This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 83% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 91,612 times.

California unemployment insurance provides compensation for workers who are unemployed due to no fault of their own. Even after you qualify for unemployment insurance benefits by meeting the threshold eligibility requirements, in some limited instances you may be overpaid benefits. If you received a notice of overpayment, then know that you can fight the claim.

Steps

Understanding Overpayment

-

1Understand what overpayment is. An unemployment insurance overpayment occurs when you receive more benefits than you are entitled to. Generally, individuals only receive a notice of overpayment from California's Employment Development Department (EDD) under two circumstances: fraud or non-fraud.

- Fraud. Overpayment is due to fraud when the individual knowingly gave false information or withheld information in order to receive benefits.

- Non-fraud. Overpayment for non-fraud occurs because of some other error, not the fault of the person receiving benefits.

-

2Review your application materials. If you have been accused of fraud, you should review the information you submitted to the state when you applied for unemployment benefits. Look to see that you accurately answered questions.

- Check the employment information you gave. Often, discrepancies between the information you provided and the information provided by your employer will trigger a notice of overpayment.[1]

- Another trigger is your claim that you were “laid off” if you were actually fired for cause. A “lay off” occurs when an employer needs to reduce headcount because of adverse economic conditions. Workers are fired when, through their own fault, they do not fulfill the duties of the job. Unemployment benefits are available for those who were laid off but not for those fired.[2]

Advertisement -

3Check if you have to pay back the overpayment. Not all over payments must be paid back. In some cases, people who were overpaid due to non-fraud are not required to pay back excess benefits. Look at your notification letter and see if you have been accused of non-fraud. If so, you may not need to pay the excess benefits back.

- Individuals who received overpayment due to fraud, however, are required to pay back the overpayment and will also be assessed a penalty.

- The penalty is 30% of the overpayment amount. You also may be disqualified from receiving unemployment insurance benefits for five to 23 weeks.

-

4Review your unemployment insurance file. In California, you can request a copy of the file the agency maintains regarding your claim.[3] You should review the file to get a better understanding of why the EDD claims you were overpaid.

- For example, if the EDD alleges that you were overpaid due to fraud, then your file may contain notes that further explain what information the agency thinks is fraudulent. With this information, you can prepare yourself to explain the allegedly fraudulent information.

- Contact the EDD to request a paper copy of your file. You can visit the Ask EDD website and select “Unemployment Insurance Benefits” under Category. Then select “Other” under the sub-category and then “Print Out Claim” under Select a Topic. It should take 10 business days to receive your records.[4]

-

5Meet with an attorney. You may want to consult a lawyer to discuss the appeals process, especially if a lot of money is at stake. If you cannot afford a lawyer, then you may want to contact a legal aid organization in your area. Legal aid organizations provide free legal advice to people who cannot afford attorneys.

- To find a legal aid organization near you, visit this website and enter your zip code.

- You might also want to find an attorney who offers “unbundled” legal services. Under this arrangement, the attorney will perform discrete tasks (such as review your notice from the EDD or provide advice) often for a flat fee.

Preparing for Your Appeal

-

1Request an appeal. When you receive notice of overpayment, you will be given the option to either repay the overpayment or request an appeal. If you choose to appeal, you have 30 calendar days from the mailing of the notice to submit the appeal to the EDD.

- To request an appeal, fill out the “Appeal Form” found here.

- You need to provide basic personal information, such as your name, address, and contact information. You also must state why you disagree with the decision.[5] It is best to keep your explanation brief. You don’t want to say anything that could be used against you later.

- You may alternatively draft an appeal letter. The letter should contain your contact information, Social Security Number, and a brief statement explaining why you disagree with the EDD.[6]

-

2Come up with a defense. If you were charged an overpayment due to fraud, then you must prove at the hearing why your actions weren't fraudulent. You may also prove that overpayment did not occur. To overcome a fraud allegation, you must demonstrate each of the following:

- the overpayment was not due to fraud, misrepresentation, or willful omission

- the overpayment was received without any fault on your part

- it would be unfair for the EDD to force you to repay it.

-

3Gather evidence. At the hearing, you may bring evidence or witnesses to support your claims. Carefully review your notice letter and think creatively about the evidence you can present to support your appeal. For example:

- If you do not believe that you were overpaid, then you could bring financial documents reflecting the amount of benefits you were paid.

- If you are accused of fraud, then you can bring in evidence supporting the information provided to the EDD. A termination letter could show that you were, in fact, “laid off.” Pay stubs could also establish your rate of pay before being laid off.

