Definition of Inventory

Inventory represents finished and unfinished goods which have not yet been sold by a company. . Inventories are maintained as buffers to meet uncertainties in demand, supply, and movements of goods. These holdings are recorded in an accounting system .

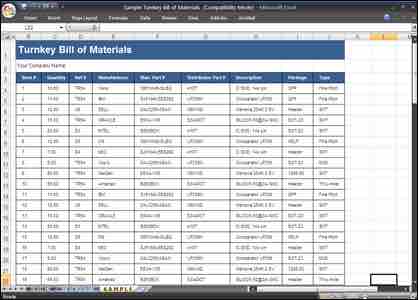

Inventory Template

Example of inventory template.

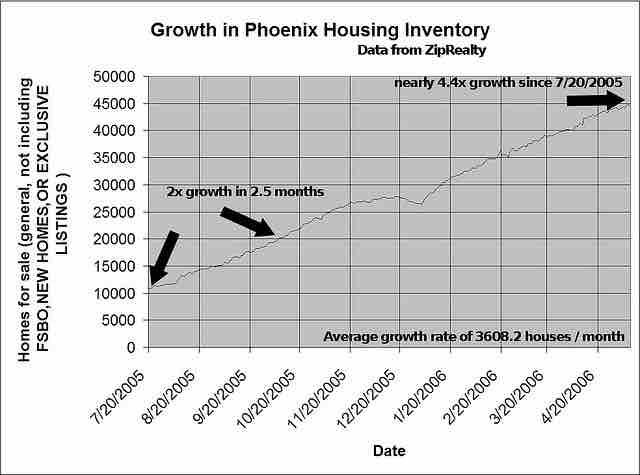

Housing inventory growth in Phoenix

There was an interesting comment on the housing bubble blog listing "available inventory", otherwise known as the number of houses currently for sale, in Phoenix. It listed the available inventory on a daily basis from 7/20/2006 to 5/9/2006 (up to the day it was posted! )Phoenix is one of the "hot" markets of the housing bubble, but certainly isn't the top of the list. Inventory run ups like this are being seen nation wide, and are leading to price reductions (if the seller is smart) and long waits to sell as bubble flippers all try to cash out at once.

Basic Inventory Accounting

An organization's inventory counts as a current asset on an organization's balance sheet because the organization can, in principle, turn it into cash by selling it. However, it ties up money that could serve for other purposes and requires additional expense for its protection. Inventory may also cause significant tax expenses, depending on particular countries' laws regarding depreciation of inventory, as in the case of Thor Power Tool Company v. Commissioner.

Inventory Systems

There are two principal systems for determining inventory quantities on hand: periodic and perpetual system.

The Periodic System

This system requires a physical count of goods on hand at the end of a period. A cost basis (i.e., FIFO, LIFO) is then applied to derive an inventory value. Because it is simple and requires records and adjustments mostly at the end of a period, it is widely used. It does lack some of the planning and control benefits of the perpetual system.

The Perpetual System

The perpetual system requires continuous recording of receipt and disbursement for every item of inventory. Most large manufacturing and merchandising companies use this system to ensure adequate supplies are on hand for production or sale, and to minimize costly machine shut-downs and customer complaints.

Inventory Costing

Inventory cost includes all expenditures relating to inventory acquisition, preparation, and readiness for sale, minus purchase discounts.

Rationale for Keeping Inventory:

- Time - The time lags present in the supply chain, from supplier to user at every stage, requires that you maintain certain amounts of inventory to use in this lead time. However, in practice, inventory is to be maintained for consumption during 'variations in lead time'. Lead time itself can be addressed by ordering that many days in advance.

- Uncertainty - Inventories are maintained as buffers to meet uncertainties in demand, supply and movements of goods.

- Economies of scale - Ideal condition of "one unit at a time at a place where a user needs it, when he needs it" principle tends to incur lots of costs in terms of logistics. So bulk buying, movement and storing brings in economies of scale, thus inventory.

Stages of Inventory:

- Raw materials - materials and components scheduled for use in making a product.

- Work in process, WIP - materials and components that have began their transformation to finished goods.

- Finished goods - goods ready for sale to customers.

- Goods for resale - returned goods that are salable.