This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 82% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 93,137 times.

In accounting, intangible assets decrease in value over time and this value is calculated in a process called amortization. In the U.S., intangible assets are amortized while tangible assets are depreciated. This article will define what qualifies as an intangible asset and how it is amortized over time. Intangible assets are generally non-physical in nature. These include patents, copyrights, and intellectual property. However, goodwill or brand names, which are also intangible assets, are generally excluded because their useful life is indefinite.

Steps

Defining the Necessary Terms

-

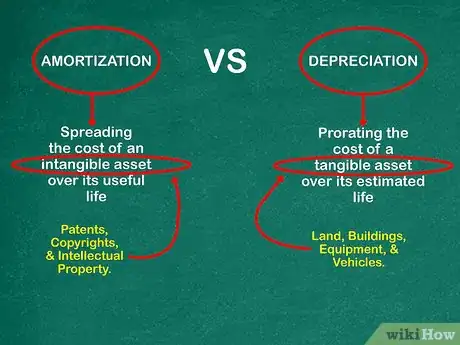

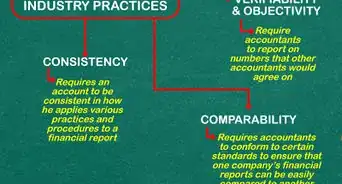

1Know the difference between amortization and depreciation. Amortization refers to spreading the cost of an intangible asset over its useful life. Depreciation refers to prorating the cost of a tangible asset over its estimated life.[1]

- Intangible assets include patents, copyrights, and intellectual property.

- Tangible assets include land, buildings, equipment, and vehicles.

-

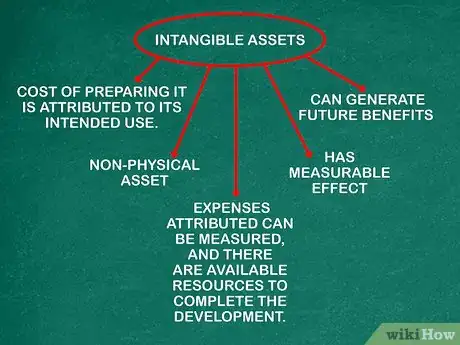

2Identify intangible assets. These records can usually be found in the company's legal department files. An intangible asset must meet the following criteria:

- It is a non-physical asset that has value to the company.

- It is an intangible asset that has measurable effect, such as cost (e.g. purchase price, taxes), that can benefit the company.

- The cost of preparing an intangible asset is attributed to the asset's intended use. For instance, an acquired patent is purchased for its intended use of protecting patent rights for an invention.

- Assets resulting from development are recognized as an intangible asset if the completion of the intangible asset will be used or sold, it can generate future benefits, the expenses attributed to the intangible asset can be measured, and there are available resources to complete the development.[2]

Advertisement -

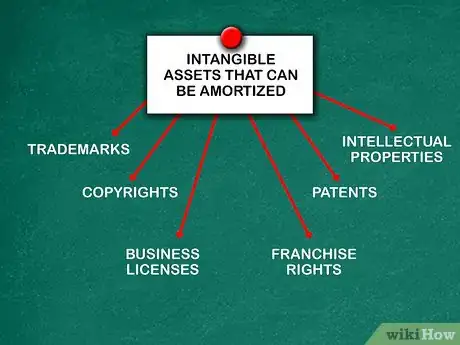

3List intangible assets that can be amortized. They must have a defined useful life. Common types of these intangible assets include the following:[3]

- Patents

- Copyrights

- Trademarks

- Intellectual Property

- Franchise rights

- Business licenses

-

4Omit intangible assets that cannot be amortized. This would be due to the asset not having a defined useful life. They generally include the following:[4]

- Goodwill (except for private companies)

- Brands

- Mastheads or Logos

- Publishing titles

- Customer lists

Amortizing Intangible Assets

-

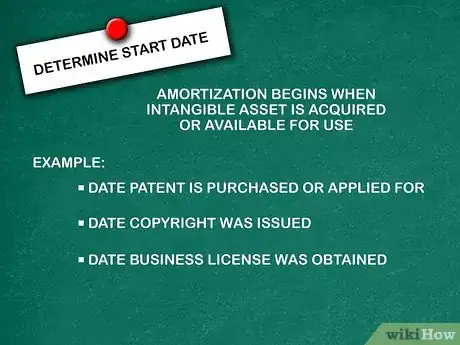

1Determine the start date. Amortization of intangible assets begins when the asset is acquired or when it is available for use. For example, this would be the date a patent was purchased or applied for, a copyright was issued or a business license was obtained.

