Definition of Long-Term Debt

Long-term liabilities are liabilities with a due date that extends over one year, such as a notes payable that matures in 2 years. In accounting, the long-term liabilities are shown on the right side of the balance sheet, along with the rest of the liability section, and their sources of funds are generally tied to capital assets. Examples of long-term liabilities are debentures, bonds, mortgage loans and other bank loans (it should be noted that not all bank loans are long term since not all are paid over a period greater than one year. ) Also long-term liabilities are a way for a company to show the existence of debt that can be paid in a time period longer than one year, a sign that the company is able to obtain long-term financing .

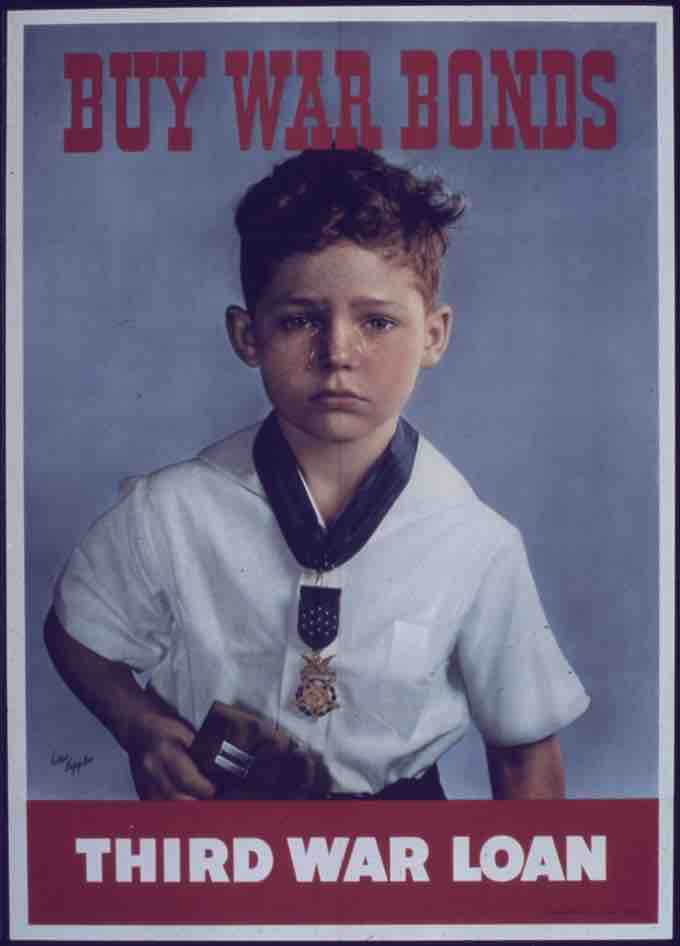

War bonds were used to support World War II.

Bonds are a form of long-term debt because they typically mature several years after their original issue date.

Long-Term Debt Due in the Current Period

The portion of long-term liabilities that must be paid in the coming 12-month period are classified as current liabilities. The portion of the liability considered "current" is moved from the long-term liabilities section to the current liabilities section. The position of where the debt should be disclosed is based on its maturity date in relation to the due date of other current liabilities. For example, a loan for which two payments of USD 1,000 are due--one in the next 12 months and the other after that date--would be split into one USD 1000 portion of the debt classified as a current liability, and the other USD 1000 as a long-term liability (note this example does not take into account any interest or discounting effects, which may be required depending on the accounting rules that may apply). If the current liability section already has an accounts payable account (balance which is usually paid off in 30 days), the current portion of the loan payable (due within 12 months) would be listed after accounts payable.