Types of Accounting Methods

The merchandise inventory figure used by accountants depends on the quantity of inventory items and the cost of the items. There are four accepted methods of costing the items: (1) specific identification; (2) first-in, first-out (FIFO); (3) last-in, first-out (LIFO); and (4) weighted-average. Each method has advantages and disadvantages.

General Information

Specific identification is a method of finding out ending inventory cost. It requires a detailed physical count, so that the company knows exactly how many of each goods brought on specific dates remained at year-end inventory. When this information is found, the amount of goods is multiplied by their purchase cost at their purchase date, to get a number for the ending inventory cost.

In theory, this method is the best method because it relates the ending inventory goods directly to the specific price they were bought for. However, this method allows management to easily manipulate ending inventory cost, since they can choose to report that the cheaper goods were sold first, therefore increasing ending inventory cost and lowering cost of goods sold. This will increase the income.

Alternatively, management can choose to report lower income, to reduce the taxes they needed to pay. This method is also a very hard to use on interchangeable goods. For example, it is hard to relate shipping and storage costs to a specific inventory item. These numbers will need to be estimated and reducing the specific identification's benefit of being extremely specific.

Using Specific Identification

The specific identification method of inventory costing attaches the actual cost to an identifiable unit of product. Firms find this method easy to apply when purchasing and selling large inventory items such as cars. Under the specific identification method, the firm must identify each unit in inventory, unless it is unique, with a serial number or identification tag.

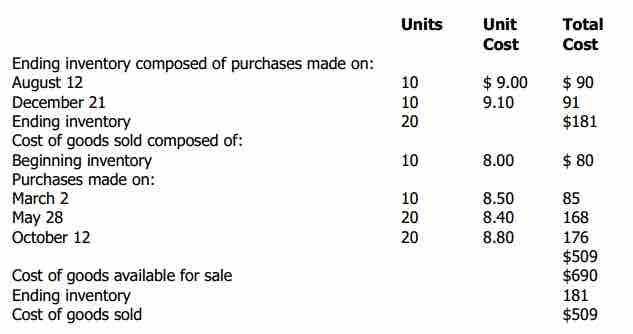

To illustrate, assume that the company in can identify the 20 units on hand at year-end as 10 units from the August 12 purchase and 10 units from the December 21 purchase. The company computes the ending inventory as shown in ; it subtracts the USD 181 ending inventory cost from the USD 690 cost of goods available for sale to obtain the USD 509 cost of goods sold. Note that you can also determine the cost of goods sold for the year by recording the cost of each unit sold. The USD 509 cost of goods sold is an expense on the income statement, and the USD 181 ending inventory is a current asset on the balance sheet. The specific identification costing method attaches cost to an identifiable unit of inventory. The method does not involve any assumptions about the flow of the costs as in the other inventory costing methods. Conceptually, the method matches the cost to the physical flow of the inventory and eliminates the emphasis on the timing of the cost determination. Therefore, periodic and perpetual inventory procedures produce the same results for the specific identification method.

Specific Identification

Determining ending inventory under specific identification