This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 43,386 times.

If you owe money to the IRS, you typically will receive a notice with the amount you owe. You can also check your balance by requesting a transcript, which gives you more detail than a notice would. If you can't pay your balance in full, you can set up an online payment agreement to avoid additional fees and penalties. When you enter the agreement, you'll create an online account that enables you to check your balance at any time.[1]

Steps

Checking by Phone, Mail, or Online

-

1Gather information from your tax returns. To order a tax transcript, you'll need your Social Security number or other tax identification number, your date of birth, and the mailing address you entered on your most recent tax return.[2]

- If you filed more than one tax return, such as one for yourself and one for your business, make sure you're using the tax ID number associated with the transcript you want.

- The IRS never charges a fee for transcripts, so you don't have to worry about a method of payment.

-

2Call the IRS to request a transcript by phone. The IRS has a toll-free number that is dedicated exclusively to transcript requests. The automated system walks you through the steps to provide the necessary information and file your request.[3]

- To request a transcript by phone, call 1-800-908-9946. This is an automated system, so it is available 24/7.

Advertisement -

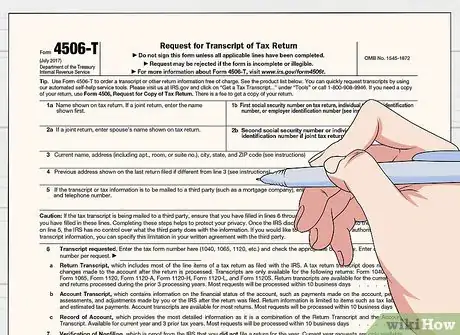

3Complete IRS Form 4506-T to request a transcript by mail. You can download a copy of the form at https://www.irs.gov/pub/irs-pdf/f4506t.pdf. This copy is a fillable PDF that you can complete on your computer, print, and mail to the IRS.[4]

- Check the instructions page following the form to get the address where you should mail the form once you complete it.

-

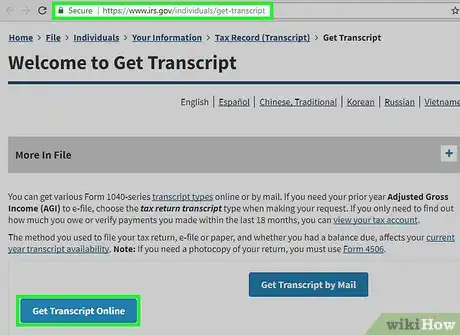

4Check your balance online if you already have an account. You may be able to order a transcript or check your balance at IRS.gov if you've already set up an IRS.gov account. However, if you don't already have an account set up, you may not be able to take advantage of these tools as a new user.[5]

- Click on the "File" tab from the IRS.gov home page, then click "Individuals" from the drop-down menu. When you navigate to "Your Information," you'll find a link to check your tax record.

- If the tool to view your record is not currently available for new users, you'll see an "Alert" box at the top of the page. If you already have an IRS.gov account, you can continue to log in as usual by clicking the "Get Transcript Online" button.

-

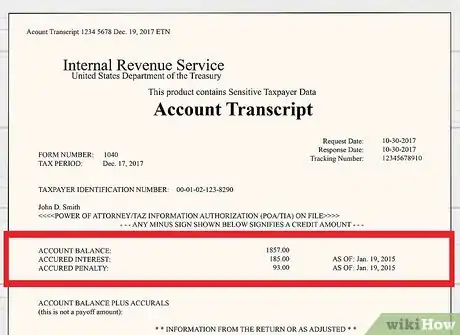

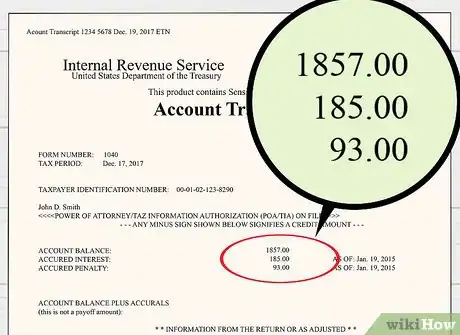

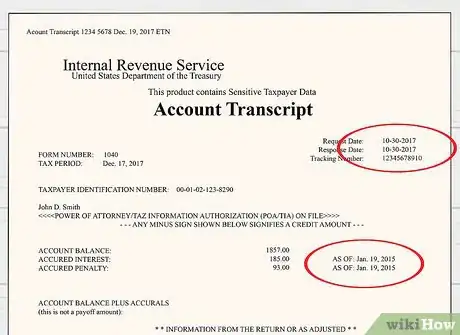

5Check the balance owed on your transcript. Once you submit your request, you should receive your transcripts in the mail within 5 to 10 days of the day the IRS receives your request. The transcript will include a total balance owed.[6]

- Requesting your transcript online rather than through the mail may enable you to get your transcript sooner.

Interpreting a Tax Balance Notice

-

1Check where the notice is from. If there's a balance listed on the notice, it may not reflect the balance you owe to the IRS. A notice from a different agency, such as the Department of the Treasury Bureau of the Fiscal Service, won't include information specifically about your IRS account.

- If you have a notice from the Bureau of the Fiscal Service, it typically relates to a non-IRS debt that was covered by taking all or part of your tax refund. The Bureau facilitates these transfers, but it doesn't have any information about your tax account balance.

- State tax department notices also won't include any information about the balance you owe to the IRS.

-

2Review the balance owed. If you get a notice from the IRS that you owe taxes, it will tell you the specific amount that is due. The notice also includes information on when to pay the balance and the methods of payment that are accepted.

