This article was co-authored by Helena Ronis and by wikiHow staff writer, Jennifer Mueller, JD. Helena Ronis is Co-founder and CEO of AllFactors, a unified web analytics software to drive company's marketing and business growth. She has worked in product and marketing in the tech industry for over 8 years, and studied Digital Marketing & Analytics at the MIT Sloan School of Management Executive Program.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 1,288 times.

That dream investor you've been courting for months has finally taken the bait and agreed to a meeting. Now what? We're here to help you fine-tune your pitch so that it appeals directly to the investor you're meeting with. If you know you're well prepared, it's easy to exude the confidence and enthusiasm you need to secure those funds. Read on to learn everything you need to know to make sure your next meeting is a success.

Things You Should Know

- Tailor your pitch to specific investors based on their background and interests.

- Show investors your enthusiasm and passion for the product or service you've developed to solve a problem people have.

- Distinguish yourself from your competition by showing how your product or service better meets consumers' needs.

- Ask investors for the exact amount of money you need and make sure that the amount is realistic.

Steps

Research the background of investors you're meeting.

-

Learn all you can about the investor so you can tailor your pitch to them. Remember: investors are people too. Everything you can learn about them can potentially help you relate to them in some way. Even their personal hobbies and interests can help you find an angle that will get them interested in your product or service.[1] X Research source

- You've likely heard or read news stories that talk about a company "courting investors"—and that's really what this is. When you're looking for investors, focus on those who typically invest in companies similar to yours. Then, work on making a personal connection with those investors.

- For example, if you learn that one investor you're really interested in is passionate about breeding huskies, you could find a way to integrate the dogs into your pitch in some way—even if it's just as an impromptu mascot.

Analyze the market and your opportunity.

-

Show investors how your company can expand an existing market. When you can take a market that others have already built and make it even bigger, that's when investors will sit up and take notice. Think about how many other people have the problem that your product or service addresses and how you'll sell your solution to them.[2] X Research source

- For example, suppose you have a nutrition app. While there are lots of nutrition apps on the market, yours is the only one that allows users to scan any barcode to upload nutrition information from a food. This feature is sure to attract people who want to keep track of the food they eat but think it's a lot of work to do so.

- Also look at how easy it would be for you to penetrate the existing market. For example, if you're trying to enter a market that's heavily regulated, it might take you some time to gain traction. While you're cutting through red tape, you're also burning through money—something investors will be very aware of.

- On a mission to disrupt a big market? As sexy as it is to be a disruptor, a lot of investors will be leery because of the high risk. If you want to go this route, make sure you've done your homework and can prove that the market you're targeting is ripe for disruption.

Update your business plan.

-

Give investors a business plan that proves you've done your homework. Investors need to know the bottom line—how much money you need and what you're going to do with it. But they also want to know that you've analyzed the market and have a realistic vision of how to make your company succeed. Use your business plan to present the nitty-gritty details about your business, as well as your understanding of the market you plan to enter and the challenges you're likely to face.[3] X Trustworthy Source U.S. Small Business Administration U.S. government agency focused on supporting small businesses Go to source

- Include the specifics of your current financials along with your projections so investors have a clear picture of how your business is doing and what your needs are.

- If someone is going to invest in your business, they want to know that you're organized and prepared to hit the ground running—your business plan shows them that.[4] X Research source

Prepare your pitch deck.

-

A pitch deck is a 15-20 slide presentation to introduce your company. Typically, each slide covers a specific aspect of your business plan. Use graphics and images to spice it up and make it visually interesting, but keep your basic design consistent with the same fonts and background colors throughout. Send the pitch deck out to the investors you'll be meeting with at least a day or two before the meeting so they'll be prepared as well and have time to organize the questions they want to ask you.[5] X Research source Include slides that cover the following:

- Your vision or company mission

- Current traction

- Market opportunities

- Monetization/revenue potential

- Team members

- Competitor research

- What makes you different from competitors

Craft a story around your pitch deck.

-

Tell the investors the story of your business and how you got started. Investors want to see your passion for the product or service you're introducing, and your story is where that really comes through. Talk about your company's mission and what it means to you, how you assembled your team, and what everyone contributes to the product or service.[6] X Research source

- Personal details will really make your story stand out. Struggles you've faced and hardships you've overcome—either individually or as a team—show your strength and resolve.

