This article was co-authored by Hovanes Margarian. Hovanes Margarian is the Founder and the Lead Attorney at The Margarian Law Firm, a boutique automotive litigation law firm in Los Angeles, California. Hovanes specializes in automobile dealer fraud, automobile defects (aka Lemon Law), and consumer class action cases. He holds a BS in Biology from the University of Southern California (USC). Hovanes obtained his Juris Doctor degree from the USC Gould School of Law, where he concentrated his studies in business and corporate law, real estate law, property law, and California civil procedure. Concurrently with attending law school, Hovanes founded a nationwide automobile sales and leasing brokerage which gave him insights into the automotive industry. Hovanes Margarian legal achievements include successful recoveries against almost all automobile manufacturers, major dealerships, and other corporate giants.

This article has been viewed 76,761 times.

At some point, you may want or need to have a new car. You may also want to weigh the cost differences between leasing and buying before you make your decision. One way to compare costs is to figure out exactly what you will be paying for each. When you buy a car, you finance the amount charged for the vehicle and the interest rate is clear. When you lease a car, you pay to use the vehicle for a period of time, similar to renting it, and turn it in at the end of the lease. The finance charges for a lease may not always be clear. To calculate the finance charges on a leased vehicle, you need to know only a few things: the net capitalized cost, residual value and money factor. If these are known, calculating your finance charges is a simple process.

Steps

Collecting Necessary Data

-

1Determine the net cap cost. The term “net cap cost” is a shortened form of net capitalized cost. This is ultimately the overall price of the vehicle. The net cap cost may be affected by other additions or subtractions, as follows:[1]

- Any miscellaneous fees or taxes are added to the cost to increase the net cap cost.

- Any down payment, trade in or rebates are considered “net cap reductions.” These are subtracted and will reduce the net cap cost.

- Suppose, for example, that a vehicle is listed with a cost of $30,000. There is a rebate or you make a down payment of $5,000. Therefore, the net cap cost for this vehicle is $25,000.

-

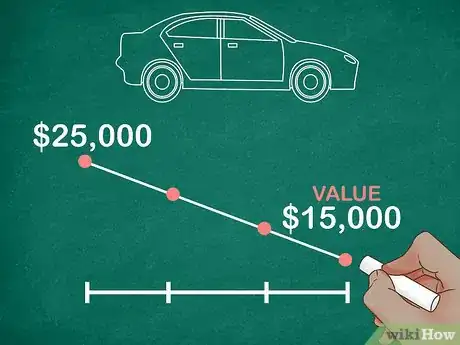

2Establish the residual value of the vehicle. This is a bit like predicting the future. The residual value is the vehicle’s value at the end of the lease, when you will return it. This is always a bit uncertain because nobody can predict the exact condition of the vehicle, the mileage or the repairs that it will undergo during the lease. To establish the residual value, dealers use industry guide books, such as the Automotive Leasing Guide (ALG).[2]

- The graphic shown above illustrates the decline in the vehicle’s value over time. For this example, the residual value at the end of the term is set at $15,000.

- Some dealers choose not to use the ALG. Instead, they may develop their own guide or functions for setting residual values.

Advertisement -

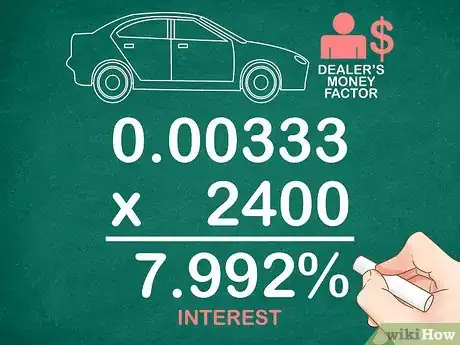

3Find out the dealer’s money factor. Leased vehicles do not charge interest in the same way that purchase agreements do. There is, however, a finance charge that is analogous to interest. You are paying the leasing company for the use of their vehicle during the term of your lease. This charge is based on a number called the “money factor.”[3]

- The money factor is not generally publicized. You will need to ask the dealer to share it with you.