- You will owe additional penalties, fees, and interest if you can't pay the balance in full by the due date listed on the notice.

- There may be an additional fee of a few dollars associated with certain methods of payment, such as credit or debit cards.

-

3Compare the date of the notice to recent payments made. The IRS often sends out notices automatically. If you've recently paid part of your balance through a payment agreement, the notice may not reflect your most recent payment.[7]

- For example, if you made a payment on December 1, and the notice is dated November 30, the balance on the notice clearly does not reflect your most recent payment. To get your correct balance you would want to subtract the amount of that payment from the amount listed on the notice.

-

4Contact the IRS. There is a phone number on every IRS notice. If you have questions about your balance or would like more information, you can use this number. You'll also find an address if you want to reach out to the IRS in writing.[8]

- If you can't find contact information on the notice, or if you misplaced your notice after receiving it, you can call the IRS's general customer service number at 1-800-829-1040. Business taxpayers should call 1-800-829-4933.

- Take notes while you're on the phone so you have written information for your records. Depending on the outcome of the phone call, the IRS may send you an additional notice.

-

5Keep the notice for your records. Any time you receive a notice from the IRS, keep it in a safe place with your other tax records. Ideally, you should file it with the return or returns the notice references.[9]

- If you've taken any notes, for example after talking to an IRS agent or tax professional, keep these notes along with your copy of the notice.

Setting Up a Payment Plan

-

1Make sure you qualify for an online agreement. Different payment options may be available depending on how much you owe the IRS and how long you need to pay the balance in full. Generally, there are long-term agreements (more than 120 days) available if you owe less than $50,000, and short-term agreements (less than 120 days) available if you owe less than $100,000.[10]

- You must file all required returns to be eligible for an online payment agreement.

- You don't necessarily have to know exactly how much money you owe to apply for an online payment agreement, as long as you know if it's less than $50,000 (for long-term agreements) or $100,000 (for short-term agreements).

-

2Gather the required information. You'll need basic information from your most recently filed tax return to apply for an online payment agreement, including the name and address you entered on that return.[11]

- You must have a valid email address to set up an online payment agreement.

- If you previously registered for another service with irs.gov, you can log in and apply for an online payment agreement using the same user name and password.

-

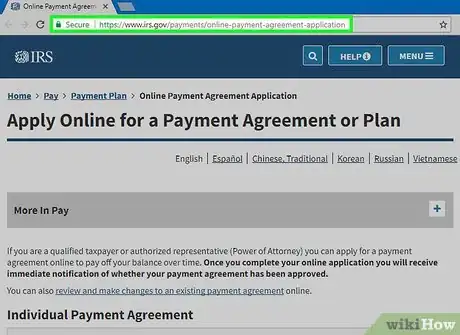

3Complete your application. To begin your online payment agreement application, go to https://www.irs.gov/payments/online-payment-agreement-application and click the "Apply as Individual" button. You'll be directed to log in to an existing irs.gov account or create a new one.[12]

- Follow the instructions to complete and submit your application. You may have to pay a fee to set up the agreement. Any fees assessed will be added to your total tax bill.

-

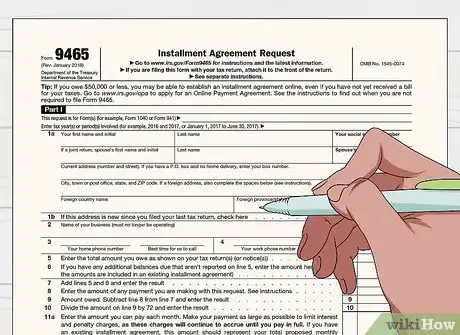

4Request an installment agreement if you don't qualify to apply online. You can still make installment payments even if the IRS doesn't approve your application for an online payment agreement. You'll have to complete and submit IRS Form 9465, Installment Agreement Request.[13]

- You can download Form 9465 at https://www.irs.gov/pub/irs-pdf/f9465.pdf.

- You can also request an installment agreement by calling 1-800-829-1040 and following the prompts.

-

5Make your payments as agreed. You can choose to make payments each month, or set up automatic payments to be automatically withdrawn from your checking account. If you make payments using a credit or debit card, you may have to pay an additional fee to process your payment.[14]

- When you pay in installments, you're still responsible for accrued penalties and interest until your balance is paid in full. You can check your balance at any time by logging in to your account.[15]

References

- ↑ https://www.irs.gov/individuals/understanding-your-irs-notice-or-letter

- ↑ https://www.irs.gov/individuals/get-transcript

- ↑ https://taxpayeradvocate.irs.gov/get-help/getting-a-transcript

- ↑ https://taxpayeradvocate.irs.gov/get-help/getting-a-transcript

- ↑ https://www.irs.gov/individuals/get-transcript

- ↑ https://www.irs.gov/individuals/get-transcript

- ↑ https://www.irs.gov/individuals/understanding-your-irs-notice-or-letter

- ↑ https://www.irs.gov/individuals/understanding-your-irs-notice-or-letter

- ↑ https://www.irs.gov/individuals/understanding-your-irs-notice-or-letter

- ↑ https://www.irs.gov/payments/payment-plans-installment-agreements

- ↑ https://www.irs.gov/payments/online-payment-agreement-application

- ↑ https://www.irs.gov/payments/online-payment-agreement-application

- ↑ https://www.irs.gov/payments/payment-plans-installment-agreements

- ↑ https://www.irs.gov/payments/payment-plans-installment-agreements

- ↑ https://www.irs.gov/payments/online-payment-agreement-application

- ↑ https://www.journalofaccountancy.com/newsletters/2016/feb/when-clients-owe-taxes-to-irs.html