This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 386,065 times.

Opportunity cost is a formula to help you calculate the difference of you make one choice over another. It gives you feedback you can use to compare what is lost with what is gained, based on your decision. It's often used to give you an advantage when you're trying to understand the returns of an investment, and you may be given a table or graph to pull your data from. Our guide will help you understand what opportunity cost is and how to calculate it!

Steps

Calculating Opportunity Cost

-

1Identify your different options. When faced with a choice between two options, calculate the potential returns of both options. Since you can only choose one option, you forfeit the potential returns from the other option. That loss is your opportunity cost.[1]

- For example, suppose your company has $100,000 in extra funds, and you have to decide between investing in securities or purchasing new capital equipment.

- If you decide to invest in the securities, you may see a return on that investment. But, you forfeit any profit you might have earned from purchasing new equipment.

- On the other hand, if you decide to purchase new equipment, you may see a return on that investment in the form of increased sales. But, you forfeit any profit you might have earned from investing in the securities.

-

2Calculate the potential returns on each option. Research each option and estimate the financial return on each. In the above example, suppose the expected return on the investment in the stock market is 12 percent. Your potential return is $12,000. The new equipment, on the other hand, might result in a 10 percent increase in your profit margin. Your potential return for that investment would be $10,000.Advertisement

-

3Choose the best option. Sometimes the best option is not the most lucrative, especially in the short term. Decide which option is best for you based on long term goals, not just on the potential return. The company in the above example may choose to invest the funds in new equipment instead of the stock market. Although the stock market investment has the higher potential return in the short term, the new equipment will allow them to increase efficiency and lower opportunity costs. This will have a long term impact on their profit margin.

-

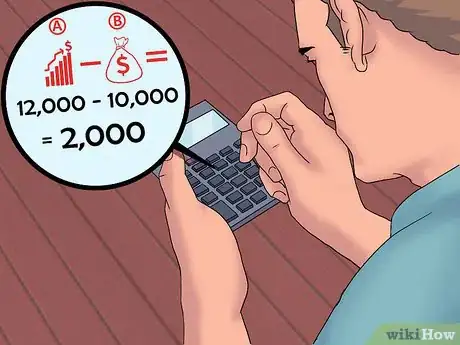

4Calculate the opportunity cost. The opportunity cost is the difference between the most lucrative option and the chosen option. In the above example, the most lucrative option is investing in the securities, which has a potential return of $12,000. The option the company chose, however, was to invest in new equipment, for a return of $10,000.

- The opportunity cost = most lucrative option – chosen option.

- The opportunity cost of choosing to purchase new equipment is $2,000.

Evaluating Business Decisions

-

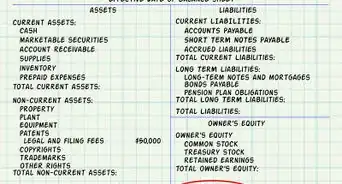

1Establish the capital structure of your business. Capital structure is how a company funds its operations and growth. It is a mix of the company’s debt and equity. Debt can be in the form of bonds issued or loans from financial institutions. Equity can be in the form of stock or retained earnings.[2]

- Companies must evaluate opportunity cost when choosing between debt and equity.

- If a company chooses to borrow money to fund an expansion, then the money used to repay the principal and interest on the loan is not available to be invested into stocks.

- The company must evaluate the opportunity cost to see if the expansion made possible with the debt will generate enough revenue in the long term to justify passing on the stock investments.[3]

-

2Evaluate non-financial resources. Opportunity cost is often calculated to evaluate financial decisions. However, companies can use opportunity cost to govern their use of other resources, such as man hours, time or mechanical output. Opportunity cost can be defined with any resource that is limited in the company.[4]

- Companies must make decisions about how to allocate these resources to different projects. The time spent on one project is taken away from something else.

- Suppose, for example, a furniture company with 450 available man hours per week uses 10 man hours per chair to produce 45 chairs per week. They decide to produce 10 sofas per week that take 15 man hours per sofa. This will use 150 man hours and produce 10 sofas.

- They will have 300 hours left to produce chairs, which will yield 30 chairs. The opportunity cost of the 10 sofas, therefore, is 15 chairs .

-

3Determine what your time is worth if you are an entrepreneur. If you are an entrepreneur, you will spend all of your time at your new business. However, this is time that you could have spent working at a different job. This is your opportunity cost. If you have high earning potential in a different line of work, you must decide whether or not it is worthwhile for you to open your new business.[5]

- For example, suppose you are a chef earning $23 per hour and you decide to leave your job to open your own restaurant. Before you ever earn a penny from the new business, you will spend time buying food, hiring staff, renting the building and opening the restaurant. You will eventually earn revenues, but the opportunity cost will be how much you would have earned working at your old job during all of that time.

