This article was co-authored by Supatra Tovar, PsyD, RD. Dr. Supatra Tovar is a Licensed Clinical Psychologist (PSY #31949), Registered Dietitian, Fitness Expert, and the Owner of Dr. Supatra Tovar and Associates. Dr. Tovar has worked in the fields of health education, clinical dietetics, and psychology. With over 25 years of holistic wellness experience, she practices Holistic Health Psychotherapy. She combines her psychology, diet, and fitness knowledge to help those struggling with depression, weight gain, eating disorders, life transitions, and relationships. Dr. Tovar holds a BA in Environmental Biology from The University of Colorado Boulder, an MS in Nutrition Science from California State University, Los Angeles, and a PsyD in Clinical Health Psychology from Alliant International University, Los Angeles.

There are 12 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 10,600 times.

You may binge spend as a way to cope with negative feelings, to feel excited, or because you lack impulse control. If you feel like your spending gets out of hand, it's time to work toward managing your money and your emotions differently. By focusing on short-term and long-term solutions, you can begin to change the thoughts and feelings that contribute to your binges.

Steps

Coping with Difficult Feelings

-

1Examine your behaviors and patterns. Binge spending is a compulsive behavior with many similarities to other types of addictive behavior. This spending may be in response to an emotional need or another mental health issue. To understand what the underlying causes might be, look out for the following behaviors:

- Low self-esteem or self-worth

- Hoarding

- Anxiety

- Depression

- Recklessness or impulsiveness

- Obsessive or compulsive disorders

- Perfectionism

-

2Pay attention to your emotions. Many people impulsively shop in response to negative emotions or a lack of self-awareness regarding emotions.[1] When you get the urge to spend, immediately confront your emotions. Did you just get some bad news? Are you feeling disappointed or low? Think about what feelings you were experiencing immediately before you got the urge to spend, and deal with those emotions before you start spending.

- Feelings of shame, hopelessness, or worthlessness can often trigger binge spending.

- While overspending can be a problem, there is likely an underlying emotional problem that is more to blame for your spending habits. Take a moment to acknowledge your emotions and how they contribute to your spending. You may want to take a walk or get some exercise instead of buying something.

Advertisement -

3Find healthy ways to deal with emotions. [2] One way to deal with negative emotions and feel healthier is to do daily relaxation. Thirty minutes of relaxation each day can help you manage depression, help stabilize your moods, and give you a healthy outlet for coping with daily difficulties.[3]

- Practice methods that make you feel good and that you enjoy doing daily. Check out yoga classes, qigong, tai chi, and meditation. Find something you like and stay consistent.

-

4Find an exciting hobby. Some people binge spend for the sense of excitement that comes with making big purchases.[4] If this is the case for you, find a different outlet that makes you feel excited. You may want to add a little excitement into your life. Do a hobby that is fun and exciting, like paragliding, mountain biking, or racing. If sports aren't your thing, try something else that's competitive and skillful, such as playing cards, chess, or other games.

- Don't turn to gambling as a means to excitement. You can become addicted to gambling and damage your finances.

-

5Talk to a therapist. If you're struggling with binge spending and cannot seem to get it under control no matter how hard you try, it may be time to speak with a professional. A therapist can help you work through your difficult feelings and develop ways to approach your challenges more effectively.[5]

- Binge spending is often used to help people cope with negative emotions. A therapist can help you deal with these underlying issues in a healthier way while providing you insight on how to stop this habit.

- Psychotherapy and mindfulness are often used by therapists to treat compulsive behaviors like binge spending. These will help give you more control over your impulses.

-

6Join a support group. Some support groups exist for people who have problems with spending. If you feel alone in your difficulties and don't know who to talk to, a support group can be a great place to meet others with similar challenges.[6] A support group can help you process and share your experience, connect with other people, share advice and recommendations, and remind you that you are not alone in your struggles.

- Check out if your community has a local branch of a national support group, such as Shopaholics Anonymous or Debtors Anonymous.

Challenging Your Impulses

-

1Slow down. Take a pause before you buy something. You may want to take three deep breaths before committing to buy an item. Perhaps you find spending to be so automatic that you forget it's become a habit or something you've stopped thinking about.[7]

- Pause and take a moment before impulsively buying something.

-

2Ask some questions. When you're about to buy something, ask yourself certain questions before going ahead with the purchase. Is this something you need? Can you live without it? Can you make a different choice that will add to longer satisfaction? What areas of your life will this purchase contribute to?[8]

- Asking questions helps you to take a moment to assess how the purchase will affect your life and what kind of impact it will have.

