AnswerThe amount of unemployment benefits you may receive each week is your Weekly Benefit Rate. The amount will be at least 60 percent of the average weekly earnings during your base-year period.

Community AnswerThe amount of unemployment benefits you may receive each week is your Weekly Benefit Rate. The amount will be at least 60 percent of the average weekly earnings during your base-year period. -

QuestionI was employed in California, but move to another state after I was laid off. Am I still be eligible for unemployment while I look for a job in a new state?

Community AnswerYes, if you worked long enough to be eligible for unemployment in California. You would have to talk to someone in the new state's Employment Services department for more information.

Community AnswerYes, if you worked long enough to be eligible for unemployment in California. You would have to talk to someone in the new state's Employment Services department for more information. -

QuestionDo I add my tips when asked my hourly pay?

Community AnswerIf you diligently reported your tips as income, you can file for the 15 an hour; if you cannot provide proof you earned the extra money and paid taxes on it, you only will receive benefits based on the base hourly rate.

Community AnswerIf you diligently reported your tips as income, you can file for the 15 an hour; if you cannot provide proof you earned the extra money and paid taxes on it, you only will receive benefits based on the base hourly rate.

Warnings

- Don't count on unemployment benefits helping you over a long period. You can only receive the benefit for 26 weeks in most states.⧼thumbs_response⧽

References

- ↑ http://www.twc.state.tx.us/ui/bnfts/eligibility-benefit-amounts.html

- ↑ http://www.edd.ca.gov/pdf_pub_ctr/de1275a.pdf

- ↑ http://www.twc.state.tx.us/ui/bnfts/bi-99.pdf

- ↑ http://www.edd.ca.gov/pdf_pub_ctr/de1275a.pdf

- ↑ http://www.edd.ca.gov/pdf_pub_ctr/de1275a.pdf

- ↑ http://www.irs.gov/taxtopics/tc418.html

- ↑ http://www.edd.ca.gov/Unemployment/School_Employee.htm

- http://www.employmentlawfirms.com/unemployment/determining-amount-compensation.htm

About This Article

To calculate unemployment, start by figuring out the income you were receiving during the first 4 of the previous 5 business quarters before you lost your job, which is also known as the base period. You’ll also need to know how many hours you worked and what you made during each quarter of this base period. Then, take your wages during your highest-earning quarter or an average of your quarters’ wages and plug it into a table of your specific state's unemployment benefits, which you can find online. To learn how to understand the basics of unemployment insurance, keep reading!