Chapter 7

Stock Valuation

By Boundless

The stock of a company represents the original capital paid into the business by its founders and can be purchased in the form of shares.

Shareholders have the right of preemption, meaning they have the first chance at buying newly issued shares of stock before the general public.

Common stock is a form of ownership and equity, different from preferred stock, that still earns rights of ownership for its shareholders.

Preferred stock usually carries no voting rights, but may carry a dividend, have priority over common stock upon liquidation and/or have other benefits.

In the cases of bankruptcy and dividend distribution, preferred stock shareholders will receive assets before common stock shareholders.

Common stock generally carries voting rights, while preferred stock does not; however, this will vary from company to company.

New shares can be purchased on exchanges and current shareholders will usually have preemptive rights to newly issued shares.

Preferred stock can include rights such as preemption, convertibility, callability, and dividend and liquidation preference.

Preferred shares have numerous rights which can be attached to them, such as cumulative dividends, convertibility, and participation.

Common stock, preferred stock, and debt are all securities that a company may offer; each of these securities carries different rights.

Market actors include individual retail investors, mutual funds, banks, insurance companies, hedge funds, and corporations.

The New York Stock Exchange is the world's largest stock exchange by market capitalization at $14.242 trillion as of December 2011.

The NASDAQ is an American dealer-based stock market in which the dealers sell electronically to investors or firms.

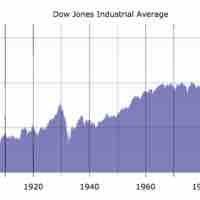

Market indices provide valuable information for stock valuation.

A no-growth company would be expected to return high dividends under traditional finance theory.

Valuations rely heavily on the expected growth rate of a company; past growth rate of sales and income provide insight into future growth.

The portion of the earnings not paid to investors is, ideally, left for investment in order to provide for future earnings growth.

There are many different ways to appraise the future value of stocks, including fundamental criteria and stock valuation methods.

Limited high-growth approximation, implied growth models, and the imputed growth acceleration ratio are used to value nonconstant growth dividends.

Three approaches are commonly used in corporation valuation: the income approach, the asset-based approach, and the market approach.

The dividend discount model values a firm at the discounted sum of all of its future dividends, and does not factor in income or assets.