-

3Buy only items on your shopping list. When you go shopping, make a list beforehand. Then, when you are in the store, keep to your list and do not stray.[9] This will help you narrow down what you need as well as help keep your extra items in check. You may also feel accomplished in buying the things that you need.

- For example, if you go grocery shopping, buy only the items you need for the next few days. A new product may catch your eye, but if it's not on your list, skip it. If it stays in your mind, write it on your list for your next trip.

-

4Think first, act later. If you tend to binge spend, you likely act on your impulse, then feel guilty about your purchases and spending. Switch the script and get into a habit of thinking first, then acting. This will help curb the impulsivity of your purchases. For example, write a pros and cons list (either on paper or in your head) about the thing you want to buy. Think about how this potential purchase will affect you, both now and in the future.

- Before making your decision about the purchase, do things that bring you back into your rational mind. You may do some math problems, read, or problem solve something else to bring your thinking capacity to the forefront.

Making Personal Spending Changes

-

1Cope with your spending cravings. You may want to go and binge spend, yet take a moment to bring mindfulness to the forefront. Notice how your body feels around your desire to spend money. Instead of wishing for the desire to go away (or giving into the desire), replace this thought with the knowledge that your urge will subside.[10]

- For example, notice how your thoughts change to things you want to buy, and wanting to buy them now. Say to yourself, “I don't need this, and it won't bring me happiness. I know this urge will pass.”

-

2Start using a mandatory waiting period. If you see something you want to buy, wait a week before purchasing the item. This helps you to walk away, think about the item, and determine if it's something worth going back to buy. You may find that your desire to buy the item decreases or that you don't actually want the item in the first place.[11]

- This method can help you with impulse buys. By making a “rule” and sticking to it, you can include some structure to your spending habits and decrease your binges.

-

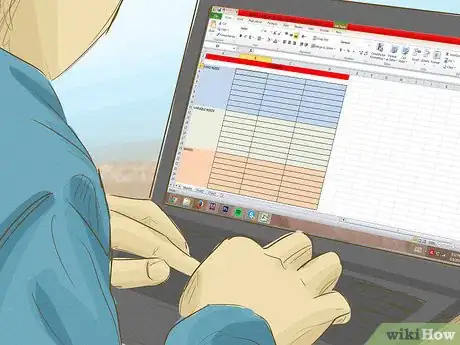

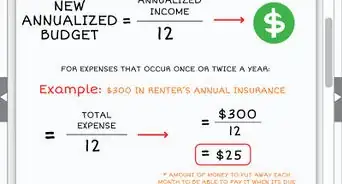

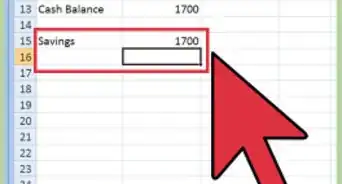

3Use a budget. Figure out what your needs are and aim to only spend your money on those things. Set aside money for necessities like groceries, living expenses, bills, and necessary items. You may also want to budget your money for entertainment (movies, restaurants, music) and social occasions. Having a budget makes you feel in control of your money and keeps you focused on your money goals.[12]

- Talking to a finance counselor or budgeting coach to help you learn how to set and stick to a budget. Reading books or free web resources can also help you learn healthy financial habits.

- You may also want to budget in “free money” which can be applied to anything you want that doesn't quite fit in the budget. This can help you feel like you have some leniency while also keeping your expenses under control.

- For example, you may put aside $40 each month as free money, and decide to spend it on something you want but don't need.

-

4Pay for all items in cash. Instead of paying for things on your credit card, move all of your spending to a cash system. If necessary, use your debit card, but know that your money is limited to what you have in the bank or in cash.[13]

- Once you run out of cash, this means that you cannot spend any more money, even if you find something you want. Refill your money each pay period.

-

5Keep a standard amount of things. If you want to buy something new, make a rule to get rid of one old thing in exchange. This can help you to declutter, but it can also raise your awareness to what you already have.[14]

- If you're not willing to part with one item, reconsider buying another one.

-

6Take a spending vacation. Choose one day each week (or one day each month) to not spend money. This can help you examine your spending habits and determine whether you really need the things you buy. This is also a good way to practice self-control regularly around money.[15] This break can help you determine what is important to spend money on and how to control your spending.

