Chapter 9

Reporting of Current and Contingent Liabilities

By Boundless

Current liabilities are usually settled with cash or other assets within a fiscal year or operating cycle, whichever period is longer.

Accounts payable is money owed by a business to its suppliers and creditors and typically shown on its balance sheet as a current liability.

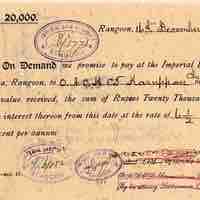

A note payable is a liability where one party makes an unconditional written promise to pay a specific sum of money to another.

The portion of long-term liabilities that must be paid in the coming 12-month period are classified as current liabilities.

Per FASB 6, current obligations that an enterprise intends and is able to refinance with long term debt have different reporting requirements.

Dividends are payments made by a corporation to its shareholders; the payment amount is reported as dividends payable on the balance sheet.

A deferred revenue is recognized when cash is received upfront for a product before delivery or for a service before rendering.

Other current liabilities reported on the balance sheet are sales tax, income tax, payroll, and customer advances (deferred revenue).

Current liabilities are reported first in the liability section of the balance sheet because they have first claim on company assets.

The balance sheet lists current liability accounts and their balances; the notes provide explanations for the balances, which are sometimes required.

Contingencies are reported as liabilities if it is probable they will incur a loss, and their amounts can be reasonably estimated.

The current ratio is a financial ratio that measures whether or not a firm has enough resources to pay its debts over the next 12 months.

The acid-test, or quick ratio, measures the ability of a company to use its near cash or quick assets to pay off its current liabilities.

Working capital is a financial metric that represents the operational liquidity of a business, organization, or other entity.