- The money factor does not look like an interest rate. It will generally be a decimal number like 0.00333. To compare the money factor to an annual interest rate, multiply the money factor by 2400. In this example, a money factor of 0.00333 is roughly like a loan interest rate of 0.00333x2400 = 7.992% interest. This is not an exact equivalence but is a regularly accepted comparison value.

Performing the Calculations

-

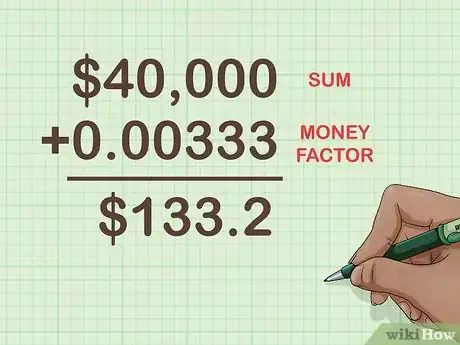

1Add the net cap cost and the residual value. The finance charge is based on the sum of the net cap cost and the residual value. At first glance, this appears to be an unfair doubling of the car’s value. However, in combination with the money factor, this works as a way to average the net cap cost and the residual value. You end up paying the finance fee on an average overall value of the car.[4]

- Consider the example started above. The net cap cost is $25,000, and the residual is $15,000. The total, therefore, is the sum of $25,000+$15,000 = $40,000.

-

2Multiply that sum by the money factor. The money factor is applied to the sum of the net cap cost and the residual value of the car to find the monthly finance charge.[5]

- Continuing with the example above, use the money factor 0.00333. Multiply this by the sum of the net cap cost and residual as follows:

- $40,000 x 0.00333 = $133.2.

- Continuing with the example above, use the money factor 0.00333. Multiply this by the sum of the net cap cost and residual as follows:

-

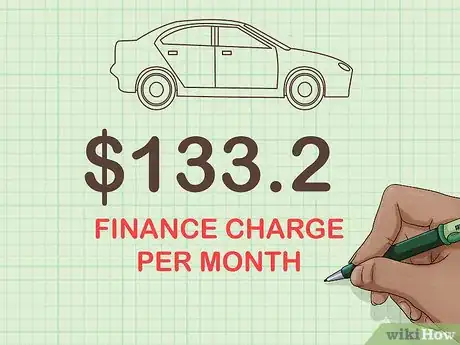

3Apply the monthly finance charge. The result of the final calculation is the monthly finance charge that will be added to your lease payment. In this example, the finance charge is $133.20 each month.

-

4Figure the full monthly payment. The finance charge may be the largest portion of your monthly payment, but you cannot count on it to be the full payment. In addition to the finance charge, many dealers will also charge a depreciation fee. This is the cost that you pay to compensate the dealer for the decreased value of the car over time. Finally, you may be responsible for assorted taxes.[6]

- Before you sign any lease agreement, you should find out the full monthly charge you are responsible for. Ask the dealer to itemize all the costs for you, and make sure that you understand and can afford them all.

Negotiating with the Dealer

-

1Ask for the data you want. Many people, when leasing a vehicle, seem satisfied to accept the bottom line figure that the dealer assigns. However, to verify that any deal you negotiate is actually honored, you need to know the details of the finance charge calculations. Without asking for the data, you could be the victim of carelessness, simple error, or even fraud.[7] [8]

- You could negotiate a reduced price for the vehicle, but then the dealer could base the calculations on the original value anyway.

- The dealer might not apply proper credit for a trade-in vehicle.

- The dealer could make mathematical errors in calculating the finance charge.

- The dealer could apply a money factor other than the one used in the original negotiations.

-

2Press the dealer for the “money factor.” The money factor is a decimal number that car dealerships use to calculate the finance charges. This number is not an interest rate but is somewhat analogous to interest rates. Some lease dealers may publicize the money factor, while others may not. You should ask for the money factor that your dealer is using. Also ask how the money factor is used to calculate the finance fee charged on your lease.[9]

-

3Ask the dealer to show you the calculation worksheet. The dealer is not required to share with you the calculations that go into the finance charge and monthly payments on your leased vehicle. Unless you ask specifically, you will probably never see that information. You should ask the dealer, sales clerk or manager to share the calculations with you. Even if you have the individual bits of data, you may not be able to confirm that the figures were calculated accurately or fairly unless you compare your notes to the dealer’s calculations.[10]

-

4Threaten to leave if the dealer is not forthcoming with information. The only leverage you have in the negotiations over a leased vehicle’s finance charges is the ability to walk away. Make it clear to the dealer that you want to verify the calculations and the individual pieces of information that go into figuring your finance charges. If the dealer is unwilling to share this information with you, you should threaten to leave and lease your car from somewhere else.[11]

Community Q&A

-

QuestionHow do I compute the monthly payment?

