This article was co-authored by Trent Larsen, CFP® and by wikiHow staff writer, Amy Bobinger. Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

There are 9 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 11 testimonials and 100% of readers who voted found it helpful, earning it our reader-approved status.

This article has been viewed 359,768 times.

Making a budget is a great way to get a handle on where your money is going, and it can also help you free up extra cash. To get started, take a good look at your spending habits and see whether there are any areas where you could cut back. There are a number of different methods for budgeting, and some are more hands-on than others, so experiment with a few until you find the one that's right for you!

Steps

Tracking Your Expenses

-

1Use labels in your banking app to keep up with your spending. If you use online banking, it can sometimes be easy to spend money without thinking much about where it's going. If your banking app has a labeling feature, create different categories of expenses. Then, add a tag each time you spend anything. At the end of the month, you'll have an easy-to-understand breakdown of where all your money went.[1]

- For instance, you might list categories like, "Dining Out," "Clothing," "Utilities and Bills," "Entertainment," and "Groceries".

- If your banking app doesn't offer this feature, you could print out your statements each month and label them, or you could use a third-party app to help track your spending.

- Quicken, Mint, YNAB, AceMoney, and BudgetPlus are all third-party apps that offer budgeting services.

-

2Divide your money into envelopes to help keep cash payments organized. The envelope budgeting system involves splitting your money between different envelopes, each with a designated spending category. Put the money you've budgeted for each category into its corresponding envelope. Then, only use the money from each envelope for its intended purpose. That way, you'll know exactly how much you're spending, and it will be easier to stay on budget.[2]

- For instance, you might put $100 a week into an envelope labeled "Groceries" and $20 into one labeled "Gas." Then, you'd take the "Groceries" envelope with you when you're buying food and the "Gas" envelope when it's time to fill up your vehicle.

- If you pay your bills online, you can still use the envelope method for controlling your spending money.

- Don't borrow from one envelope if you overspend from another—otherwise, you may find yourself running short at the end of the month. However, if you regularly find yourself running out of money in a certain category, you may need to add more money to that envelope at the beginning of the next month.

Advertisement -

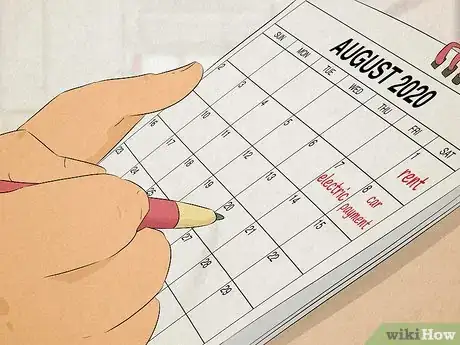

3Use a calendar to track your bills if you need the extra reminder. Sometimes it can be hard to juggle all of the different bills and payments you have due. Write each of your bills on their due date in your calendar, along with their average amount. Then, check the calendar regularly so you don't forget when you have something due.[3]

- As a bonus, this approach can help save you from getting hit with costly penalties and late fees.

- You can use a physical calendar if you'd like, or you can use a calendar app on your phone or tablet.

Divvying Up Your Money

-

1Pay your bills first, then use what's left for extras. To ensure you don't accidentally spend your bill money on things like going out with your friend, it's a good idea to pay your bills as soon as you get your paycheck. Then, you can divide whatever's left between your savings and your other expenses.

- If you pay your bills online automatically, consider depositing your bill money into a separate account every time you get paid. That way, the money will already be there when it's time for the bill to come out, and you won't have to worry about accidentally spending too much.

-

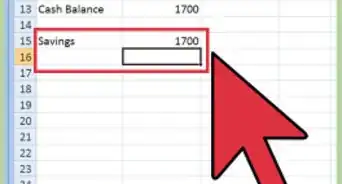

2Put some of your extra money into savings each month. Part of being financially healthy involves having savings set aside for things like emergencies and large expenses. As you plan out your budget, be sure to include a little money out of each paycheck to grow your savings. It can help to have this money automatically deducted and moved into a savings account, since you'll be less likely to miss the money if you never see it.[4]

- Ideally, you should eventually have about 3-6 months' worth of expenses saved, but it's okay if you need to set a smaller goal at first. For instance, you might start by saving $20 out of every paycheck, or you might set a goal of saving $500 by the end of the year.

- Keep your savings somewhere separate from your spending money. For instance, you might open a savings account with your bank, or if you prefer to keep your cash in savings, you might keep it in an envelope that's locked in a safe.