- Play around with what works for you. You may take a spending vacation one day each month, or work up to one week without spending.

Expert Q&A

-

QuestionHow do you stop binge spending?

Supatra Tovar, PsyD, RDDr. Supatra Tovar is a Licensed Clinical Psychologist (PSY #31949), Registered Dietitian, Fitness Expert, and the Owner of Dr. Supatra Tovar and Associates. Dr. Tovar has worked in the fields of health education, clinical dietetics, and psychology. With over 25 years of holistic wellness experience, she practices Holistic Health Psychotherapy. She combines her psychology, diet, and fitness knowledge to help those struggling with depression, weight gain, eating disorders, life transitions, and relationships. Dr. Tovar holds a BA in Environmental Biology from The University of Colorado Boulder, an MS in Nutrition Science from California State University, Los Angeles, and a PsyD in Clinical Health Psychology from Alliant International University, Los Angeles.

Supatra Tovar, PsyD, RDDr. Supatra Tovar is a Licensed Clinical Psychologist (PSY #31949), Registered Dietitian, Fitness Expert, and the Owner of Dr. Supatra Tovar and Associates. Dr. Tovar has worked in the fields of health education, clinical dietetics, and psychology. With over 25 years of holistic wellness experience, she practices Holistic Health Psychotherapy. She combines her psychology, diet, and fitness knowledge to help those struggling with depression, weight gain, eating disorders, life transitions, and relationships. Dr. Tovar holds a BA in Environmental Biology from The University of Colorado Boulder, an MS in Nutrition Science from California State University, Los Angeles, and a PsyD in Clinical Health Psychology from Alliant International University, Los Angeles.

Licensed Clinical Psychologist (PSY #31949), Registered Dietitian, & Fitness Expert Licensed Clinical Psychologist (PSY #31949), Registered Dietitian, & Fitness ExpertExpert AnswerFind some positive ways to fill that void. Addressing negative feelings can be hard, but you don’t have to face this alone. Talking to a trained psychotherapist can help you address emotional needs while providing you insight on how to stop this habit. If therapy isn’t an option, make a list of free things that help you feel better and try those when you are tempted to spend.

Licensed Clinical Psychologist (PSY #31949), Registered Dietitian, & Fitness ExpertExpert AnswerFind some positive ways to fill that void. Addressing negative feelings can be hard, but you don’t have to face this alone. Talking to a trained psychotherapist can help you address emotional needs while providing you insight on how to stop this habit. If therapy isn’t an option, make a list of free things that help you feel better and try those when you are tempted to spend.

References

- ↑ https://www.psychologytoday.com/blog/cant-buy-happiness/201308/what-can-be-done-help-compulsive-spending-habits

- ↑ http://www.everydayhealth.com/depression/how-i-stopped-compulsive-shopping.aspx

- ↑ http://www.helpguide.org/articles/bipolar-disorder/bipolar-support-and-self-help.htm#stress

- ↑ https://www.elementsbehavioralhealth.com/behavioral-process-addictions/spending-addiction/

- ↑ http://www.nhs.uk/conditions/stress-anxiety-depression/pages/benefits-of-talking-therapy.aspx

- ↑ http://www.mayoclinic.org/healthy-lifestyle/stress-management/in-depth/support-groups/art-20044655

- ↑ http://www.simplemindfulness.com/mindful-spending-the-happy-way-to-financial-freedom/

- ↑ http://www.simplemindfulness.com/mindful-spending-the-happy-way-to-financial-freedom/

- ↑ http://www.indiana.edu/~engs/hints/shop.html

- ↑ http://www.helpguide.org/harvard/benefits-of-mindfulness.htm

- ↑ http://www.aarp.org/money/budgeting-saving/info-10-2010/savings_challenge_tips_for_impulse_shopping.html

- ↑ http://www.budgetingincome.com/10-benefits-of-budgeting-your-money/

- ↑ http://www.indiana.edu/~engs/hints/shop.html

- ↑ http://www.aarp.org/money/budgeting-saving/info-10-2010/savings_challenge_tips_for_impulse_shopping.html

- ↑ http://www.forbes.com/sites/maggiemcgrath/2016/03/08/turbo-charge-your-finances-with-the-power-of-mindful-spending/#2bcafc823796

Medical Disclaimer

The content of this article is not intended to be a substitute for professional medical advice, examination, diagnosis, or treatment. You should always contact your doctor or other qualified healthcare professional before starting, changing, or stopping any kind of health treatment.

Read More...