- If the idea for your product or service came from a problem you personally had and wanted to resolve, talking about that is a great way to get investors to empathize with you.

- Keep in mind that a lot of investors have pretty short attention spans.[7] X Research source Use your story to keep them engaged, interested, and excited about your company.

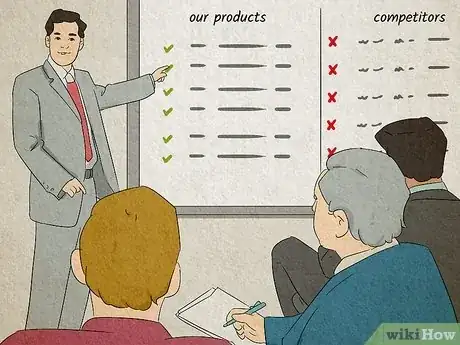

Show how your product does what competitors don't.

-

Highlight specific features that set you apart from your competition. No matter how unique or inventive you think your product or service is, you're sure to have competitors. Investors want to know that you've identified your key competitors and know the threats they pose and how you'll counter those threats or set yourself apart in the minds of consumers.[8] X Trustworthy Source U.S. Small Business Administration U.S. government agency focused on supporting small businesses Go to source

- Typically this means taking what competitors offer and tweaking it, not reinventing the wheel. Your product could be faster, more direct, more efficient, smaller or larger (depending on which is better for consumers), or more convenient.

- Use free government sources to get a lot of data and information about your competitors and the market you're trying to enter. They'll help you understand what aspects you should focus on if you want to find your competitive edge.

Anticipate questions investors will ask.

-

Practice so you can give a polished answer. A great way to do this is to make your pitch to a group of friends, then have them pepper you with hostile, rapid-fire questions. Do this several times, until you can answer even the toughest questions thrown at you without getting flustered.[9] X Research source

- When you're answering investors' questions, try to put yourself in their shoes. That will help you craft an answer that's more closely tailored to their interests in asking the question in the first place.[10] X Research source

- At the meeting, investors might also make suggestions of ways you could improve your product or service. Always remember to thank them and tell them you'll take it under advisement. They have years of experience and can give you some great ideas.

- Be really clear about what you know and what you don't. If you don't know something, don't just make it up—let the investor know that you don't have a good answer for that but you'll get back to them as soon as possible.[11] X Research source

Start the meeting with confidence.

-

Make eye contact and express genuine enthusiasm. Investors want to know that they can trust you—own your space and display confidence in yourself and your company. Enthusiasm is contagious! If you're excited, they'll get excited too. Listen when investors ask questions or make comments and find ways to incorporate those comments into your presentation, along with things you've learned about the investors from your research.[12] X Research source

- Perhaps the most important part about having a meeting with investors is making sure that meeting starts on time. It's okay if they're late, but if you're late, you've likely already lost your funding opportunity before you even make your pitch.

Pace yourself and leave time for interaction.

-

Treat the meeting more like a conversation than a presentation. These meetings typically last about 30 minutes, but that doesn't mean you want to have 30 minutes of you talking non-stop. Pepper your presentation with questions and interactive moments that promote an exchange between you and the investors you're meeting with.[13] X Research source

- If an investor asks you a question, stop and respond to it immediately—even if you're planning on covering it in more detail later. You can give a brief answer, then say, "I'll cover that in more detail in a moment; you've actually anticipated my next section."

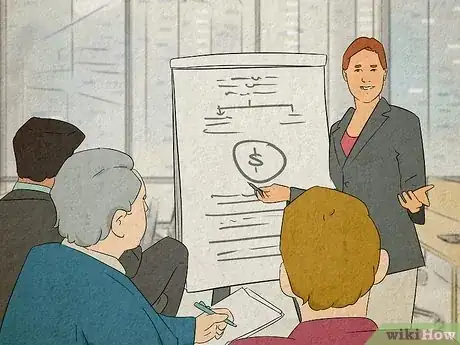

Share your financial documents.

-

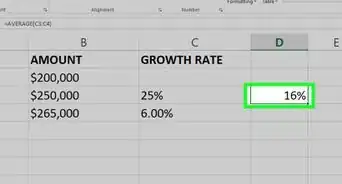

If your meeting is going well, investors will want to see the numbers. Prepare documents that lay out your company's revenue projections, operating expenses, and cash flow. All of these documents detail specifically when and how money comes in and out of your business.[14] X Research source

- A 4-year revenue projection is generally a good place to start. You might also want to include alternate projections and statements that analyze what might happen if your business grows at different rates or expands to different sectors or geographic regions.

