This article was co-authored by Darron Kendrick, CPA, MA and by wikiHow staff writer, Jennifer Mueller, JD. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 21,516 times.

If you've already filed your federal taxes separately, or if you are only filing a state tax return for whatever reason, you have 3 basic methods for doing so. You can file your return directly with your state's department of revenue by completing a paper form and mailing it in. Most states also allow you to file your return online through the state department of revenue's website. If you use commercial tax preparation software or an online tax preparation service, you must first fill out your federal return to file your state return.

Steps

Using Tax Preparation Software

-

1Create an account if you haven't already. If you're new to tax preparation software, you must open an account to use the software to file your taxes. If you have a relatively low income, you may qualify to use commercial tax preparation software, such as TurboTax or H&R Block, for free.[1]

- To create your account, you'll have to answer a few basic questions to confirm your identity.

- If you've previously used a tax preparation service and move to the free file version, you may have to create a new account. That would mean your tax information from previous years would not be imported.

-

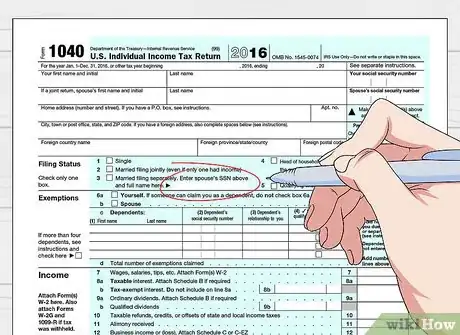

2Complete your federal return. If you want to e-file only your state taxes using tax preparation software, you must first go through the motions of completing your federal return. This is because the tax preparation software uses information from your federal return to complete your state return. You can't do your state return first.

- You don't have to actually file your federal return, but you do have to provide the information.

- Before you start working on your returns, make sure you have all the documents you'll need with information about your employer, your income, and any other sources of income you received through the year.

- Most states model their tax system closely on the IRS rules, which is part of the reason that tax software is designed to process federal and state returns together and in order.

Advertisement -

3Select your state. Once you complete your federal return, the tax preparation software gives you the option of selecting the state for which you want to prepare and file a tax return. It may already have a state selected as a default based on the personal information you provided for your federal return.[2]

- If you lived in more than 1 state during the year, confirm that you can still use the software to file your returns. Some online tax preparation services only support full-year resident state tax returns.

-

4Verify the information on your state return. Based on the information you provided on your federal return, the tax preparation software will already have done most of the work for you in filling out your state return.[3]

- Double-check the numbers entered for wages and other income and make sure they're correct.

- Check your W-2 or other income documents to enter the amount of state tax taken out of your paychecks throughout the year.

-

5File your state return. Once your state return is complete, the tax preparation software will give you the option to file either your federal return, your state return, or both. On this screen, you can select and file only your state return.

- If you owe state taxes, the tax preparation software will give you payment options. You may have to pay a processing fee if you pay using a credit or debit card.

- On the other hand, if you're owed a refund, you will have the opportunity to enter your bank account information so your refund can be direct-deposited into your account. You may also choose to have a paper check mailed to you.

Filing through the State Website

-

1Find the website for your state's department of revenue. Each state has a department of revenue responsible for collecting individual income taxes. The name of the department may differ depending on the state you live in.[4]

- The website will have information on contacting the department and filing your taxes, as well as instructions and tips on how to fill out the correct forms.

- TurboTax has a list of the department of revenue websites for all states available at https://ttlc.intuit.com/questions/1901670-how-do-i-contact-my-state-department-of-revenue. Simply click your state to be taken to the website.

-

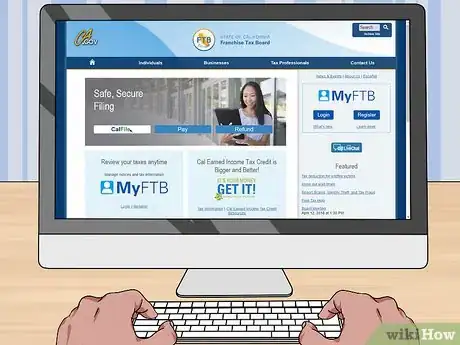

2Register with your state's e-filing service. Many states allow you to file your taxes online through the website of the state department of revenue. If your state has this option available, you may have to first create an online account and verify your identity.[5]

- Look for a link on the website of the state's department of revenue to "e-file" your taxes, or file your taxes online. You'll typically start under an "individual" tab, then look for "filing" or similar.

- If you own your own business and operate it as a sole proprietorship, you're still filing individual taxes rather than business taxes.