Assessing Personal Decisions

-

1Decide whether or not to hire a housekeeper. Identify which household chores are using up your time. Decide whether the time spent on these chores takes away from time spent doing something else that you consider more valuable. Chores such as laundry and cleaning may interfere with work if you work from home a lot. Also, time spent on housework may hinder your ability to partake in other more enjoyable activities, such as being with your children or pursuing a hobby.[6]

- Calculate the financial opportunity cost. Suppose you work from home and earn $25 per hour. If you hired a housekeeper, you would have pay $20 per hour. The opportunity cost of doing the housework yourself is $5 per hour .

- Calculate the opportunity cost in time. Suppose you spend 5 hours each Saturday on laundry, food shopping and cleaning. If a housekeeper came once per week to clean and help with laundry, you would only have to spend 3 hours on Saturday finishing the laundry and food shopping. The opportunity cost of doing the housework yourself is 2 hours.

-

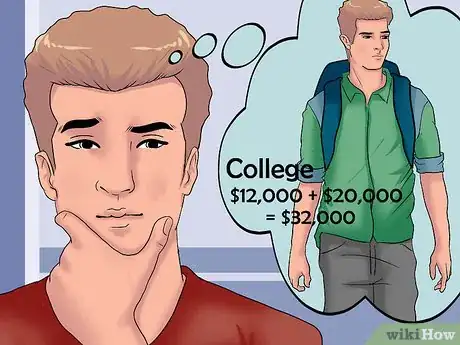

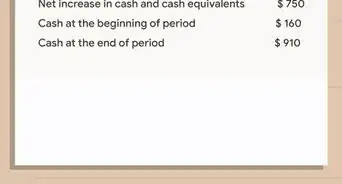

2Determine the true cost of going to college. Suppose you are going to pay $4,000 per year to attend an in-state college. The government will subsidy an additional $8,000 for your tuition. But, you must also factor in the opportunity cost of not working while you’re in college. Suppose you could earn $20,000 per year at a job instead of going to college. This means that the true cost of a year of college is the tuition plus the opportunity cost of not working.[7]

- The total tuition is the amount you pay ($4,000) plus the government subsidy ($8,000), which equals a total of $12,000.

- The opportunity cost of not working is $20,000.

- Therefore, the total cost of a year of college is .

- Other opportunity costs associated with going to college include the value of four years’ real-world work experience, the value of time spent on studying instead of other activities, or the value of what you could have purchased with the money you spent on tuition or the interest that money could have earned if you had invested it.[8]

- However, consider the other side of the coin. Median weekly earnings is $400 higher for a person with a college degree than for a person with only a high school diploma. If you decide not to go to college, the opportunity cost is the value of your future increased earnings.[9]

-

3Recognize opportunity costs in daily choices. Whenever you make a choice, you are foregoing something else. The opportunity cost is the value of the option you do not choose. That value can refer to something personal, financial or environmental.[10]

- If you choose to buy a new car instead of a used car, the opportunity cost is the money you could have saved on the used car and how you could have used that money differently.

- Suppose you decide to spend your tax return on a family vacation instead of saving or investing the money. The opportunity cost is the value of the savings account interest or the potential return on an investment.

- Remember that the value does not necessarily just refer to money or tangible assets. Consider how a choice will impact your intangible assets, such as happiness, health, and your free time.

References

- ↑ http://www.investopedia.com/ask/answers/032715/what-formula-calculating-opportunity-cost.asp

- ↑ http://www.investopedia.com/terms/c/capitalstructure.asp

- ↑ http://www.investopedia.com/ask/answers/032715/what-formula-calculating-opportunity-cost.asp

- ↑ http://www.economist.com/blogs/graphicdetail/2014/06/daily-chart-1

- ↑ http://www.slate.com/articles/double_x/doublex/2013/02/time_is_money_opportunity_cost_can_help_you_figure_out_how_much_your_time.html

- ↑ https://www.aeaweb.org/

- ↑ http://www.econlib.org/library/Enc/OpportunityCost.html

- ↑ http://www.referenceforbusiness.com/management/Ob-Or/Opportunity-Cost.html

- ↑ http://www.bls.gov/emp/ep_chart_001.htm

About This Article

To calculate opportunity cost, identify your different options and their potential returns. Do this by calculating how much interest they will earn or how much money they will save. Then, subtract the potential gain of the chosen option from the potential gain of the most lucrative option. For example, if option A could earn you $100, and option B could earn you $80, then option B has an opportunity cost of $20 because $100 minus $80 is $20. For more information from our reviewer on calculating opportunity cost, including how to evaluate non-financial resources, read on!