This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

This article has been viewed 87,538 times.

Learn more...

Moving is part of life and requires a few steps to ensure a positive experience. If you are moving, you will need to update your address to have your mail forwarded to you. Other reasons for updating your records include avoiding landlord disputes and paying utility bills.

Steps

Changing Your Address with the USPS

-

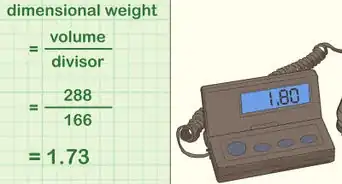

1Change your address online. Go online to fill out a Change of Address (COA) form at the U.S. Postal Service website. [1] The step-by-step instructions will require:

- Indicate whether your move is permanent or temporary (under twelve months).

- Your full name and the names of any family members who are moving with you. A separate form will be required for each member with a different last name.

- A debit or credit card for the $1.05 verification fee. The post office uses your debit or credit card to verify your address information. You can avoid the verification fee if you go to your local post office and fill out the COA[2]

-

2Request the form by phone. You can contact your local post office and request a 3575 form to be mailed to you. The number for USPS is 1-800-275-8777. You will have to pay the $1.05 verification fee if you choose to change your address over the telephone.[3]Advertisement

-

3Fill out the form in person. Visit your nearest post office and request a 3575 form. By going into the post office, you will avoid paying the service fee that is required for telephone and online conveniences.[4]

Notifying Social Security Administration

-

1Determine if you receive benefits. The Social Security Association is in charge of federal benefits other than social security. You must receive one of the following in order to change your address with this department:

- Social Security Income

- Retirement

- Survivors benefits

- Medicare[5]

-

2Contact the nearest Social Security office. Report your change of address to the Social Security Administration if you are receiving their benefits. This is the best way to make sure you continue to receive your government benefits without interruption.

- If you go to their website, you can enter your new zip code and find the nearest location.

- At the office, a representative will help you change your address so you can receive your benefits.

-

3Change your address online. Use your free account, my Social Security account, to update any personal information online. SSA has simplified many of the petty changes in administrative work to be completed online.

Changing Your Address For the IRS

-

1Keep a positive standing with the IRS. It is important for the IRS to stay updated with your current address. Even if you changed your address with the post office, this doesn’t always crossover to the IRS’ information. Tax season can sneak up on you and it is your duty to stay on top of your records.

-

2Submit a written statement. You can download and print Form 8822 and include it with some other key information. Compile the necessary information followed by your signature. You’ll need to additionally supply your:

- Full name

- Old address

- New Address

- Social security number[6]

-

3Use your tax return. When filing for a tax return, put down your new address directly on the return. This is a simple way to update your information without doing any additional paperwork.

- The only instance where the IRS will accept an electronic request is if your tax return wasn’t mailed.[7]

-

4Call them. Look up the phone number for the nearest office to you. This can be done if you do not wish to mail out your SSN, and would like confirmation. Before dialing have the following information in hand:

- Full name

- Address

- Date of birth

- Social security number[8]

Community Q&A

-

QuestionMy mom died and I would like to have any mail forwarded to me from her old address. I've had power of attorney and am now executrix of her estate. What should I do?

Community AnswerContact the postal service, tell them that your mother passed away and that any of her mail should be redirected to your address.

Community AnswerContact the postal service, tell them that your mother passed away and that any of her mail should be redirected to your address. -

QuestionWhat’s the phone number to change your address with the IRS?

DonaganTop AnswererDon't call them. Change your address as described in the above article. The IRS will learn about the change from the Postal Service or through their written exchanges with you. If they have your Tax ID Number and your Social Security Number, they don't care much about your address.

DonaganTop AnswererDon't call them. Change your address as described in the above article. The IRS will learn about the change from the Postal Service or through their written exchanges with you. If they have your Tax ID Number and your Social Security Number, they don't care much about your address. -

QuestionI never moved and received a letter that the post office returned mail undeliverable?

DonaganTop AnswererShow the letter to the people at your local post office. They need to see it in order to fix the problem.

DonaganTop AnswererShow the letter to the people at your local post office. They need to see it in order to fix the problem.

Help Changing Your Address

Warnings

- Magazines and newspapers are forwarded for 60 days at no charge. After 60 days, the post office discards them, so notify the publishers of any magazine or newspapers you subscribe to that you have a new address. Publications often take as long as 60 days to change your address, so notify them individually at the same time you put in your change of address at the post office.⧼thumbs_response⧽

- According to U.S. Postal regulations, “Anyone intentionally submitting false or inaccurate information on a COA request form is subject to punishment by fines or imprisonment or both under Sections 2, 1001, 1702 and 1708 of Title 18, United States Code (U.S.C.). “⧼thumbs_response⧽

References

- ↑ https://www.usps.com/umove/

- ↑ https://moversguide.usps.com/icoa/move-info/icoa-main-flow.do?execution=e1s3&_flowId=icoa-main-flow&referral=UMOVE

- ↑ https://www.usa.gov/moving

- ↑ https://www.usa.gov/moving

- ↑ https://www.socialsecurity.gov/myaccount/

- ↑ https://www.irs.gov/Help-&-Resources/Tools-&-FAQs/FAQs-for-Individuals/Frequently-Asked-Tax-Questions-&-Answers/IRS-Procedures/Address-Changes/Address-Changes

- ↑ https://www.irs.gov/Help-&-Resources/Tools-&-FAQs/FAQs-for-Individuals/Frequently-Asked-Tax-Questions-&-Answers/IRS-Procedures/Address-Changes/Address-Changes

- ↑ https://www.irs.gov/Help-&-Resources/Tools-&-FAQs/FAQs-for-Individuals/Frequently-Asked-Tax-Questions-&-Answers/IRS-Procedures/Address-Changes/Address-Changes

- ↑ http://answers.usa.gov/system/selfservice.controller?CONFIGURATION=1000&PARTITION_ID=1&CMD=STARTPAGE&SUBCMD=TOPICS&USERTYPE=1&LANGUAGE=en&COUNTRY=us

About This Article

The easiest way to change your address with the US Postal Service is to visit the USPS website. Then, fill out the Change of Address form and pay the verification fee using a credit or debit card. If you don't want to pay the fee, visit your local post office to fill out a Change of Address form. Alternatively, call your local post office and ask them to mail you the form. For tips on how to change your address with the IRS, keep reading!

-Step-12-Version-2.webp)

-Step-12-Version-2.webp)