Definition of Promissory Note

A promissory note is a negotiable instrument, where one party (the maker or issuer) makes, under specific terms, an unconditional promise in writing to pay a determined sum of money to the other (the payee), either at a fixed or determinable future time or on demand by the payee. The terms of a note usually include the principal amount, interest rate (if applicable), parties involved, date, terms of repayment (which may include interest), and maturity date. Sometimes, provisions are included concerning the payee's rights in the event of a default, which may include foreclosure of the maker's assets. Demand promissory notes are notes that do not carry a specific maturity date, but are due on demand by the lender. Usually the lender will only give the borrower a few days notice before the payment is due. For loans between individuals, writing and signing a promissory note are often instrumental for tax and record keeping purposes .

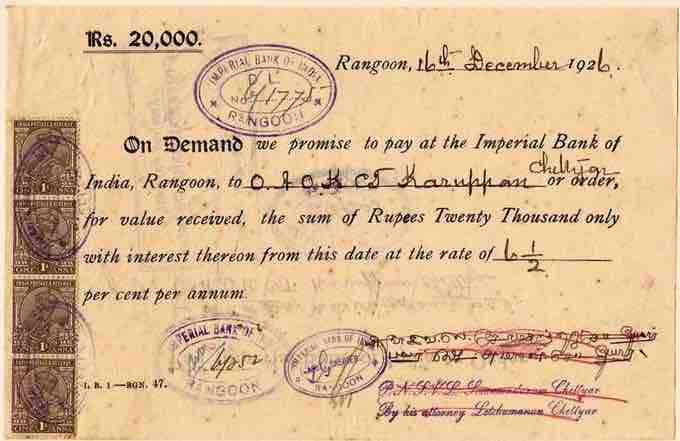

A 1926 promissory note from the Bank of India.

A promissory note due in less than a year is reported under current liabilities.

Accounting for Notes Payable

Negotiable promissory notes are used extensively in combination with mortgages in the financing of real estate transactions. Notes are also issued, along with commercial papers, to provide capital to businesses. When a note is signed and it becomes a binding agreement, a notes payable can be recorded to report the debt on the balance sheet. To report the note as a current liability it should be due within a 12-month period or current operating cycle, whichever is longer. The note payable amount can include the principal as well as the interest payment amounts due. If periodic payments are made throughout the term of the note, the payments will reduce the notes payable balance. It's important not to confuse a note with a loan contract, which is a legally distinct document from a note. It is non-negotiable, and does not include an unconditional promise to pay clause.