Transfer pricing refers to the setting, analysis, documentation, and adjustment of charges of goods and services within a multi-divisional organization, particularly in regard to cross-border transactions. Transfer pricing describes all aspects of intra company pricing arrangements between related business entities, including transfers of intellectual property, transfers of tangible goods, services and loans, and other financing transactions.

For example, goods from the production division may be sold to the marketing division, or goods from a parent company may be sold to a foreign subsidiary, with the choice of the transfer price affecting the division of the total profit among the parts of the company. This has led to the rise of transfer pricing regulations as governments seek to stem the flow of taxation revenue overseas, making the issue one of great importance for multinational corporations.

Intra-company transactions across borders are growing rapidly and are becoming much more complex. Compliance with the differing requirements of multiple overlapping tax jurisdictions is a complicated and time-consuming task. At the same time, tax authorities from each country are imposing stricter penalties, new documentation requirements, increased information exchange and increased audit/inspection activity.

Division managers are provided incentives to maximize their own division's profits. The firm must set the optimal transfer prices to maximize company profits, or each division will try to maximize their own profits leading to lower overall profits for the firm. Double marginalization is when both divisions mark up prices in excess of marginal cost and overall firm profits are not optimal.

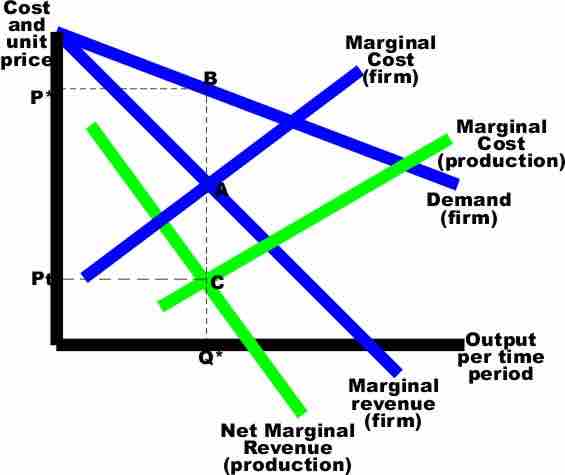

One can use marginal price determination theory to analyze optimal transfer pricing, with optimal being defined as transfer pricing that maximizes overall firm profits in a non-realistic world with no taxes, no capital risk, no development risk, no externalities, or any other frictions which exist in the real world. From marginal price determination theory, the optimum level of output is that where marginal cost equals marginal revenue. That is to say, a firm should expand its output as long as the marginal revenue from additional sales is greater than their marginal costs. In the diagram that follows , this intersection is represented by point A, which will yield a price of P*, given the demand at point B.

Optimal Transfer Pricing Diagram

From marginal price determination theory, the optimum level of output is where marginal cost equals marginal revenue.

When a firm is selling some of its product to itself, and only to itself (i.e., there is no external market for that particular transfer good), then the picture gets more complicated, but the outcome remains the same. The demand curve remains the same. The optimum price and quantity remain the same. But marginal cost of production can be separated from the firm's total marginal costs. Likewise, the marginal revenue associated with the production division can be separated from the marginal revenue for the total firm. This is referred to as the Net Marginal Revenue in production (NMR) and is calculated as the marginal revenue from the firm minus the marginal costs of distribution.

It can be shown algebraically that the intersection of the firm's marginal cost curve and marginal revenue curve (point A) must occur at the same quantity as the intersection of the production division's marginal cost curve with the net marginal revenue from production (point C).