Equity

Common Stock and Preferred Stock are both methods of purchasing equity in a business entity.

Common stock generally carries voting rights along with it, while preferred shares generally do not.

Preferred shares act like a hybrid security, in between common stock and holding debt. Preferred stock can (depending on the issue) be converted to common stock and have access to accumulated dividends and multiple other rights. Preferred stock also has access to dividends and assets in the case of liquidation before common stock does.

However, both common and preferred stock fall behind debt holders when it comes to claims to assets of a business entity should bankruptcy occur. Common shareholders often do not receive any assets after bankruptcy as a result of this principle. However, common stock shareholders can theoretically use their votes to affect company decision making and direction in a way they believe will help the company avoid liquidation in the first place.

Debt

Debt can be "purchased" from a company in the form of a bond.

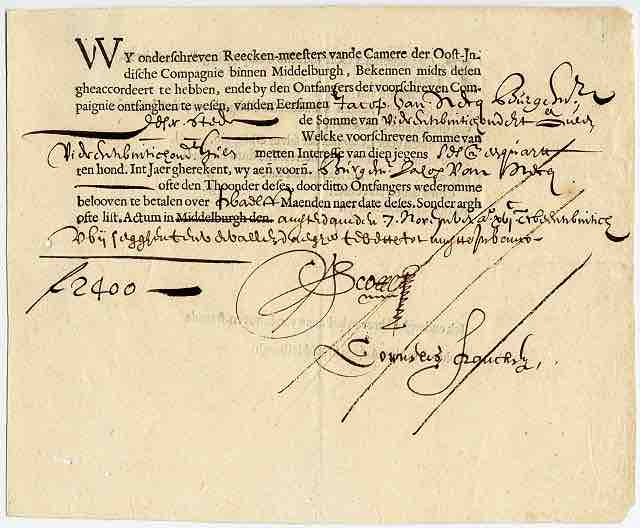

A bond from the Dutch East India Company

A bond is a financial security that represents a promise by a company or government to repay a certain amount, with interest, to the bondholder.

In finance, a bond is an instrument of indebtedness of the bond issuer to the holders. It is a debt security, under which the issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay them interest and/or to repay the principal at a later date, termed the maturity. Therefore, a bond is a form of loan or IOU: the holder of the bond is the lender (creditor), the issuer of the bond is the borrower (debtor), and the coupon is the interest. Bonds provide the borrower with external funds to finance long-term investments, or, in the case of government bonds, to finance current expenditure.

Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in the company (i.e., they are owners), whereas, bondholders have a creditor stake in the company (i.e., they are lenders). Another difference is that bonds usually have a defined term, or maturity, after which the bond is redeemed, whereas stocks may be outstanding indefinitely.