- If it would be unfair for the EDD to force you to repay the benefits, then you should prepare detailed information about your financial obligations. Bring in utility bills, rent/mortgage payments, and other obligations to illustrate your expenses. Argue that you need the benefits otherwise you cannot pay your basic living expenses.[7]

- Sometimes the only evidence is your own testimony. For example, the EDD may claim you committed fraud by failing to report earnings or a disability, or that you claimed to have been “laid off” when you were actually fired. You will need to argue at the hearing that your misstatements were the result of mere oversight and not willful.[8]

-

4Review applicable laws and legal decisions. As part of your preparation, you should review the laws and legal decisions that may apply to your claim. The EDD organizes relevant statutes and legal decisions (called "precedent benefit decisions") and makes them available online.

- Precedent can be very helpful. You can search by topic. For example, if the EDD is accusing you of fraud, then you can search under “Types of Index: Subject” for “Fraud.” You can then read the relevant decisions. If any decision addresses an issue relevant to your case, then you should print it off and bring it with you to the hearing.

- You may also claim that you submitted false information negligently but not willfully. Accordingly, you might wish to look at the decisions under “Negligence” and see if the facts of your situation match the facts of the case. If so, you can bring this case to the attention of the judge at your hearing.

Attending Your Hearing

-

1Attend the hearing. The hearing will be held in front of an administrative law judge (ALJ). The judge will make introductory remarks and will turn on a recording device to make a record of the proceedings. In addition, the ALJ will provide an overview of the hearing process.

- A hearing is not a full trial. It is more informal. You should ask questions if you do not understand anything.

-

2Answer questions. The ALJ will ask you questions related to your unemployment insurance claim. You will have an opportunity to share your reasons why you should not be required to pay back the overpayment and why your actions were not fraudulent.

- If your employer attends, then they will have an opportunity to ask you questions related to the unemployment insurance claim.

- If you have witnesses with relevant information, you should inform the ALJ of that fact and ask if they can speak on your behalf.

-

3Wait for the decision. After your hearing, the EDD will send you a decision. The ALJ will state the facts of your case as well as the basis for the decision. If you disagree, you may appeal again. The letter you receive from the EDD should spell out how.

- If you want to appeal, do not wait. You will have only 30 days to submit an additional appeal.

-

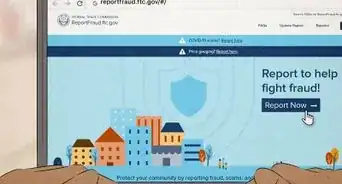

4Pay back the overpayment. If you ultimately agree to pay back any excess benefits, then you can pay back the money in a variety of ways.[9]

- You can make payment by phone. Call 1-888-272-9829. Choose option 3 and then enter jurisdiction code 1577. Follow the instructions. Pay using a debit or credit card.

- You can also pay online. Click on this website and select “State Payments.” Enter jurisdiction code 1577 and then select “California Employment Development Dept.” and then “Benefit Overpayment.” Pay with debit or credit card.

- You may also pay by mail. Send a personal check, cashier check, or money order. Make the check payable to EDD and write the Social Security Number on the check. Mail payments to:

- Employment Development Department, Attn: Cashier Benefit Recovery, P.O. Box 826806, Sacramento, CA 94206-0001.

Warnings

- If you do not repay the overpayment, then the agency can deduct the money owed from future unemployment or state insurance benefits. The EDD can also reduce or totally withhold your state income tax refunds, lottery winnings, or any other money the state owes you.⧼thumbs_response⧽

- The EDD may also file a claim against you in court, charge you for the cost of the suit, and then record a lien on your property.⧼thumbs_response⧽

References

- ↑ https://las-elc.org/factsheets/ui-overpayment.pdf

- ↑ https://las-elc.org/factsheets/ui-overpayment.pdf

- ↑ http://www.edd.ca.gov/unemployment/faq_-_contacting_ui.htm

- ↑ http://www.edd.ca.gov/unemployment/faq_-_contacting_ui.htm

- ↑ http://www.edd.ca.gov/pdf_pub_ctr/de1000m.pdf

- ↑ https://las-elc.org/factsheets/ui-overpayment.pdf

- ↑ https://las-elc.org/factsheets/ui-overpayment.pdf

- ↑ https://las-elc.org/factsheets/ui-overpayment.pdf

- ↑ http://www.edd.ca.gov/unemployment/How_to_Pay.htm