Chapter 5

Controlling and Reporting of Inventories

By Boundless

Inventory represents finished and unfinished goods which have not yet been sold by a company.

Most manufacturing organizations usually divide their "goods for sale" inventory into raw materials, work in process, and finished goods.

The cost of goods produced in the business should include all costs of production: parts, labor, and overhead.

Accounting techniques are used to manage assumptions of cost flows related to inventory and stock repurchases.

Inventory internal controls ensure that a company has sufficient resources to meet its customers' needs without having too much goods.

Perpetual inventory updates the quantities continuously and periodic inventory updates the amount only at specific times, such as year end.

There are three phases of a physical inventory: planning and preparation, execution, and analysis of results.

Measurement error leads to systematic errors in replenishment and inaccurate financial statements.

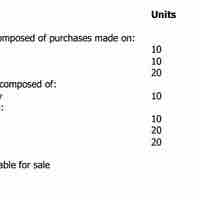

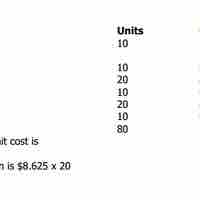

There are four accepted methods of costing items: specific identification; first-in, first-out; last-in, first-out; and weighted-average.

Specific identification is a method of finding out ending inventory cost that requires a detailed physical count.

Inventory cost flow assumptions (e.g., FIFO) are necessary to determine the cost of goods sold and ending inventory.

Under the Average Cost Method, It is assumed that the cost of inventory is based on the average cost of the goods available for sale during the period.

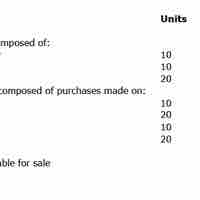

FIFO stands for "first-in, first-out," and assumes that the costs of the first goods purchased are charged to cost of goods sold.

LIFO stands for last-in, first-out, meaning that the most recently produced items are recorded as sold first.

The gross profit method uses the previous year's average gross profit margin to calculate the value of the inventory.

When selecting an inventory method, managers should look at the advantages and disadvantages of each.

The method a company uses to determine it cost of inventory (inventory valuation) directly impacts the financial statements.

The difference between the cost of an inventory calculated under the FIFO and LIFO methods is called the LIFO reserve.

If a company uses LIFO, the recorded amount of inventory is not an accurate reflection of cost, reducing comparability to companies using FIFO.

In law, liquidation is the process by which a company is brought to an end, and the assets and property of the company redistributed.

Dollar value LIFO (last-in, first-out) is calculated with all figures in dollar amounts, rather than inventory units.

Using LIFO accounting for inventory, a company generally pays lower taxes in periods of inflation.

LIFO is facing pressures from international standards boards that may result in its possible complete elimination.

In lower of cost or market (LCM), inventory items are written down to market value when the market value is less than the cost of the items.

For some companies, taking a physical inventory is impossible or impractical so the Retail Inventory Method is used to estimate.

Efficiency ratios for inventory measure how effectively a business uses its inventory resources.

The inventory method chosen will affect the amount of current assets and gross profit income statement, especially when prices are changing.

Inventory is an asset and its ending balance should be reported as a current asset on the balance sheet.

Inventory turnover is the measure of the number of times inventory is sold or used in a time period such as a year.

The difference between the cost of an inventory calculated under the FIFO and LIFO methods is called the LIFO reserve.