- It's recommended that you have 3-6 months' worth of expenses in your emergency savings. You don't necessarily have to save that all at once, but over time, if you save into it, you'll be able to cover your expenses if you lose your job or run into another emergency.[5]

-

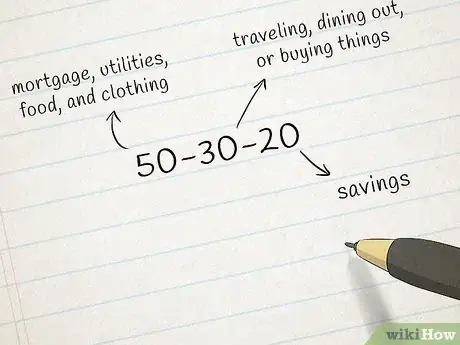

3Try the 50-30-20 method for an easy way to divide up your spending. In the 50-30-20 method, you start by figuring out your income. Then, you split it up so 50% goes towards your basic needs, like your rent or mortgage, utilities, food, and clothing. Another 30% can go toward the things you want, like traveling, dining out, or buying things that aren't strictly necessary. Then, 20% will go into your savings.[6]

- After you have emergency savings built, the extra money you put into savings can go toward bigger expenses like trips, new appliances, a vehicle, as well as long-term goals like your children's education or your retirement.

- If you don't really want to spend much time tracking your spending, you could also try the 80-20 method, where you put aside 20% of your income into savings, then spend the other 80% to cover all of your bills and personal expenses.

- Of course, if you can't pay all of your bills with 50% of your income, you'll have to adjust your percentages based on what you can afford.

-

4Use value-based budgeting to match your spending to your priorities. In value-based budgeting, you divide up your money based on what's really important to you. That doesn't necessarily mean that you're only spending money on the fun stuff—your biggest priorities might be paying off your car, keeping the lights on, and making your rent on time every month. However, you can also allocate some money each month to other goals that really matter to you, like taking trips to see new places or having a nice wardrobe.

- Remember, you'll probably have to cut back on other areas that don't matter as much. For instance, you might have to do without snacks at the gas station to afford the new designer purse you've been wanting. If a situation like that comes up, remind yourself of your bigger goals, and learn to say no, even when it's hard![7]

Building a Basic Budget

-

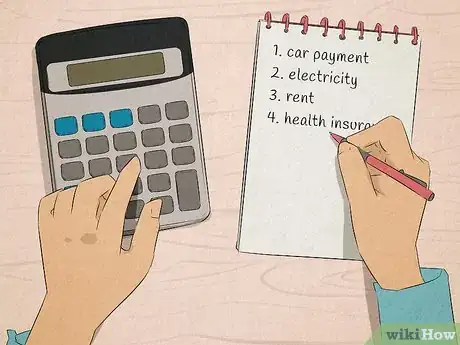

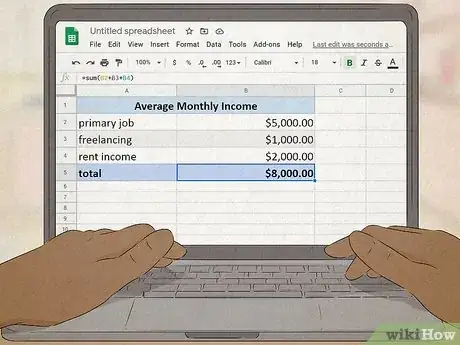

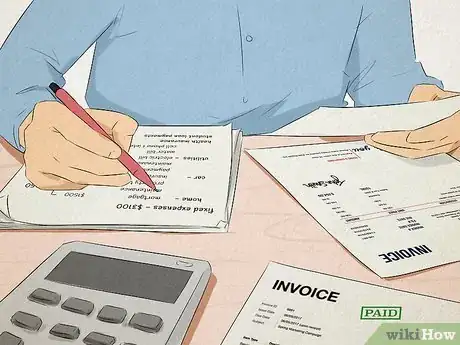

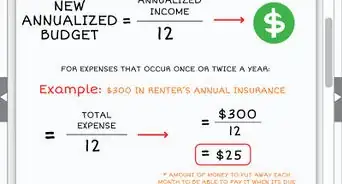

1Calculate all of your expenses and your income. Before you can start planning how you should spend your money, you have to understand where it's actually going right now. Start by writing down all of the money that you bring in every month after taxes and other deductions. Then, read over your credit card and bank statements and write down everything that you spend money on each month.[8]

- Your income might include money from your primary job, a side hustle like babysitting or freelancing, financial assistance from your parents, or money that your spouse earns if you're married. You can find this information by looking at your pay stubs or by calculating your average monthly income for the previous year.

- Your expenses include all of your major bills, such as your rent or mortgage, car note, insurance, childcare, debt repayment, phone and internet bills, and utilities. In addition, you have expenses that may change each month, like your average grocery bill, gas, medical care, and clothing.

- Try using this worksheet to make it easier to total up your expenses: https://www.consumer.gov/content/make-budget-worksheet.

-

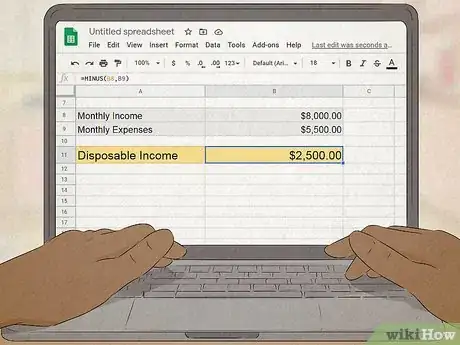

2Subtract your expenses from your income to get a working budget. Everyone's budget is different, and you'll be most likely to stick to a spending plan if you build it based on how you actually spend money, rather than someone else's ideal budget. Take the number you got when you totaled up all of your income. Then, subtract the number from adding up all of your expenses.[9]

- If the number you get is positive, that means you already have money left over in your budget every month! You may not need to make any changes at all, unless you'd like to reprioritize your spending.