- The most important thing here is that all of your documents are accurate and your projections are relatively conservative. If business finances aren't in your wheelhouse, hire an accountant to draw these documents up and explain them to you.

Ask for a specific amount of money.

-

Demonstrate that you know exactly how much money you need. Generally, the investors will know how much the things you want to do are going to cost—they want to know that you do too. If you present a lowball number, they're more likely to think that you're being unrealistic and don't have a good understanding of the costs involved.[15] X Research source

- Don't be afraid to ask for what you need! If an investor can't meet your whole need, they'll let you know—but they might still want to offer you something.

- Typically, investors are more interested in a realistic, well-planned budget that shows you understand what your expenses will be every step of the way.

- To see this more easily from the investor's perspective, imagine a friend tells you they're going to buy a brand-new car for $500. You know this is ridiculous—you can't buy a brand-new car for such a low price. This is how investors feel when start-ups claim they only need a small amount of funding.

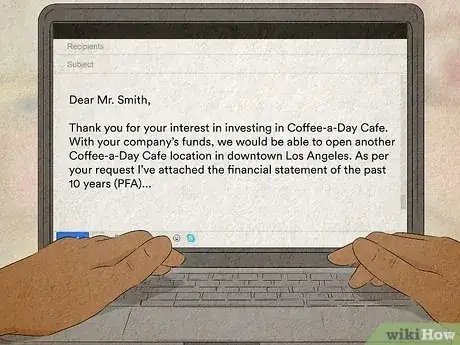

Provide any requested information as soon as possible.

-

Follow up within a day or two of the meeting. Hopefully, you'll know the answers to most questions you're asked during the meeting, but it's not a dealbreaker if you don't as long as you can follow up quickly. Send them an email reminding them of the context in which they asked for the information, then provide them with the information they needed. Close your email by letting them know that you appreciated them meeting with you and look forward to hearing from them.[16] X Research source

- It's also a good idea to shoot investors an email immediately after the meeting. Thank them for their time, mention something they said that really struck you, and let them know they shouldn't hesitate to reach out to you if they have any further questions.

You Might Also Like

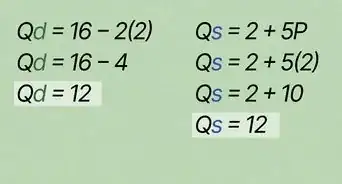

How to Find Equilibrium Quantity

How to Find Equilibrium Quantity

References

- ↑ https://fi.co/insight/6-things-you-should-do-before-meeting-an-investor

- ↑ https://www.nfx.com/post/how-vcs-decide-to-take-a-first-meeting-12-reasons

- ↑ https://www.sba.gov/business-guide/plan-your-business/write-your-business-plan

- ↑ https://fi.co/insight/6-things-you-should-do-before-meeting-an-investor

- ↑ https://www.fundable.com/learn/resources/guides/investor/what-to-prepare-before-you-pitch

- ↑ https://fi.co/insight/6-things-you-should-do-before-meeting-an-investor

- ↑ https://www.fundable.com/learn/resources/guides/investor/what-to-prepare-before-you-pitch

- ↑ https://www.sba.gov/business-guide/plan-your-business/market-research-competitive-analysis

- ↑ https://fi.co/insight/6-things-you-should-do-before-meeting-an-investor

- ↑ https://www.eci.com/blog/29-how-to-prepare-for-investor-meetings-hedge-fund-communications-part-two.html

- ↑ https://www.nfx.com/post/how-vcs-decide-to-take-a-first-meeting-12-reasons

- ↑ https://www.inc.com/christina-desmarais/10-executive-tips-on-how-to-make-a-lasting-first-impression.html

- ↑ https://www.eci.com/blog/29-how-to-prepare-for-investor-meetings-hedge-fund-communications-part-two.html

- ↑ https://www.fundable.com/learn/resources/guides/investor/what-to-prepare-before-you-pitch

- ↑ https://fi.co/insight/6-things-you-should-do-before-meeting-an-investor

- ↑ https://www.nfx.com/post/how-vcs-decide-to-take-a-first-meeting-12-reasons

About This Article