- Once you've created an account, you can file your taxes directly with your state's department of revenue for free. However, unlike tax preparation software, the website typically won't walk you through the forms. Only choose this option if you're comfortable filling in tax forms directly.

-

3Complete your return. Your state's department of revenue will have PDF versions of the forms needed to file your state taxes. Typically you can fill these forms in online, but you may have to download them if you want to save your progress.[6]

- Enter your personal information and income. In most cases, you will need to enter your adjusted gross income from your federal return.

- If you haven't completed a federal return, you'll need to do that before you do your state returns. You can get a copy of the federal return to fill out online at https://www.irs.gov/forms-instructions.

-

4Choose your payment method. If you owe state taxes, you typically have several methods available to pay when you file your state taxes online. Some methods, such as using a credit or debit card, may require you to pay additional fees.

- If you can't pay all the taxes you owe due to financial hardship, you may be able to apply for an installment agreement. This agreement may be subject to additional fees or interest until your taxes are paid in full.

- On the other hand, if you're due a refund, you can enter your bank account information to have that money direct-deposited to your account. You may also have the option of receiving a paper check in the mail from your state's department of revenue.

-

5Submit your return. Once you've completed your return, use your state's e-file system to submit the return along with payment or bank account information. Each state has its own process for electronic submission of state tax returns.

- Depending on how your state's e-file system is set up, you may have to print your return and sign it. You would then need to scan the signed form to submit it electronically.

- Some states have a process for you to sign your return electronically using a unique PIN you select to identify yourself.

- In most cases, you will not need to mail any documents to your state's department of revenue if you e-file your taxes.

Mailing Paper Forms

-

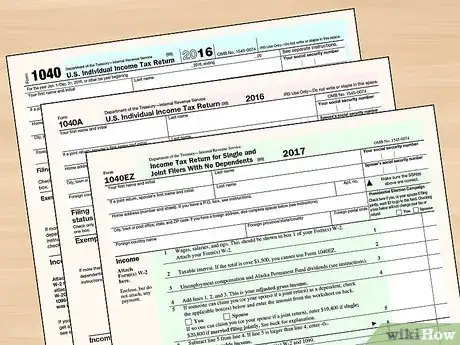

1Download the forms online. The website for your state's department of revenue will have tax forms available for download. The forms are in PDF format, so you'll need Adobe Reader software to view the forms.[7]

- Look for forms on the website for your state's department of revenue. TurboTax provides a list of forms for each state at https://turbotax.intuit.com/tax-tips/irs-tax-forms/2017-tax-forms-for-federal-and-state-taxes/L5zRNtLqo that you can use. Just click on the name of your state.

-

2Pick up paper forms in person. If you want to pick up paper forms, you may have to do a little hunting. Some states still have paper tax forms available at post offices. You can also go to your nearest public library and pick up or make copies of forms there.[8]

- You may also be able to call your state's department of revenue and have the forms mailed to you.

-

3Complete your return. Gather the documents that you need to provide your income and other information. You typically need the figure for your adjusted gross income from your federal tax return as well.[9]

- If you haven't yet completed your federal tax return, you can download a copy of the tax return form at https://www.irs.gov/forms-instructions and use it to calculate your adjusted gross income.

- Fill in the form completely and legibly using blue or black ink. You may want to fill out the form in pencil first, in case you make mistakes. Then you can go over the pencil in ink.

-

4Mail your return by the deadline. Look on the form, or the instructions to the form, to find the address you need to use to submit your return to your state's department of revenue. You may have to use a different address depending on whether you are paying taxes or are owed a refund.[10]

- Before you mail your return, make sure you remembered to sign and date it. After you sign it, make a copy of it for your records.

- Most states only require your returns to be post-marked by the deadline, rather than received. You may want to double-check, though, especially if you're cutting it close.

References

- ↑ https://www.tax.virginia.gov/free-file

- ↑ https://www.esmarttax.com/support/faq-state-returns/

- ↑ https://www.esmarttax.com/support/faq-state-returns/

- ↑ https://ttlc.intuit.com/questions/1901670-how-do-i-contact-my-state-department-of-revenue

- ↑ https://www.ftb.ca.gov/online/calfile/index.asp

- ↑ https://www.tax.virginia.gov/sites/default/files/taxforms/individual-income-tax/2017/760-2017.pdf

- ↑ https://turbotax.intuit.com/tax-tips/irs-tax-forms/2017-tax-forms-for-federal-and-state-taxes/L5zRNtLqo

- ↑ https://revenue.delaware.gov/information/paper_forms.shtml

- ↑ https://www.tax.virginia.gov/sites/default/files/taxforms/individual-income-tax/2017/760-2017.pdf