-

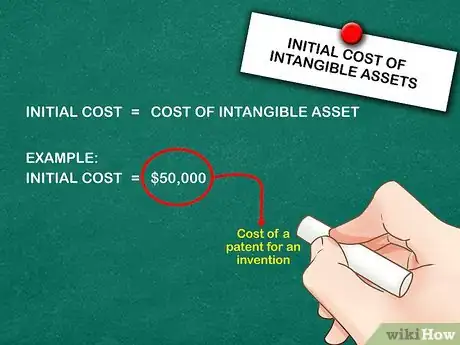

2Determine the initial cost of the intangible asset. As an example, assume that you bought a patent for an invention. It cost you $50,000 to buy the patent so this will be your initial cost.

- Costs cannot be accumulated for making the invention, but can be for applying for a patent.

-

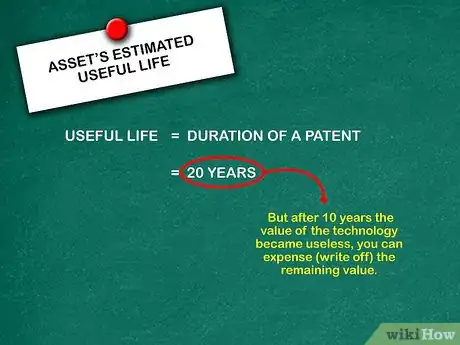

3Calculate the asset's estimated useful life. Using the same example, find out the duration of the patent. Let's say that your patent for an invention will be protected for 20 years, as stated when it was first granted. This will be the useful life.

- The useful life of a patent could change over time due to technological advances. If you assumed the patent was useful for 20 years, but after 10 years the value of the technology became useless, you can expense (write off) the remaining value.

-

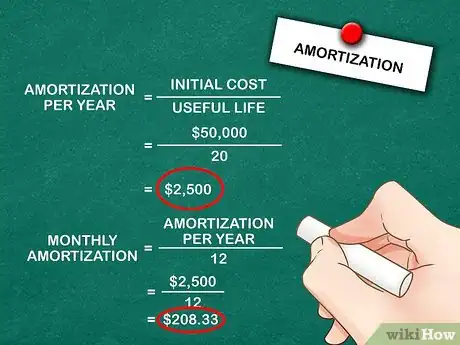

4Calculate the amortization per year. Use this formula: Initial cost / useful life = amortization per year. Therefore, $50,000 / 20 = $2,500.

- To calculate the monthly amortization amount, divide the yearly amount by 12.

Recording Amortization

-

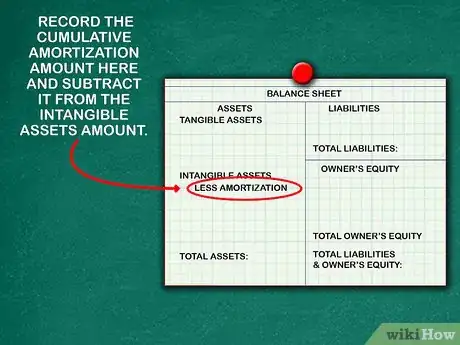

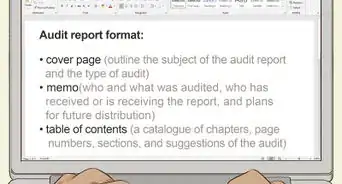

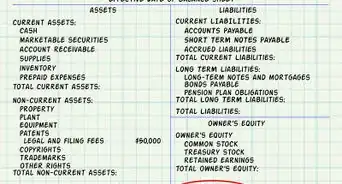

1Record the amortization amount on the company's balance sheet. There will be a line item on the balance sheet for intangible assets. A line under this will say "Less Amortization." Record the cumulative amortization amount here and subtract it from the intangible assets amount.

- The amount that is amortized per year goes on the income statement.

-

2Keep good records. It is important to keep all invoices, patent grants, business licenses, copyrights, trademarks and other intangible assets for at least seven years for future audit purposes. Note the dates that all were acquired and the cost for each.

-

3Don't undervalue intangible assets. This is especially true when a business is being sold. The importance placed on intellectual property, brand recognition, goodwill and trademarks is becoming even more valuable than tangible assets such as equipment and machinery.[5]

References

- ↑ http://www.accountingtools.com/intangible-assets-accounting

- ↑ http://www.accountingtools.com/intangible-assets-accounting

- ↑ http://www.investopedia.com/terms/a/amortization-of-intangibles.asp

- ↑ http://www.accountingtools.com/questions-and-answers/what-are-examples-of-intangible-assets.html

- ↑ http://www.entrepreneur.com/article/51628