Community AnswerIn the example above, you'd take the difference between the agreed-upon price, and the residual value (in this example it is $10,000) and then divide that by the number of months the lease is for (i.e. 36). This gives you $277.78. Then you add the finance fee to this number, which gives you a grand total of $410.98.

Community AnswerIn the example above, you'd take the difference between the agreed-upon price, and the residual value (in this example it is $10,000) and then divide that by the number of months the lease is for (i.e. 36). This gives you $277.78. Then you add the finance fee to this number, which gives you a grand total of $410.98. -

QuestionCan you capitalize the interest cost on a car loan or lease?

Community AnswerThis is possible but depends on whatever deal you can make with the dealership or lender.

Community AnswerThis is possible but depends on whatever deal you can make with the dealership or lender. -

QuestionWe leased a vehicle for $56,025 and paid $5,000 down. The rent money factor was $6,245.22. Were we scammed?

Community AnswerI don't have all the data to give you a complete answer, but I can show you how to analyze what you have. You say you leased it for $56,025. Subtracting your down payment, this gives a net cap cost of $51,025. You don't say what the residual value was set at. I will assume 50% depreciation, so a (very) rough estimate of the combined values (net cap + residual) is about $75,000. To calculate the money factor, divide the amount you were charged, $6,245.22, by this total. This gives 6,245.22/75,000 = 0.0833. Multiply this by the standard 2400 to figure an analogous interest rate of 0.0833 x 2400 = 199.9%. Yes, I would say you were scammed. (Be careful - this is based on a lot of rounded and assumed data. But the figure is SO far from reasonable that you should go back to the dealer and review the calculations.)

Community AnswerI don't have all the data to give you a complete answer, but I can show you how to analyze what you have. You say you leased it for $56,025. Subtracting your down payment, this gives a net cap cost of $51,025. You don't say what the residual value was set at. I will assume 50% depreciation, so a (very) rough estimate of the combined values (net cap + residual) is about $75,000. To calculate the money factor, divide the amount you were charged, $6,245.22, by this total. This gives 6,245.22/75,000 = 0.0833. Multiply this by the standard 2400 to figure an analogous interest rate of 0.0833 x 2400 = 199.9%. Yes, I would say you were scammed. (Be careful - this is based on a lot of rounded and assumed data. But the figure is SO far from reasonable that you should go back to the dealer and review the calculations.)

Warnings

- Some dealers may present the money factor number so that it is easier to read, such as 3.33; however, this could be misinterpreted as the interest rate. Be aware that this is not the rate that will be used. This number should be converted to the actual money factor by dividing by 1,000 (3.33 divided by 1,000 = 0.00333).⧼thumbs_response⧽

- Be aware that the finance cost (as calculated here to be $133.20) is not necessarily your total monthly payment. It is only the finance charge and may not include other charges such as sales tax or the acquisition fee.⧼thumbs_response⧽

Things You'll Need

- Net cap cost

- Residual cost

- Money factor

- Paper

- Pen or pencil

- Calculator

References

- ↑ http://www.leaseguide.com/lease08/

- ↑ http://www.swapalease.com/lease101/guide/terms/residual-value.aspx

- ↑ http://www.leaseguide.com/lease08/

- ↑ http://www.leaseguide.com/lease08/

- ↑ http://www.leaseguide.com/lease08/

- ↑ http://www.swapalease.com/lease101/guide/chapters/calculating-your-monthly-lease-payment/determining-your-monthly-lease-payment.aspx

- ↑ http://www.leaseguide.com/lease08/

- ↑ https://www.carbuyingtips.com/lease2.htm

- ↑ http://www.swapalease.com/lease101/guide/terms/interest-rate.aspx