- If you get a negative number, you're spending more than you earn each month. You'll probably need to take a serious look at where your money is going to figure out where you can save.

- If the number you get is 0, that means you're spending exactly what you make. If you're happy with the way your money is allocated, you don't have to make any adjustments to your budget: this is called zero-based budgeting.[10]

-

3Track your spending to see how well you stick to your budget. Once you set your spending limits, monitor your purchases to make sure you're meeting your goals. If you notice that you're regularly overspending in a certain area, you may need to adjust that spending limit each month, or you might need to take additional steps to cut back on your spending.[11]

- Don't think of budgeting as a one-time thing, but as something that will become an ongoing process. That way, it will be easy to make adjustments whenever you need to.

- When you understand where your money is going, it will be easier to understand whether your spending lines up with your priorities. For instance, if you really enjoy going out to restaurants and bars, you may still be able to afford to do that if you cut back in another area.[12]

-

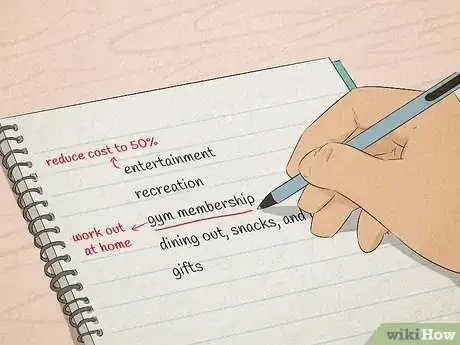

4Make small adjustments to your budget by setting spending limits. Once you have a clear picture of how you're spending your money, look for any areas where you think it would be easy to cut back. Then, set spending limits for yourself to ensure you don't accidentally spend too much. However, unless you're wildly overspending, you probably don't need to make huge, sweeping changes to your budget, especially at first—even small cuts can really start to add up. [13]

- It's usually easiest to cut back on discretionary spending, like eating out, buying new clothes, and going to concerts and movies. However, if you've already cut back on those areas, you may be able to save more by shopping around for better deals on bills like your insurance or cell phone plan.

- Being on a budget doesn't mean you can never treat yourself—it just means that you're planning out how you'll spend your money so you can really enjoy what you get without overspending.

Expert Q&A

-

QuestionHow do you save money each month?

Trent Larsen, CFP®Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

Trent Larsen, CFP®Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

Certified Financial Planner Save money by comparison shopping. Compare different items before you buy them, rather than just buying the first thing you see. Weigh the pros and cons of each choice to make sure you really get the best value for what you spend.

Save money by comparison shopping. Compare different items before you buy them, rather than just buying the first thing you see. Weigh the pros and cons of each choice to make sure you really get the best value for what you spend. -

QuestionHow do I modify my budget?

Trent Larsen, CFP®Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

Trent Larsen, CFP®Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

Certified Financial Planner It's really important to understand what you're currently spending. That way, you'll be able to identify the areas where you can decrease your spending, which will help you save more in the long run.

It's really important to understand what you're currently spending. That way, you'll be able to identify the areas where you can decrease your spending, which will help you save more in the long run.

References

- ↑ https://www.smartaboutmoney.org/Topics/Spending-and-Borrowing/Control-Spending/Mobile-Banking-Apps-Help-Track-Spending

- ↑ https://www.abc.net.au/news/2019-04-01/struggle-with-budgets-you-could-try-one-of-these-three-methods/10955990

- ↑ https://www.abc.net.au/news/2019-04-01/struggle-with-budgets-you-could-try-one-of-these-three-methods/10955990

- ↑ https://www.consumer.gov/articles/1002-making-budget#!what-to-know

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ https://ylai.state.gov/top-4-budgeting-methods-to-try/

- ↑ https://ylai.state.gov/top-4-budgeting-methods-to-try/

- ↑ https://www.consumer.gov/articles/1002-making-budget#!what-to-know

- ↑ https://www.consumer.gov/articles/1002-making-budget#!what-to-know

- ↑ https://ylai.state.gov/top-4-budgeting-methods-to-try/

- ↑ https://www.forbes.com/advisor/personal-finance/how-to-budget-simple-steps/

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ https://www.forbes.com/advisor/personal-finance/how-to-budget-simple-steps/

About This Article

To do a monthly budget, start by calculating your monthly income and fixed expenses, like your rent, debt payments, and groceries. Enter this data into a spreadsheet to keep yourself organized, and use receipts or bank statements to figure out how much you usually spend. Then, calculate your other monthly expenditures, like the amount you spend on entertainment. Subtract your expenses from your income to see how much money you have left over each month. If you don't have any money left over, you'll need to cut expenses or increase your income if you plan to save. For tips on saving money, see our Financial reviewer's advice below.